RE: Why Jump Into Sui?

You are viewing a single comment's thread:

Thanks, a great summary, I'll definitely have a look at some of those dApps, so far, all I've really needed to use in the SUI ecosystem is Suilend where I deposit my SUIand borrow USDC ( nett profit on the APR the, I'm getting paid to borrow!!) and Bluefin, where I convert that Borrowed USDC into other tokens and use them in LP's, such as SUI:wBTC

The earnings from Bluefin I take back to Suilend and either convert to SUI to build up my SUI stake, convert to USDC to paydown my borrow, or convert to something line WAL, which I stake for 47% apr atm.

SUI reminds me of SOL before it took off in 2021.

BTW, KASPA reminds me of SUI before it had DeFi, have you looked into $KAS ?

0

0

0.000

Thank you for stopping by and commenting! 🙏

You know, I really close to adding SuiLend as a fourth protocol but the post was getting a bit too long. I'm staking WAL there as well, nice APR. I think NAVI has a similar WAL ARP for deposits, but I like SuiLend more.

Volo is great if you are holding SUI, cos my reasoning is that why just hold when we farm the airdrop at the same time + plus tiny APR.

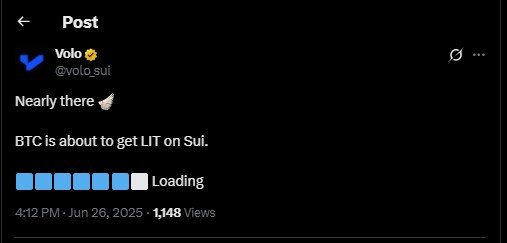

Just a moment ago, I noticed they are cooking something BTC-related as well...

Need to check out Kaspa, btw! I was holding that some time ago, but haven't been active on-chain.