The State of Cryptocurrency On The Rise

a16z just came out with its latest crypto report, this for 2024. The last time they released one was back in 2022.

The research digs into many variables surrounding the crypto industry. When we look at the basic conclusion, we see a big rise from just two years ago.

This is not to surprising based upon simple observation. We see the narrative changing around crypto. Today, there are candidates for President of the United States talking about crypto. At the same time, Wall Street is involved to the degree that CEOs such as Larry Fink are discussing it on earnings calls.

Of course, both of these are points that were not lost on the folks at a16z.

The conclusion is an optimistic one. This is not completely surprising since people such as Marc Andreeson have long being proponents of cryptocurrency along with blockchain. Nevertheless, it is nice to see it spelled out with data.

If you want a TL:DR, here it is:

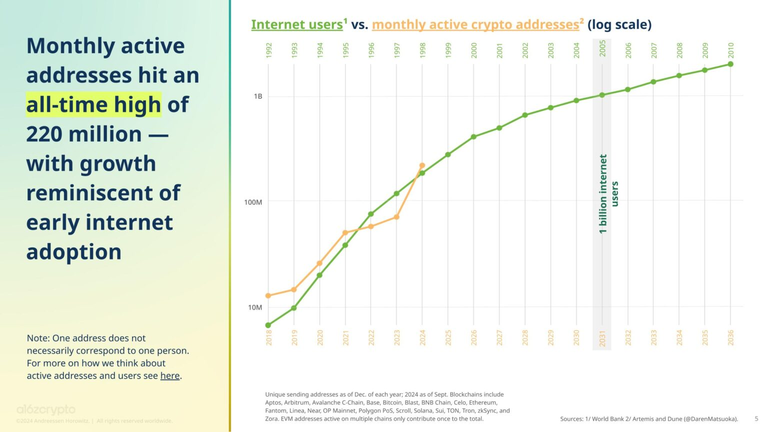

- Crypto activity and usage hit all-time highs

- Crypto has become a key political issue ahead of the U.S. election

- stablecoins have found product-market fit

- infrastructure improvements have increased capacity and drastically reduced transaction costs

- DeFi remains popular — and it’s growing

- Crypto could solve some of AI’s most pressing challenges

- More scalable infrastructure has unlocked new onchain applications

Cryptocurrency On The Rise

Nothing boils this down better than simply looking at usage. We know more is being built, which fosters adoption. While it might not be at the pace most individuals desire, this is something that is expanding rapidly. Many get caught up in the daily ups and downs. It is best to step back and view things through a wider lens.

There tends to always be dispute on how these things are compiled. Personally, the raw numbers are not relevant. If it is 220M active address, or 1 billion, that means nothing. As stated, there are more addresses than users. Thus, I think their method understates things since many who are involved use different tokens and coins.

Nevertheless, as long as they are consistent in their methodology, then we get a chart like above. Here is where we can see the growth rate. That is the most vital aspect. Compared to a few years ago, we can see significant improvement.

It is also interesting how they are comparing it to the Internet. This is a common practice and does give people some inclination of where the industry stands.

If accurate, they place us near the 1998 Internet. For those old enough, consider for a moment how archaic that was compared to today. We were dealing with dial up, Google was just emerging, there was really no social media, and many were not willing to put a credit card online.

That could be the state of today's cryptocurrency world. Extrapolate the development over another 10 years, to equate what the Internet looked like in 2008.

Global Expansion

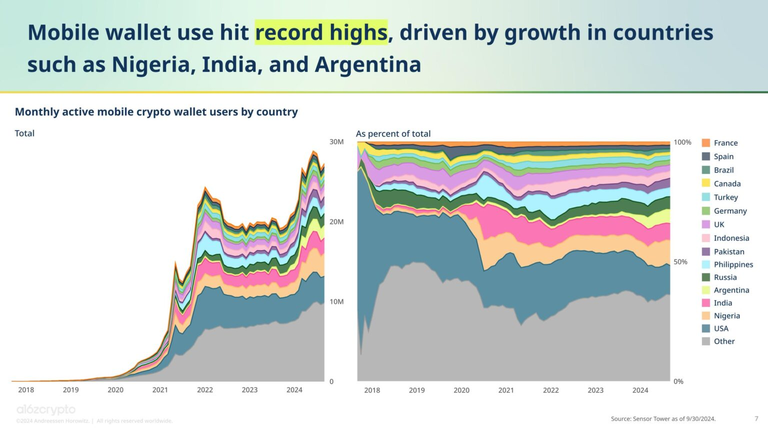

What are the fastest growing countries in regards to crypto adoption?

