Why Buy $LSTR?

Many are confused as to reasons to buy $LSTR. Before getting into the why, perhaps we should briefly cover the what.

What is Leostrategy (LSTR)?

As you can guess from the name, this is model that follows Microstrrategy yet is contoured to $LEO.

While MSTR is known for this model it is really called Bitcoin Treasury companies. They are ones that add Bitcoin to their balance sheet and trade on the public markets.

When looking at these entities, we are dealing with two numbers of importance: the value of the enterprise versus the NAV of the asset. In the instance of LSTR, the underlying is LEO.

We often see mNAV when talking about these types of companies. This stands for multiple Net Asset Value.

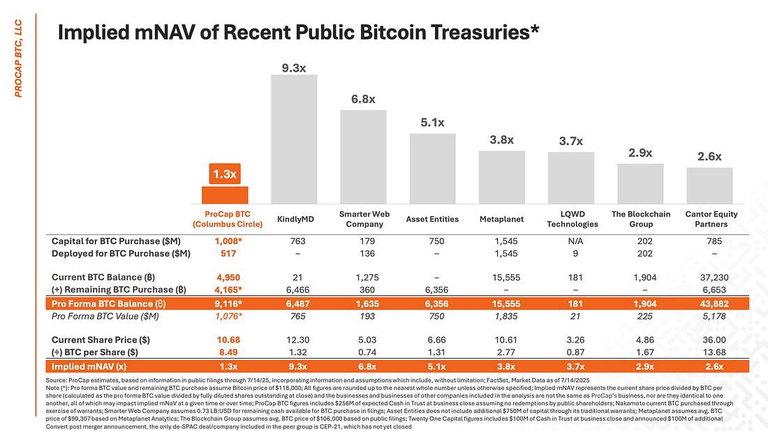

Here is a chart of some of the Bitcoin Treasury companies that are out there and the mNAV.

As we can see, the mNAV 1.3 to 9.3 depending upon the company. This means the stock price is that X higher than the underlying asset.

Each of these is trading at a premium against the Bitcoin.

Leostrategy

Leostrategy is following a similar design just using LEO. At present, MSTR is trading at a discount as opposed to a premium.

Here is how it looks:

There are 22,595 LSTR sold at a present with a price of $1.02 . This is a enterprise value (market cap) of $21,047.71

467,386.84 LEO is held by Leostrategy. At a price of $.042, this is $19,630.24 in LEO NAV.

Doing the math we have:

$21,047.71/$19,630.24 = 1.07x

Compared to the multiples on the chart above, this is low. We can see how the premium is under what is common in the Bitcoin Treasury companies.

Of course, this is not an exact science. Leo and Bitcoin are worlds apart. We are also dealing with liquid markets (stocks) versus a token on Hive Engine. Liquidity is a major issue.

The advantage is there are only 100K LSTR available. Once they are out, that is it. The idea is to keep building the project in a way where the mNAV keeps increasing, at a rate that is higher than the just the price of LEO.

This is what provides the token holders a leveraged gain.

Liquidity

One of the major issues at the moment is liquidity of the LSTR token. It is still in the initial sale so trading is limited. This is bad for traders since there is nothing worse than getting into a position that cannot be exited.

It is going to be addressed in a couple ways.

In discussions behind the scenes, we are going to see a LP added to Hive-Engine. This will allow for holders to provide liquidity, helping the entire ecosystem.

Another idea that is gaining traction is eventually placing LSTR on Solana. By tapping into larger networks, we can pull liquidity towards Leo. This will also set up arbitrage opportunities for traders (bots) on LSTR.

This is crucial for the increase in mNAV. Without liquidity, the market cap of LSTR will be stifled. We often see this with thinly traded assets.

As LEO becomes harder to come by due to the Leo 2.0 mechanisms in place, other avenues will be sought. Traders can pit LSTR against LEO based upon the pricing of each. Providing other entry points via other chains is a positive.

Why Buy $LSTR

Why do you want to be involved in LSTR? Why not just buy LEO and handle it yourself?

The reason for this is twofold.

First, we have the multiple revenue streams that might not exist at an individual level. For example, bridging between networks generates revenue. For Leostrategy, it is likely this is used to buy LEO and stake it. This will earn more USDC which can buy more LEO.

As more revenue streams are developed and implemented, there is a built in feeder system for LSTR. Individuals will not have this.

Second, the mNAV. When people get involved in this types of structures, there is a premium. It is same no matter what the commodity. This is a leveraging of the holdings, driven by market action.

For example, if the mNAV goes up from 1.03 to 2.06, the value of each LSTR, relative to LEO, doubled. It is not, however, due to a doubling of the LEO price. If that was the case, the multiple increase is likely higher.

To realize this, of course, the market has to be fluid and liquid. That is why this point was mentioned. For now, it is hard to see but the model always works the same. With this in the plans, we will incrementally move closer.

Posted Using INLEO

This came at the perfect time. Need to hop in and get few LSTR.

Hey @bitcoinman, you may want to read this.

Out of curiosity, what is the mNAV on MSTR? I see these other examples, most of which I haven't heard of. Just wondering what the number is on the one I have heard of, and the namesake of LSTR?

I get the compounding effect that LSTR should generate going forward. I think it would be beneficial to people to lay out what each LSTR actually represents in LEO right now. I feel like that's where a bit of the disconnect is.

If 22,595 LSTR have been sold and represent 467,387 LEO, then each LSTR is worth 467,387/22,595= 20.7 LEO, right? If each LEO is worth 4 cents (as of this writing) then you're getting 83 cents worth of LEO for a dollars worth of LSTR/HIVE...since you're using HIVE to buy the LSTR. Until it's sold out and you can actually trade LSTR, the premium actually works against you because your dollars could buy more LEO than what you get from buying LSTR.

All that said, the benefit, as you pointed out, will be the fact that as LSTR sells out and starts trading in the "real" world, that premium should grow. Plus, the amount of LEO underneath the LSTR umbrella should also compound as well; probably faster than each of us could do ourselves, and certainly with a LOT less work.

The thing that has been the trickiest for me to wrap my brain around has been the price of LSTR in HIVE vs the amount of LEO that same HIVE could buy.

Full disclosure, I own some LSTR and am looking forward to seeing it in action down the road. I'm just still working through why I should buy more.

The toughest part is the initial cap raise

While LSTR has this sell wall, price is static. That being said, it’s a limited wall. It will go down eventually. The question is when

When it does go down, the market can price LSTR. It will do so at some level of mNav Premium (IMO) as buying 1 LSTR is - at the most basic fundamental level - purchasing:

So from a fundamental basis, the value of LSTR is at the very least 1:1 with the LEO it holds. Then you have to value the incoming revenue / capital raises that can purchase more LEO with both inflows and leverage.

This is where things get tougher without the open market at play. Once we have that open market (because the sell wall is sold out), the real value of LSTR will be a lot clearer.

TLDR; Buying 1 LSTR is buying the LEO mNav value + the proprietary ability of the fund to generate revenue and buy more LEO.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Congratulations @taskmaster4450le! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 900000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSolana's idea would be magnificent. Plus, creating a pool on Orca costs less than $5.

https://x.com/jewellery_all/status/1945807412306509877

This is definitely an eye opener then. I strongly believe this is the right time to actually accumulate as much lstr

i still have a lot to digest here. seeming a mouth watering opportunity if the issue of liquidity can be well addressed. i buy the idea of extending into other blockchains for liquidity purpose. in short, this should be how web3 should operate, collaborations will strengthen market and utilities.

LSTR looks pretty neat to me