More Corporate Earnings

Earnings Earnings Earnings

CVS

Let’s start with CVS , which arguably had the most interesting performance recently.

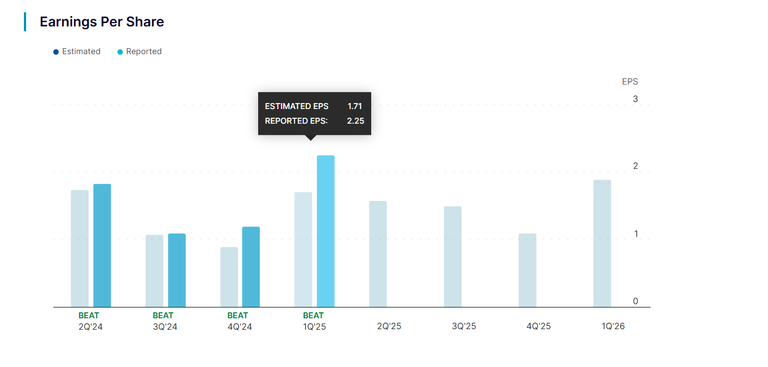

The company reported earnings per share of $2.25, beating analysts’ estimates by $0.58.

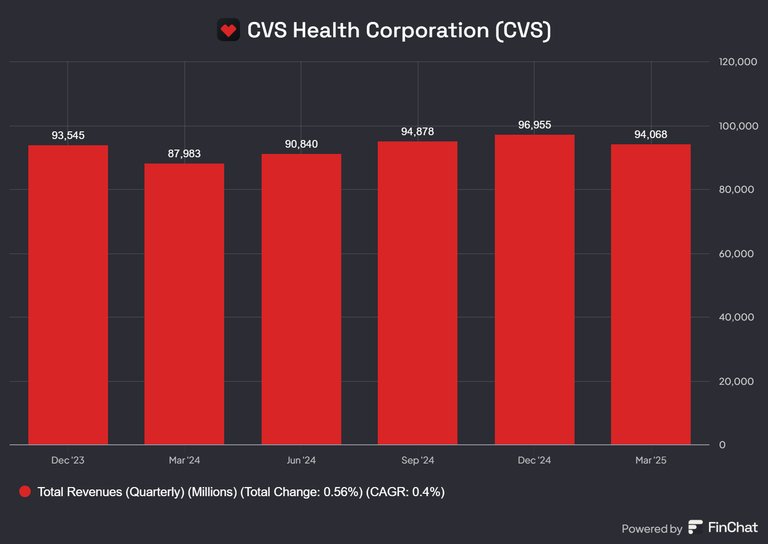

Its revenue reached $94.6 billion, up 7% year-over-year, while its cash flow from operating activities stood at $4.6 billion—an especially positive sign of strong operational performance.

But that’s not all. CVS revised its guidance upward for the rest of the year. Specifically, it raised its forecast for adjusted earnings per share to a range of $6.00 to $6.20—above initial estimates and even above analysts’ average forecast of $5.91. At the same time, it raised its projection for annual cash flow to $7 billion, up from the previous estimate of $6.5 billion.

Additionally, the company announced it will exit the individual insurance market (Obamacare) due to the segment’s unprofitable performance, recording a projected loss of $448 million for 2025.

And how did the other segments perform? Well, the pharmacy and consumer health division reported an 11% increase to $31.9 billion. CVS Caremark, the pharmacy benefit management segment, announced a partnership with Novo Nordisk to promote Wegovy over Eli Lilly’s Zepbound. Meanwhile, the health services division (CVS Health Services) contributed $43.5 billion to total revenue, up 8% from the previous year.

AMAZON

Now, let’s take a look at Amazon , which also reported strong results—but the market’s reaction was... a bit more cautious.

