The Defense Against CBDC Could Come From The States

The passage of the GENIUS Act in the United States did little to put fears of an eventual central bank digital currency (CBDC) to rest. There is another bill that will ban the Fed from issuing a coin along with the prohibiting of developing one.

However, the caveat is "without Congressional approval". Congress can authorize the Fed to issue one, hence removing the protection the bill, if passed, would offer.

Some crypto watchers believes this offer the government with a loophole.

As for the GENIUS Act, others are viewing this as a defacto CBDC. The government is now regulating the stablecoin issues, effectively putting them under the umbrella.

So what is the answer? We will dive into this question in this article.

The Defense Against CBDC Could Come From The States

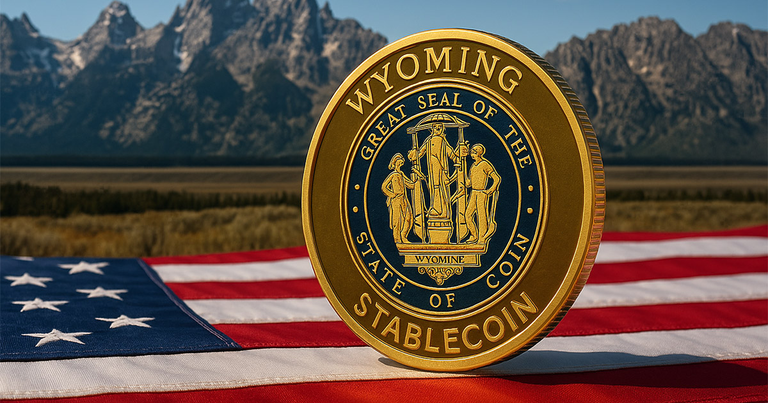

Wyoming is about to become the first state to issue its own stablecoin. This is potentially pitting it against the US government.

The Wyoming Stable Token (WYST) is set to release next month and it could provide pushback against the freezing of coins or seizure of assets.

Many cite the fact that compliance with KYC, AML, and sanctions is included in the law. At the same time, yields are banned.

The landmark bill requires financial institutions to issue stablecoins with “procedures to block, freeze, and reject specific or impermissible transactions,” but as a state-issued token, they say some rules may not apply to WYST, including restrictions on offering a yield.

WYST is looking to get around it. Officials believe the law does not apply to the states and they have the right to issue a coin that does not adhere to what outline the Feds laid out.

For those outside the US, this is a battle over states' rights, a central premise of the rule of law. That said, it does not mean conflict is absent. We will likely seeing this headed to court.

Even though the state feels it could offer yield, it will not go live with that. It is something they will seek to implement in the future.

Pushback On Many Fronts

So far, I felt one of the core pushbacks to the centralization and government regulation is "dark" stablecoins. These are those which operate outside the centralized system, offering true medium of exchange without government interference.

The Hive Backed Dollar (HBD) on the Hive blockchain is one such example.

These will likely be in the form of algorithmic backed or synthetic dollars. Of course, we might see new innovations pop up in the future.

Assisting in this battle could be stablecoins issued by the states. It would not require too many to provide a "hole in the bucket" of the establishment. As long as people have another option or two, the entire system of control is negated.

For this reason, I would expect fierce pushback from the Federal government.

If one of the states can prevail, it will open the door for others to follow. State governments do not have to adhere to federal requests in the same way corporations do. This could be a caveat that provides freedom to the stablecoin market.

It is a bit ironic that the path against government overreach could be government.

Ultimately, it will take a basket of options to combat the recent trend in crypto towards centralized control overseen by governments. CBDCs are only one battle where things are brewing.

Posted Using INLEO

https://www.reddit.com/r/CryptoCurrency/comments/1mape4w/the_defense_against_cbdc_could_come_from_the/

This post has been shared on Reddit by @dkkfrodo through the HivePosh initiative.

There will be a lot of confusions and dragging at this early phase of stablecoins regulations. Still surprised CBDC is thriving for relevance, I feel it will shrink dollar dominance on the long run.

Congratulations @taskmaster4450! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 620000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPHello taskmaster4450!

It's nice to let you know that your article won 🥉 place.

Your post is among the best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by heruvim1978

You and your curator receive 0.0045 Lu (Lucoin) investment token and a 4.42% share of the reward from Daily Report 738. Additionally, you can also receive a unique LUBROWN token for taking 3rd place. All you need to do is reblog this report of the day with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by @szejq

STOPor to resume write a wordSTART