a16z: Stablecoin Explosion

Andreeson Horowitz is one of the best known venture capital firms in Silicon Valley. It was started by Mark Andreeson and Ben Horowitz, both well known technology figures.

The firm is a supporter of cryptocurrency. It was an early investor in firms such as Coinbase, I am sure earning a tidy profit. Many visit their website, a16z.com, for not only crypto insights but also general trends in technology.

Marc Andreeson is famous for saying "software is eating the world". It stems from the idea that every company will eventually be a software company.

Here are some examples:

- Netflix disrupting the traditional TV and movie industry

- Amazon transforming retail and commerce

- Uber and Lyft changing the transportation landscape

- Airbnb revolutionizing the hospitality industry

The takeaway is the company is not afraid of bold claims.

It is now predicting a stablecoin explosion, thoughts we have echoed in a number of articles.

a16z: Stablecoin Explosion

Maybe the update to Andreeson's quote should be "stablecoins are eating the world".

While it might be a bit early to predict this, we have to keep in mind the first quote was made back in 2011. Thus, perhaps we are using some foresight as opposed to wishful thinking.

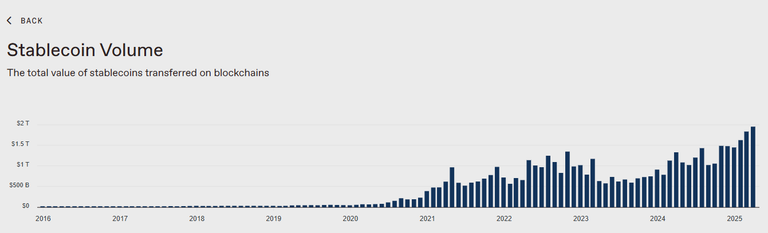

The month of April saw $1.94 trillion in payments made using stablecoins. It likely pales in comparison to the total global payment system but, as they say, we have to start from somewhere.

It is crucial to note that we are still in the embryotic stages of this development. Legislation in the United States is still lacking, something that is keeping most institutions on the sidelines. Yet, in spite of that, we see the numbers growing.

The reality of the situation is that stablecoins, riding along blockchain networks are simply faster and less costly than the existing system. In other words, we are looking at better technology.

We see this mirrored in the list above. Taking the first example, Netflix, it is easy to see how that is a better experience for viewing films as opposed to driving to the video store. Thus, it is easy to grasp why the likes of Blockbuster Video are out of business.

Here is what the trend looks like:

We can see the trend over the last 18 months. The $1.94T was an increase from $1.82T in March.

This is a part of crypto that is vastly different from the "price go up" focus of most.

But stablecoin activity is largely uncorrelated to crypto market cycles — organic, non-speculative use appears to be widespread and growing even as crypto trading volume fluctuates

The WhatsApp Moment

With the focus upon the price of Bitcoin price, and talk of bull or bear, it is easy to lose sight of what is truly happening. Basically, when it comes to crypto, most of that is noise. Markets go up, and they go down. That was always the case. Of course, this is fed by the "get rich quick" narrative with many looking to instantly change their fortunes.

Building is what is important since this is where revolution will take place. Bitcoin is not changing the world: stablecoins are.

How much of an impact can they have:

The big picture: Stablecoins could be a ‘WhatsApp moment’ for money, making international transactions nearly free and instant

Stablecoins are our first real shot at doing for money what email did for communication: Make it open, instant, and borderless.

People who are not old enough to remember life before the instant messenger age lack the contrast of how much different things are. Communication was slower and more expensive then. It was also inefficient.

Before apps like WhatsApp, sending a text across borders meant paying 30 cents per message. Internet-native messaging is now instant, global, and free. Payments are now where messaging was in 2008: limited by borders, burned by intermediaries, and expensive by design. Stablecoins could dramatically improve this situation.

Just consider how different things are now compared to then. We do not give a second though when sending a message as to where the individual is located. Global communications is near free and available to anyone with a smartphone.

If we want to step back a bit further, ponder life before SMS. There was a time when a message was writing a letter and putting it in the mail.

a16z is predicting a similar revolution due to stablecoins. Here is the basis of the problem:

Today international remittances can cost up to 10% in fees. (A $200 remittance cost 6.62% on average in September 2024.) These remittance fees aren’t just friction points — they’re effectively regressive taxes on the world’s poorest workers. But businesses also suffer from the inefficiencies of global payments. Along certain corridors, B2B payments can take 3-to-7 days to clear and can cost anywhere from $14-to-$150 per $1,000 transacted — passing through as many as five intermediaries along the way, each of whom takes a cut. Stablecoins could help bypass legacy systems and silos, like the international SWIFT network and associated clearing and settlement processes, and make these transactions nearly free and instant.

Just reading this makes on realize the magnitude of this problem. We are dealing with something that is archaic along with a solution. It is happening in real time.

This isn’t theoretical — it’s already happening. In 2024, stablecoins moved $15.6 trillion in value, effectively matching Visa’s volume. While that figure mostly represents financial flows (versus retail payments), its magnitude still suggests we’re on the verge of a financial infrastructure shift.

My view still holds that we are going to see the stablecoin count get into the trillions. The volume listed is taking place with around $200 billion in stablecoins issued. What happens when this number is $2 trillion? Or 20 trillion?

Legislation is the holdup What happens when banks start to issue their own stablecoin. The volume of payments using these tokens will explode.

I agree with a16z. We are seeing a revolution unfolding in global finance.

Posted Using INLEO

https://www.reddit.com/r/CryptoMarkets/comments/1kflkc7/a16z_predicts_stablecoins_will_transform_global/

This post has been shared on Reddit by @flummi97 through the HivePosh initiative.

This article makes me even more bullish on Circle going public. Paxos is holding a lot of power as the underwriter for several important stablecoins, not just tied to USD but also to Gold.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.