Trump Won , Stocks Pumped , Crypto Pumped And Trumponomics Are Coming

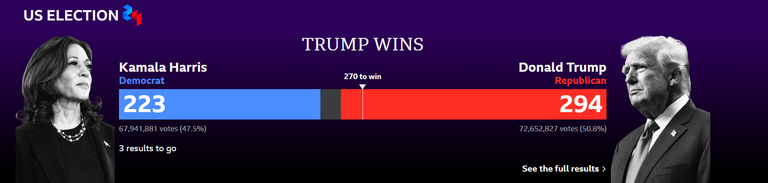

Yesterday, the entire planet was on pins and needles, waiting to see who would become the next President of the United States. And, as we now know, the winner of the election is Donald Trump.

Of course, the result was already clear early on, as the statistics indicated a decisive Trump victory.

BEFORE THE RESULT

The outcome was pretty much determined early, with the statistics clearly pointing to a Republican win. Naturally, this led to a mini-rally in the pre-market, with Wall Street indices showing gains of up to +3%, along with a boost in many stocks.

Okay, that was expected, you might say. Anything more exciting? Well, of course! Early in the morning, long before his victory was officially confirmed, Trump started celebrating. In a speech in West Palm Beach, Florida, he thanked American citizens for the honor of being elected president and promised to heal the country and fix its problems, forecasting a golden age for America. I repeat, WAY before the official win. Sure, he knew he’d win (thanks to the statistics), but he just couldn’t contain himself!

And, naturally, this wouldn’t be complete without a mention of Elon Musk, who actively supported Trump’s campaign. Trump also praised Musk for SpaceX’s successful landing of the Starship rocket.

AFTER THE RESULT

Musk is expected that he’ll have an active role in Trump’s administration.

You might wonder, what does Musk have to do with the government? Well, for those who don’t know, Elon Musk is set to take over the Department of Government Efficiency (D.O.G.E) to help organize the U.S. government’s finances. We’ll see if it actually happens, though. Anyway, let’s move on.

As expected, the markets continued the rally that began pre-opening, with major indices soaring and the Dow Jones breaking records, closing at +3.57%! It wasn’t just the Dow; we also saw significant gains across most sectors of the S&P500, with the financial sector leading the way, rising by +6.14%! and BTC making a 13% move.

Alright, we expected this. But what does Trump’s win actually mean? Well, the truth is that Trump has made some bold promises. Among the things that matter to us, he’s mentioned tax cuts and boosting the economy through tariffs.

So, will this strengthen the U.S. economy? The issue of tariffs is controversial; yes, it could boost the sale of products made in the U.S., but many analysts worry tariffs might raise prices for American consumers. On the other hand, as we said, Republicans favor more tax cuts, which means they’re more business-friendly (helping companies through favorable tax policies).

So should we be happy that Trump won?. Will the markets rally now? Historically speaking, markets indeed tend to perform better under Republican administrations, at least in the short term. Long term, though? It doesn’t really matter.

The markets will follow their path over time, regardless of who’s president.

INVESTMENT-WISE

And what does all this mean for us? Firstly, yesterday serves as a perfect example of why we shouldn’t stay out of the markets, waiting for a downturn.

That’s because, if we miss even a few of the best days in the market, it can lead to dramatically negative effects on our returns.

TrumpoNomics

Regarding inflation control, Trump mentioned that he plans to increase oil and natural gas production. He believes America has vast oil reserves and needs to capitalize on them. Whether he can achieve this is questionable, though, as we already know U.S. oil producers are operating at full capacity. Additionally, he plans to impose new tariffs on imported goods. Specifically, he intends to (a) impose additional tariffs on products from China (ranging from 60% to 100%) and (b) an extra 10% tariff on imports from other countries. Through these measures, Trump aims to “ensure economic fairness.” (Whatever that means in his mind.)

But hold on ,won’t this raise product prices? Correct, the higher import taxes will increase the prices of imported goods, and thus inflation. However, it will be beneficial elsewhere!

Consider that Trump believes Taiwan stole the chip market from America and thinks they should pay America for protection.

THE UPSIDES

Enough with the negatives—this is where it gets interesting and where the positive impact on the markets comes in.

Trump wants to lower the corporate tax rate to 15%! This rate is much lower than his initial proposal to reduce it to 20%. This, combined with a looser regulatory framework, is set to give a significant boost to economic activity.

And when this economic boost combines with increased tariffs, it will greatly support the consumption of domestic products, as they’ll be cheaper!

So what does all this mean? More profits for American companies, which means an increase in their stock value! (And in the markets in general.) Of course this might also increase the cost for essential materials that are imported.

In the realm of social media, Trump believes that big companies like Facebook and Instagram have become too powerful. However, he doesn’t plan to ban TikTok, as he believes there should be competition.

Regarding cryptocurrencies, although he previously called them a scam, he now believes that America should lead in this field. If America doesn’t, then China or some other country will, he says, and he’s right.

In short, Trump’s plans favor American companies, which obviously has a positive impact on those of us investing in them.

Now I won't comment for social matters and what he is going to do with the two major wars that are taking place in the world this is a topic for a later time.

Posted Using InLeo Alpha

One might think that because Musk' is wealthy that he had no business being in government, well with the office he'll potentially hold, it just opens a lot more opportunities for him. When powerful people come together the effect can be devastating.

Well musk will soon collide with Trump I am sure of it they are really explosive personalities.