No Rate Cuts While Tariffs Remain So High

It seems like every day we’re just waiting to see what the FED will do with interest rates and what Trump will do with tariffs… and every day, they just give us a new version of the same story.

And you know what’s funny? Every time we think something will finally change, we end up right back where we started. Statements, minutes, tweets, letters... and the markets trying to figure out what it all means for the next quarter. Exhausting, right?

FED

So the other day, the minutes from the FOMC meeting (that’s the committee that sets interest rates) were published, and what did we learn?

That yes, interest rates remained unchanged at 4.25%–4.50% for the fourth consecutive time, but there’s SERIOUS concern about inflation. Specifically, whether the tariffs that are starting to kick in will reignite it.

Because what are tariffs, in practice? A tax. A cost that gets passed on to the consumer. Meaning: import costs rise > shelf prices go up > inflation increases > the FED gets nervous about cutting rates too quickly.

That said, quite a few committee members mentioned that if the economy evolves as expected, a rate CUT might come later this year. In fact, some are even eyeing the next meeting as a possible moment for it. Some believe inflation has stabilized and that long-term inflation expectations remain under control.

BUT. And here’s the kicker: if tariffs turn out to be more persistent than expected, or if inflation sticks around because of them, then… forget the cuts. The scenario flips. Back to tighter policy.

And as if that wasn’t enough, the big scary word came up: stagflation. That’s when you have BOTH low growth AND high inflation at the same time. A central bank’s worst nightmare.

That would put the FED in a huge dilemma. Support growth with lower rates? Or fight inflation by keeping them high? Options shrink, and the risk of mistakes increases.

In any case, the FED essentially sent one message: “We’re waiting to see. Don’t pressure us.” Meanwhile, Trump keeps hammering them.

TRUMP AND TARIFFS

And since we brought up Trump, let’s talk tariffs. If you thought the 90-day “pauses” he announced had settled the issue… guess again.

source

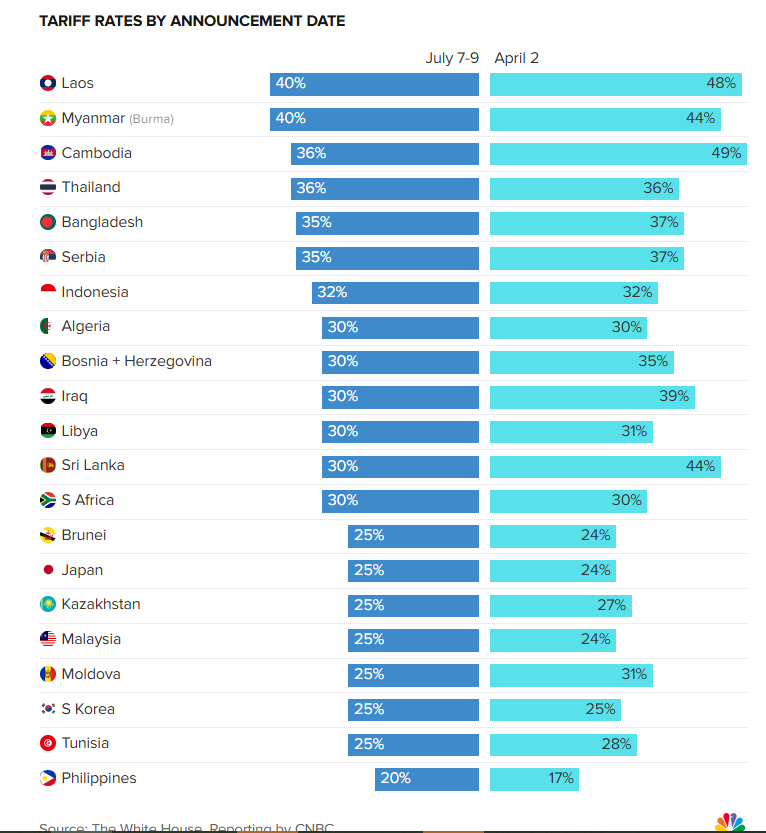

Just the other day, president Trump announced new tariffs on another 7 countries: the Philippines, Libya, Iraq, Sri Lanka, Moldova, Algeria, and Brunei. And these come on top of the 14 that had already been notified earlier this week.

So in total, we now have 21 countries facing new tariffs between 20%–40%. And those numbers are expected to grow.

And don't forget that yesterday he announced a 30% tariff in Europe.

And it doesn’t stop there. In the letters he sent them, he said the tariffs are “less than what you actually deserve,” and that they may be revised in the future… depending on how good of friends we turn out to be. In other words, trade policy based on political friendship.

Put another way, trade policy used as a negotiation tool. Or to put it even more bluntly… as leverage.

And the best part? Most of these countries aren’t even significant trading partners for the U.S. So the whole thing feels more like political theater than serious strategy. It’s for headlines, not for economics.

Still, the tariffs officially take effect on August 1st, with no further delay. Trump made it clear: “No extensions will be granted.”

So yeah, we might laugh at the spectacle, but the consequences are real. And they could lead to a new wave of uncertainty for markets, inflation, supply chains, and more.

Posted Using INLEO

Playing the "wait and see game" can sometimes suck because what you end up seeing may not be part of your plans. I think doing nothing is the second best option here. Trump has an erratic character and what he says sometimes doesn't match what he ends up doing.

Tariffs are going to raise prices, are almost certainly going to have an inflationary effect. Trump's looking to Powell to bail him out. He wants that rate cut before the full impact of the tariffs hit. It's a race. Will the prices/inflation start rising, which will make a cut difficult if not impossible. Without a rate cut, and an increase in prices, there will be reduced consumption, a drag on the economy. A rate cut would be a life preserver, an artificial boost to offset that drag.

It's funny watching Trump fume at the one person in the world who doesn't seem to cower before him, the one person in the world who may hold the keys to the economic success of his second term.

Yes if he continues with tariffs cutting interest rates will make inflation a bigger problem than it was before. Powell is doing an excellent job but his term is ending in less than a year .

Congratulations @steemychicken1! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP