Tether US Treasury Holdings Surpass Germany: The Future of Stablecoins

The stablecoin coin world is awaiting the bills in Congress. Each house has a version that it is working upon. If passed, they can be reconciled and sent to the President's desk for signature into law.

It will establish regulatory framework within the United States.

Many are awaiting this move. As we covered in other articles, this is going to kick off a major move. Based upon revised drafts of the GENIUS Act, this is going to be handed to the banks since Big Tech will be excluded.

The production of stablecoins simply means more US Treasuries being bought. This is a key component to both bills. Asset backing is required and this mostly boils down to Treasuries or Mortgage Backed Securities.

What it is going to do is shake up the bond market. Specifically, we are going to see the holders of US debt changing.

Tether is already leading the way.

Tether US Treasury Holdings Surpass Germany: The Future of Stablecoins

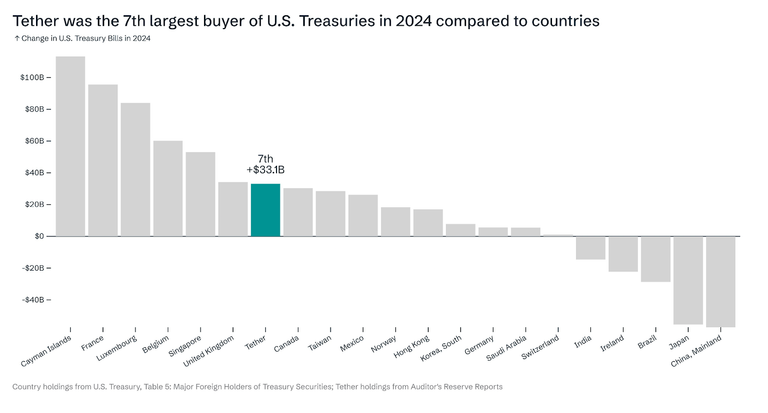

In 2024, Tether was the 7th largest buyer of US Treasuries. This outpaced countries like Canada, Mexico, and Taiwan. The move now puts the company over $120 billion in Treasury holdings.

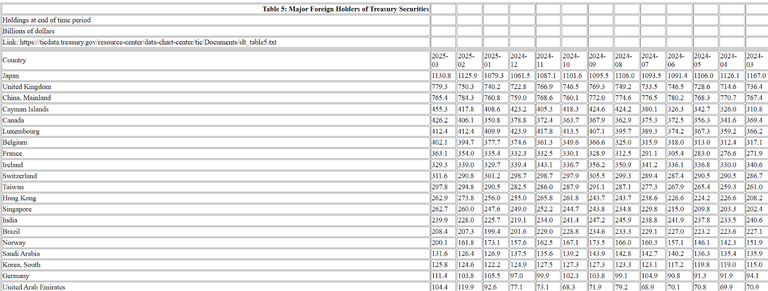

One a global scale, this total puts it ahead of Germany, the number 19th ranked country.

Here is where we gain some insight into the early shifts that we could foresee in the future.

The list is populated with countries. These tend to be some of the largest holders of government debt. Naturally, this is fueled by the power of their economies. The largest, such as the US and China, are in the tens of trillions in GDP. Multi-trillion economies can push Treasury holdings to near a trillion.

The Banks Will Be Loading Up

My view is that Big Tech will easily enter the trillion dollar category in Treasury holdings. This is a given for Meta. Of course, if they are prohibited from issuing stablecoins, this alters teh dynamics.

The banks are going to issue their share. When we think about the potential of a Bank of America or Citigroup, both can enter the multi billion dollar stableocoin range. Will either be as large as Tether? On that I am not sure.

What I do know is that most every major bank will be involved. They will all issue their own stablecoins. The collective will really add up.

This means the commercial banks will be loading up on US Treasuries.

One indicator is Blackrock's BUIDL. This is an institutional token that was established last year. The holdings are now over $2.8 billion. It is a fund that backs with a combination of cash, US Treasuries, and Repo contracts.

Nearly Free Money

Why will all the banks want it?

The answer is because they like making money. It only requires simple math skills to see how this can benefit these institutions.

In fact, going back to Tether, we see how it pulled in over a billion dollars earlier in the year.

Tether reported over $1 billion in operating profit from “traditional investments” during the first quarter of the year, “driven by solid performance in its US Treasury portfolio, while the performance of Gold has almost offset the volatility in crypto markets,” according to the firm’s attestation report.

Banks are not going to pass that up.

The key issue will be the distribution of the interest paid on the assets. Tether and Circle retain it, being part of the companies revenue streams. Blackrock pays the interest to the token holders, instead charging a management fees of the fund. This is more in line with the structure of traditional investment banking.

At question is the legality. Blackrock can do this simply because it is not offering this to the general public. So far, the SEC has not stated how it will handle stablecoins which distribute the profits to token holders. When the company retains it, the token is not a security. By distributing, that might change things.

For the most part, banks, in my estimation, will retain the interest payments. While the Blackrock number is small compared to the size of the top US Treasury holding nations, the key is the number. We could see hundreds of tokens that top a billion. Naturally, every token is not 100% backed by a T-bill but we can see how this starts to add up.

We are watching a complete change in how the money supply operates.

Posted Using INLEO

I enjoy this your wonderful teaching about stable coin, you are really knowledgeable and wise, keep it up sir 🙏🙏🙏.

https://www.reddit.com/r/CryptoCurrency/comments/1kqdkwu/tether_us_treasury_holdings_surpass_germany_the/

https://www.reddit.com/r/economy/comments/1kr0yqr/tether_us_treasury_holdings_surpass_germany_the/

This post has been shared on Reddit by @x-rain, @uwelang through the HivePosh initiative.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

In Europe, Tether is facing closure because the EU requires investments in euros. BlackRock is already further ahead and already has a euro stablecoin in its back pocket. The German bank is now entering the stablecoin business and creating its own euro-based cryptocurrency.

Europe is cooked though.

Yes, from the socialists. However, Europe has already regulated the crypto sector recently. The US hasn't yet done so.

Nobody wants a Euro stable coin. It’s dollars that matter. It’s just the truth

Yes, private individuals don't want euro stablecoins, but European banks are under pressure from the European Central Bank.

So far, only the USDC stablecoin is eligible in the EU; Tether has already been delisted from crypto exchanges in Europe.

that is an impressive achievement

I think stable coins will keep the dollar alive a little longer. I think Trump and team recognize this.

More than a little longer.

Dollar isn’t going anywhere anytime soon.

Dollar will be around forever, but it might not be the world reserve currency for too much longer. I think you're right, it will take at least ten more years, but this petrodollar system is on its last legs.

Since the involvement of banks in stablecoins and the acquisition of US Treasuries will impact both the bond market and the broader economy, how should a small-time crypto retailer prepare for these developments?

!PIZZA

!LOLZ

lolztoken.com

I wish you were a little patient.

Credit: reddit

@taskmaster4450, I sent you an $LOLZ on behalf of rzc24-nftbbg

(2/10)

$PIZZA slices delivered:

@rzc24-nftbbg(2/10) tipped @taskmaster4450

Come get MOONed!