Stablecoin Innovation On The Rise

This article is for educational purposes. It is not a condoning of the development contained herein nor is it meant to be financial advice.

The stablecoin world is starting to wake up. We are looking at roughly a $200 billion market cap. As stated in the past, my expectation is we will see this move into the trillions.

A major step forward will occur when the United States passes stablecoin legislation. This will open the gates to major institutions such as banks entering. At the onset, this will likely following the existing models.

However, we are going to see a great deal of innovation, especially as Big Tech gets involved. The marriage between technology and money (finance) is multi-decade. Like most things, we could see an acceleration of this.

In this article we will dive into a proposed idea for a new form of stablecoin.

Stablecoin Innovation On The Rise

Innovation is key. It is crucial for industries to keep moving forward, presenting new ideas. Iterations of what went before is the basis of technological advancement. Models such as S Curves explain the trend that products and different developments follow.

This is now the world of money.

It does not take a genius to figure out that almost the entire financial system is digitized. We operate via an online device. Computers are connected to networks, allowing for financial transactions to occur.

Cryptocurrency made news because it literally merged these ideas together. The monetary unit of a blockchain like Bitcoin or Ethereum were native. This means the network was not separate from the money. To contrast, Visa is a massive computer network, passing data along throughout the day. It is tied to currency, mostly the USD, which rides on top. Currencies are added as the network enters new markets.

The problem with most cryptocurrency is the low quality it brings as a medium of exchange. Anything that is HODLed is not ripe for that role.

Enter stablecoins.

These are tokens that can operate in this capacity. The $200 billion is not a surprise, nor will massive growth. To facilitate a greater number of transactions, usually a combination of more money along with greater velocity is required.

New Kind of Stablecoin?

Could we see some innovation taking place?

Cab Labs believes it is onto something with the release of its new paper.

Cap Labs Reveals Type III Stablecoins, Promising Smarter Yield Generation With No Human Oversight

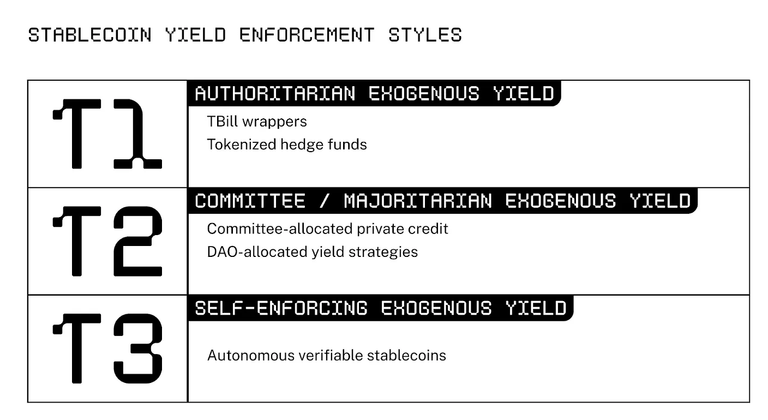

We can see what is proposed in the above chart.

They are calling this "Type III Stablecoins". The design is to eliminate human activity with regards to yields. We see this becoming popular as more entities start to provide yield for staking stablecoins. The challenge, according to this team, is that humans determine what the rate should be.

Ironic that many in crypto espouse negative sentiment towards the Fed yet that is exactly what it does with its monetary policy.

Type III stablecoins eliminate human governance by encoding rules for capital allocation, operator oversight, and recourse into immutable smart contracts. Unlike Type I (centralized) or Type II (DAO-managed) models, Type III delegates decision-making to “restakers” who collateralize assets to back third-party operators. These operators generate yield through strategies like lending, with restakers incentivized to prioritize safety due to direct exposure to slashing risks if strategies fail.

Cap Labs’ solution automates strategy shifts via market-driven interest rates and redistributes slashed funds to users during failures, ensuring verifiable recourse without legal intermediaries.

That certainly is a mouthful.

Basically, the goal is to remove human decision making from the process. Instead, technology will be incorporated to facilitate market activity for setting the return. The paper goes into the details.

Of course, this is a TradFi solution since it is going to be only available to "accredited investors". This means another innovation that is basically Wall Street institutions.

Hopefully, as we move further along, the industry realizes the need to innovate. We are seeing the usuall suspects taking advantage of this.

Stablecoins are going to be a major force in the future. In fact, they will end up being the currency that everyone uses as a medium of exchange.

Posted Using INLEO

This post has been manually curated by @steemflow from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @steemflow by upvoting this comment and support the community by voting the posts made by @indiaunited.

I personally believe that stablecoins are perfect for the future, hopefully immediate. Removing human decisions from the process could make things safer and faster. I also think that spending in crypto, that is the stable coins should be our focus with the adoption and not just having reserves, trading and making profits.

Human decisions mess up the idea most of the time and taking it out would be good. Although, I won’t deny that some of these decisions keep the market going most of the time too.