Elon Musk: The First To $1 Trillion

According to the Bloomberg Billionaire Index, Elon Musk has a net worth just shy of $350 billion. He is worth roughly $129 billion more than the second place holder, Jeff Bezos.

For years, many have speculated upon who will become the first person with a $1 trillion net worth. As of NOW, it looks like Musk is going to be the winner.

Of course, we have to keep a couple things in mind. Much of this is an estimate. While we can determine the exact value of ownership in a publicly traded company, those that are not on exchanges are harder to determine.

Another factor is net worth is different than liquid valuation. If, for example, Musk tried to liquidate his Tesla holdings, they would not be worth what they are today since the stock would crash.

Nevertheless, let's take a look and see how Musk could get there.

Elon Musk: The First To $1 Trillion Net Worth

Musk has the advantage of owning piece of a number of different companies that could become very valuable. He will likely have significant stake in a few trillion dollar corporations.

Before diving in, this is will a rough outline. I do not know the holdings in each that Musk has. Outside of Tesla, there is no way to tell the exact value or how much Musk owns.

Tesla

According to Investopia, Musk as over 715 million shares of Tesla. This was as of the filing for year end, 2023 with the SEC.

Tesla is worth $1.12 trillion, with a price of around $350. This accounts for $251 billion of his total.

Many are projecting that Tesla will reach $1,000 per share in the next few years. This would put it at around $3 trillion, with Musk holding $750 billion.

Thus, Tesla could get him most of the way there.

xAI

This is a newcomer to the game which, as of the last funding round, was valued at $50 billion.

The leading LLM company, OpenAi, captured a valuation of $150 billion not long before xAI did its capital raise.

Here is where an unclear ownership enters. What we know is that X owned 25% of xAI.

The potential is enormous. We are likely to see these LLM companies worth more than trillion dollars in the future. Obviously, there is a lot of speculation with this but, for xAI, there are going to be licensing deals with Tesla on both the vehicles and, more importantly, Optimus bots.

That means that each unit is going to require Tesla to pay xAI some money. This ignores the other deals that can be struck as more applications are built by the company.

X

The value of xAI impacts the value of X. According to the latest valuation, we are seeing holdings of $12.5 billion.

We again have speculation about the value of this since we are dealing with a privately held asset. The purchase price was $44 billion, an overpay for now.

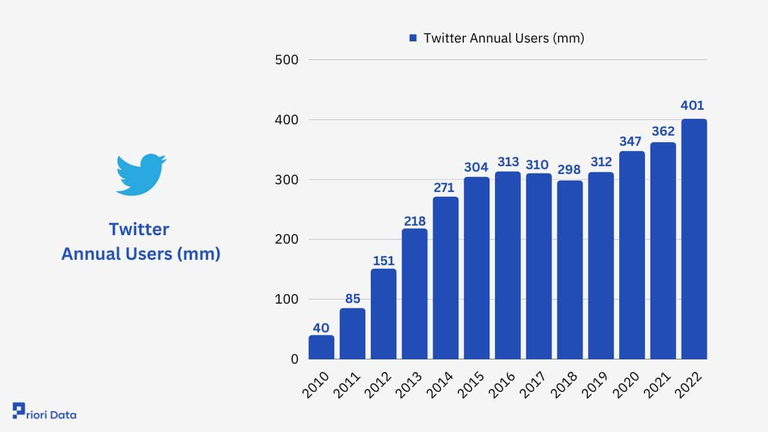

What we can determine is the monthly active users. Here is a chart for Twitter.

This has increased to 586 million according to this article.

The revenue, by all accounts, is down from the time of purchase. Of course, Musk slashed 70% of the workforce, lowing the costs also. Is there profitability? We cannot be sure at this point since the numbers aren't public.

Fidelity placed a value of $9.4 billion on X in early October. Obviously, this ignores the xAI stake which is worth more than that. Using that number, we can place it at $20 billion combined.

This is a loss of more than 50%.

Naturally, we are looking into the future, guessing where things might be heading. PayPal carries a market capitalization of $87 billion. We know X is in the process of acquiring the licensing to make it a payments platform. With close to 600 million accounts, this opens up a huge avenue for commerce on the site.

SpaceX

This is another company that is completely dominating.

The future here is:

- Starlink

- rocket Launches

- Terrestrial Flights

Like with the entire concept of space, our imaginations can run wild.

Starlink is a worth system. There are over 4 million Starlink customers, paying between $80-$100 per month.

Here again, we can guess at the revenues but have no idea at the cost. Some believe this will be worth hundreds of billions at some point. Do not be surprised if it is eventually spun out of SpaceX.

The COO, Gwynn Shotwell, made some headline recently by stating that the Starship business could be more valuable that Starlink. This encompasses the other two areas mentioned above.

At present, more than 90% of cargo launched into space is from SpaceX. This is a number that is going to decline as the market get larger. We know launches are getting more frequent, along with bigger rockets in the making.

One of the future goal is to have planetary flights. We could see a day when cargo and people are moved around the globe using rockets instead of planes. Naturally, this will not be for domestic flights. However, going from Tokyo to New York might not occur using a traditional plane.

According to Forbes, SpaceX, founded in 2002, is worth nearly $210 billion based on a tender offer launched during the second half of 2024. Musk owns an estimated 42% stake.

This is a company that will likely reach at least a trillion dollar market cap. Before arriving at that point, the ownership will be diluted as more funding occurs. Nevertheless, Musk will still have a couple hundred billion if it reaches that level.

The Path To $1 Trillion

There are other companies that have potential yet aren't worth much with regards to revenues.

The Boring Company and Neuralink could see huge valuations at some point. At present, they are in early stages, far away from reaching profitability.

We simply can look at this as cherries on the sundae if they do amount to anything valuable.

In the meantime, we can see how the path with the other companies gets to $1 trillion. Tesla, xAI, and SpaceX will get him there simply by following their present path. There are still some technical requirements to work out but, these are companies full of engineers and software people.

I would not be surprised if the total market cap of these three company exceeds $5 trillion by the end of the decade.

The only question is whether someone else can be Musk to the $1 trillion level. That might be tough since few have as many holdings with the same upside. Bezos still have a ton of Amazon stock, something that should keep growing in value over the next decade. He also has Blue Origin, his own rocket company. Unfortunately for him, it is trailing SpaceX by a wide margin.

Posted Using InLeo Alpha

Congratulations @taskmaster4450le! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPElon Musk has the unique potential to be so and the favourable conditions of combining such sky high wealths living in a capitalistic countries. Being a billionaire with such high terms of wealths are approved by the US government. Which is why we dont see their incomes and revenues are cut short by unresolved tax impositions.

In most of the third world countries people suffer too much due to that.

Well to be frank, I will not really be surprised to see Elon hitting the $1 Trillion in years to come because certainly it will play out. With the momentum he is going, he will certainly hit it