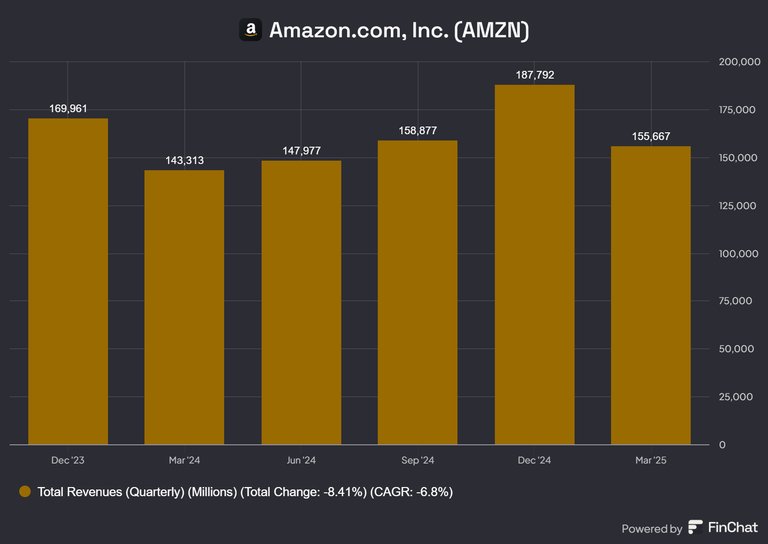

Amazon, you see, reported revenue of $155.7 billion for Q1 2025, up 8.7% from last year, beating analysts’ expectations.

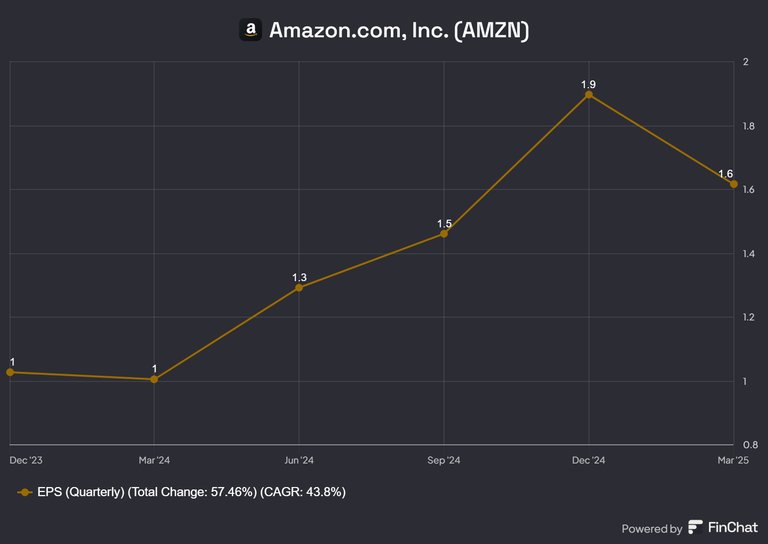

Operating income was $18.4 billion—a 20% increase from last year—while earnings per share hit $1.59, also beating estimates by $0.23.

AWS, the cloud computing division, continues to be the main growth driver, with revenue of $29.3 billion and a 17% year-over-year increase. Excellent performance was also seen in online sales ($57.4 billion) and third-party seller services ($36.5 billion), highlighting Amazon’s multifaceted strength.

However, despite the impressive results, the stock dropped 0.12% on Friday.

The main reason was the company’s guidance for Q2 2025. Amazon projected revenue between $159 and $164 billion—slightly below the $161.4 billion analysts expected—while operating income is expected to range from $13 to $17.5 billion, which is lower than the $17.8 billion analysts had forecast.

But that doesn’t worry me at all. Amazon is a GIANT of the global economy, with a stellar track record, continuous innovation, and a presence in virtually every corner of both the digital and physical marketplace. So, for those thinking about building a position or strengthening their investment in Amazon , if this dip continues after the market opens, it could be a golden opportunity. Long-term investors know these chances don’t come around often.

Posted Using INLEO

Great earnings breakdown! CVS really crushed expectations with that $2.25 EPS beat while Amazon showed its usual strong performance despite the market's cautious reaction. The pharmacy division's 11% growth and Amazon's AWS continuing to dominate are particularly impressive highlights. That CVS guidance boost to $6.00-$6.20 EPS shows serious confidence too. Thanks for sharing these detailed numbers and analysis - always helpful to see the key metrics laid out so clearly!

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Congratulations @steemychicken1! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Stellar earnings breakdown! CVS blew past expectations with a $2.25 EPS beat, and Amazon’s rock-solid performance shines through, even with market nerves. That 11% pharmacy division surge for CVS and AWS’s profit dominance are huge highlights. CVS’s bold $6.00-$6.20 EPS guidance boost screams optimism! In my view, these numbers reflect a crazy resilient market, though volatility keeps things spicy. Thanks for the crystal-clear metrics and insights, super helpful!