This is something that could provide a great deal of insight. While many think of crypto as speculation, which is mostly is, there is another side to it.

The idea of the industry being driven by countries like Nigeria, Argentina, and India provides a different viewpoint. While there is some speculation, many of these people have different motives. To them, this could be a form of protection against their native currency. There is also the income factor.

Of course, we have to mention that crypto adoption in India is huge simply due to the fact it is the most populous country. With 1.4 billion people, many of then tech savvy, they could bring a lot of people to the table.

Over time, this is not going to be a developed world industry. The major benefits, and easier adoption, is in these types of nations. For the most part, the developed nations had decent banking systems. In general, people can access the services they need. This is not the case in many other nations.

The important point here is the network effect. Since we are dealing with high population areas, with people who can quickly realize a benefit, this can set off growth rates over the next few years that keep moving the first chart much higher.

The Rise Of Stablecoins

We are seeing a great deal of adoption due to the fact that stablecoins are becoming heavily integrated into the system.

For years, crypto tried to be a medium of exchange without having the characteristics that made it ideal for that purpose. Stablecoins are able to offer what is needed.

This serves a massive role when it comes to financial and commercial applications. That is something that was missing. After all, Bitcoin is known for its HODLers. That is counter to what you want with a medium of exchange.

To me, there are two big advantages to stablecoins.

The first is tied to what we mentioned about some countries and their native currencies. A stablecoin gives people access to another currency, usually the US Dollar. This means that they are gaining simply as the dollar holds against their currency.

Developing nations always had a great deal of US dollar usage. Of the $2.4 trillion in banknotes, 3/4 of that is outside the United States. Naturally, with cash, there is a risk. Stablecoins allow people to operate in a digital manner.

Our second advantage to stablecoin is familiarity. Most people are accustomed to dealing in a digital manner with a currency. The US dollar is also something many are familiar with. A stablecoin combines this in a way that allows for easy transactions.

For example, if a merchant accepts both naira and USD, the pricing is already set. How much is required in ETH is something that adds another layer (leaving aside the fees)? The same is true for BTC. Can you see someone asking, where is the Satoshi price?

In Closing

There is so much in the report that another article is required.

We did not even get to the AI part of the equation. This is something that is going to provide, in my view, the massive thrust. It is going to change everything.

For the moment, we can see how crypto is expanding. While it is easy to get caught up in the daily activity, it is best to stand back once in a while.

Compared to 2022, we see massive progress.

It is something that, I think, will only accelerate. This should make for an interesting 2026 report by A16z.

Posted Using InLeo Alpha

!BBH

@taskmaster4450! @fiberfrau likes your content! so I just sent 1 BBH to your account on behalf of @fiberfrau. (2/20)

(html comment removed: )

)

Even without the numbers and the charts. Government reaction tell enough stories about progress. The ETF firms coming in, Wall street taking a seat and Trump trying to win a campaign through crypto adoption shows progress. This industry will Thrust soon beating even internet at 2008 n present.

Yep. The Wall Street entry changes everything. On one hand, it will provide liquidity; on the other, takes us away from the values of crypto.

!discovery 35

!PIZZA

This post was shared and voted inside the discord by the curators team of discovery-it

Join our Community and follow our Curation Trail

Discovery-it is also a Witness, vote for us here

Delegate to us for passive income. Check our 80% fee-back Program

$PIZZA slices delivered:

@jlinaresp(12/15) tipped @taskmaster4450

Just very quickly, check this out www.minepi.com/zdigital huge airdrops will go live this early 2025!