The Reality of Interest Rates and the Economy

We hear a lot of discussion about interest rates.

Since we are in earnings season, this seems to be the topic of conversation. Many CEOs are talking about how bad things are. One of the causes, according to them, is high interest rates. We hear this a lot.

When I hear this, I am reminded of the "chip shortage" of a few years ago. While there was a problem, it seemed every company that had a bad earnings number used that as the reason why. In fact, it went on longer than the shortage actually did.

That said, we have the interest rate situation. There is no doubt we saw a massive run up. However, when people point to them, it is like they are proposing that rates keep moving higher.

So let us take a look at what is taking place.

Interest Rates Affecting The Economy

Jumping Jerome Powell, the Chair of The Fed, is intent on wiping out inflation. These prices are way too high for his liking.

Many forecast the Fed shifting to a rate reduction strategy this has not happened. But what is really going on with rates?

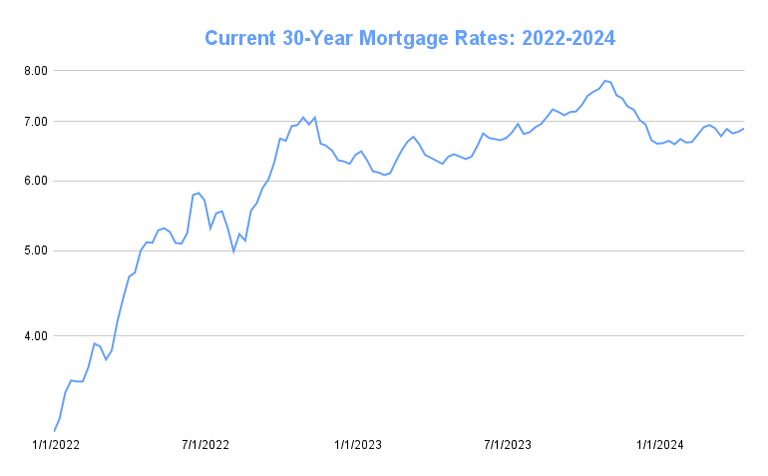

If we look at the 30 year mortgage rate, perhaps we can gain some insight.

We can see how they bounced around a bit. That said, We are basically at the same point we were at towards the end of 2022. At that time, we crossed 7%, then had a pullback, went sideways, and then ran up again.

After the pullback earlier in the year, we are maintained at just under 7%.

What this means is the market had 18 months to digest these interest rates. That is a fair bit of time to adjust.

Does that mean what these CEOs are saying is not true? Absolutely not. People tend to go for as long as they can before cutting back. This could align with what the companies are seeing.

Perhaps the consumer is truly running out of money.

An Unnamed Recession

We often find that we are in recession long before it is officially proclaimed. For various reasons, the official statement tends to lag.

That said, what happens if something walks like a duck, looks like a duck, and sounds like a duck? It is probably a duck.

What we are seeing is a continuation of deteriorating conditions that many warned about. Big ticket purchases are being delayed. The automobile industry has taken a hit. Certain real estate markets are starting to get pinched. Red Lobster filed for bankruptcy and McDonalds is seeing serious headwinds.

It should be an eye-opener when the Big Mac economy goes to hell.

The problem is we do not have enough money in the system. During the Great Financial Crisis, a lot of collateral was wiped out. The realization that mortgage backed securities were not on par with Treasuries caused balance sheet constraint which we still have no recovered from.

When we look at the lost of productivity compared to the half century historical trend, forget recession; we are in a depression.

And that has gone on for the past 16 years.

Trillions in productivity is absent from the GDP numbers. This is not funky accounting. Instead, it simply is not there.

economic output cannot increase if the money is not there to do so. This is what is happening across the economy. Workers like to be paid for their services. Equipment and raw materials have a cost. building plants and factories necessitates investment.

All of the reverts back to money. When there is a shortage of collateral, global trade suffers. This is exactly what we are seeing.

Are interest rates having an effect? Certainly. However, there is something much larger taking place. The system that emerged post World War II is broken. International banks cannot allocate the money in a way the market demands. Due to balance sheet constraint, we are watching massive contraction.

Ultimately, this shows up throughout the regular economy. It is easy to dismiss this as something only involving bankers. It is much bigger than that.

If we had the collateral, repo agreements would total $7T-$8 trillion per day. Instead, we are basically sitting at $4.5T-$5T.

Posted Using InLeo Alpha

🤩 !PGM

That is very concerning. In stocks, a common phrase when the markets are down is "Cash is King". If there is a shortage of money, then that isn't really a good thing to do, and could cause more problems. I feel like we are going to go into a downward spiral where people are more frugal because of the cost, and then there is even less money circulating, which can raise costs, and back and forth.

Money is what drives economic productivity. People fail to consider that. If I give your $10 million, could you grow a business quicker, larger, and into more areas than if you didnt have the money? Of course.

How come people do not apply that to the economy? The key is can the economy handle it in terms of having the capabilities of expanding things. If there are not the resources, physical and human, then problems arise.

By the way, I failed to mention it is armstrongeconomics blog.

I guess that makes sense. Although I don't think countries can just add money to their books with just a snap of their finger.

I check the blog out a bit, and looked him up. He is an interesting fellow to say the least. His views and posts are not the usual type compared to what is in popular media. I did notice that he was convicted felon.

LOL if you knew how NY courts worked, you would see why.

He pissed the bankers off.

Countries add money through making loans. That is how the money supply increases under fractional reserve lending.

The world is in a very deep recession when you look at the performance of a lot of economy of some nations. I can't even know right now when the economy situation of my country will be better

It quite looks like the economy of the world instead of getting better is getting worst. Another recession every year

OVER REWARDED TRASH

HIVE IS DEAD

HIVE IS ONE BIG FARM !LOL !WEED !MEME

https://hive.blog/hive-104387/@bpcvoter3/se19g2

Downvoted BY HIVE FARMERS

6 days ago in #life by slobberchops (81)$0.00

Reply 3

Sort: Trending

[-]bpcvoter2 (-5)(1) 4 days ago · Will be hidden due to low rating

NO DOWNVOTES FOR MARKY MARK'S SELF VOTING !WEED

https://hive.blog/life/@slobberchops/re-gogreenbuddy-sdr1wb

https://www.publish0x.com/the-dark-side-of-hive

https://www.reddit.com/r/stoptheabuseonhive/

https://peakd.com/hive-164833/@bilpcoinbpc/you-have-all-witnessed-this-account-being-downvoted-to-a-negative-reputation-for-no-reason

SHAME ON YOU ALL SAD PEOPLE WHO SCAM LIE AND FARM HIVE AND HIVERS