Visa

Visa didn’t just do well this past quarter—it delivered one of the strongest performances we’ve seen so far.

EARNINGS

Visa , the global leader in electronic payments, reported its quarterly results and absolutely crushed it once again. Specifically, earnings per share came in at $2.76, beating analysts’ estimates of $2.68. That’s a beat of $0.08 per share, proving the company’s strong profitability.

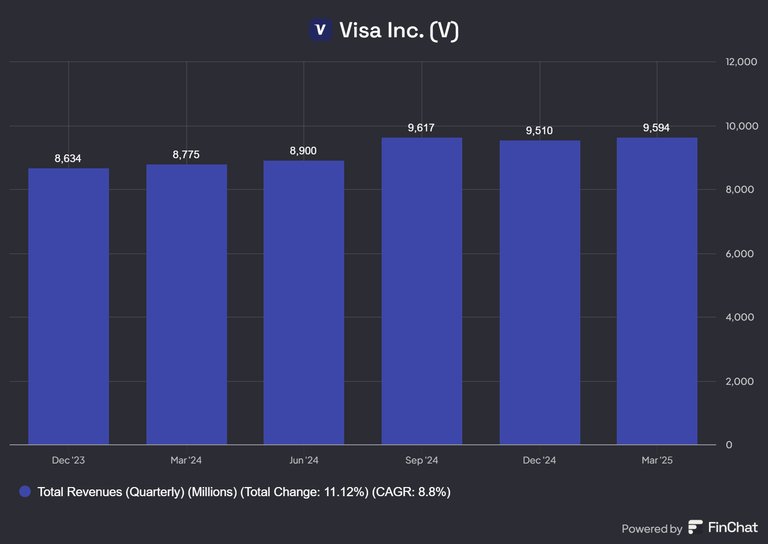

Revenue also reached $9.6 billion, marking a 9% increase compared to the same quarter last year, and $50 million above expectations.

Now you might be asking, Where did all this revenue come from? Well, service revenues rose by 9%, reaching $4.40 billion. Meanwhile, data processing revenues increased by 10%, hitting $4.70 billion. And lastly, international transaction revenues jumped by 10%, coming in at $3.29 billion.

But in a company like Visa , revenue isn’t the most important figure. Then what is? Transaction volumes. Because the bigger the transaction volumes, the higher the revenue.

Total payment volume reached $3.94 trillion. And although that’s slightly lower than Q4 due to the holiday season, it still represents an 8% increase year-over-year! Cross-border volume saw an impressive +13% growth in constant currency, proving Visa’s resilience on a global scale. And total processed transactions hit 60.7 billion, a 9% increase.

It’s clear that Visa is maintaining a very strong growth trajectory, despite the ongoing uncertainty in the global economic environment. And that’s exactly why I like it so much!

BUYBACK

And as if the stellar results weren’t enough, management also announced a brand-new $30 billion share buyback program!

And why is this buyback such a big deal? Well, let me explain. First off, it reduces the total number of shares in circulation. That improves EPS even further and increases the stock’s value for existing shareholders. And finally, it signals management’s confidence in the company’s long-term value.

Naturally, the market responded positively to this news.

Right after the earnings release and the buyback announcement, Visa’s stock jumped as much as +2.2% in after-hours trading before settling back, confirming the positive sentiment from investors and analysts alike.

Posted Using INLEO

That is always what investors want to see. The growth in the business shares and sustainable profit over the years.

Exactly visa a paradise for investors

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

https://www.reddit.com/r/Economics/comments/1kd6a5l/visa/

This post has been shared on Reddit by @dkkfrodo through the HivePosh initiative.