High Interest Rates And Strong Number Suggests Incoming Recession ?

What’s Really Happening with Interest Rates in the US, What the Market Is Telling Us.

Because, as it turns out, Jerome Powell seems to be preparing for a marathon. But the numbers are starting to tell a different story – one that might mark the beginning of a new era.

POWELL’S SPEECH

The other day, Jerome Powell, the Chair of the Federal Reserve, made a critical statement: interest rates – the Fed’s main tool against inflation – might need to stay high for longer than we thought.

And the reason?

Not just because inflation remains stubborn, but because the world has changed. We now have more frequent supply shocks, as he specifically mentioned. In other words, disruptions in the supply chain that can repeatedly trigger new waves of price increases.

He said, “We might be entering an era of more frequent and persistent supply shocks. A tough challenge for central banks.”

And all this comes just as the Fed has launched a new five-year strategic plan, signaling a fundamental rethink of how US monetary policy works.

In short, Powell is telling us: forget the era of near-zero interest rates. We’re entering a new age – one that’s more unpredictable, more complex, and more demanding.

Overall, Powell and the Fed’s stance seems to be that interest rates will likely remain high for much longer than we expected.

PPI REPORT

But the numbers seem to be telling a different story.

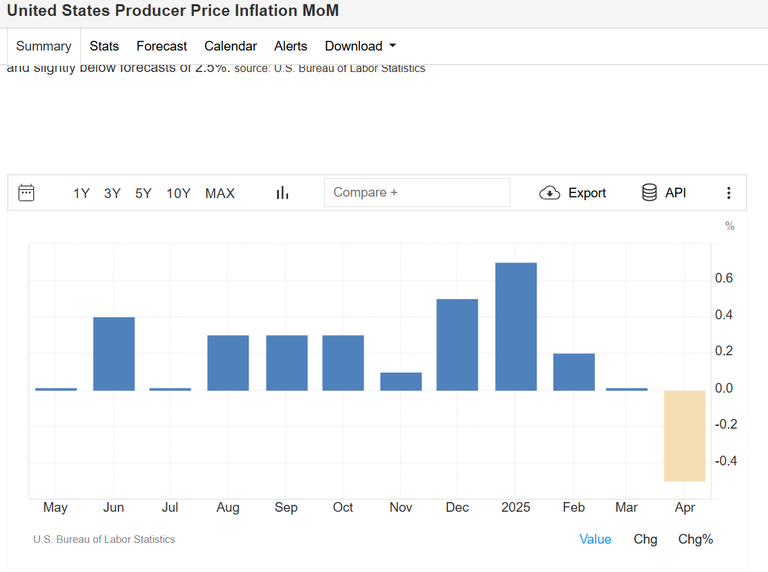

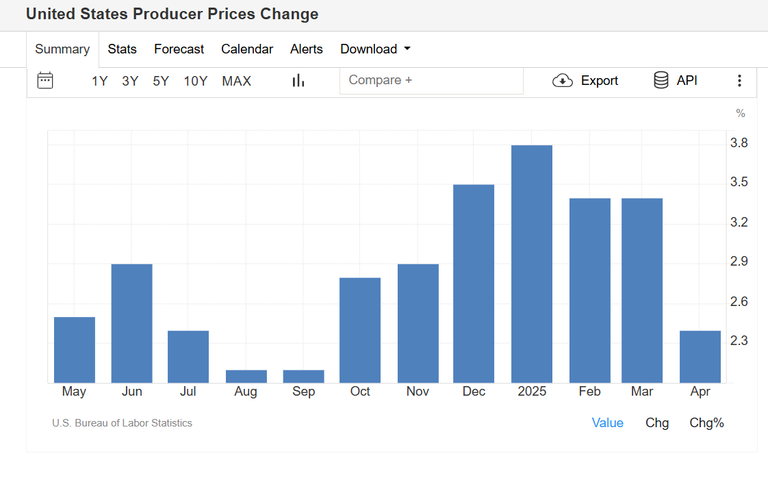

According to the latest official data, the Producer Price Index (PPI) fell by 0.5% in April. Analysts were expecting a rise, yet we saw a drop.

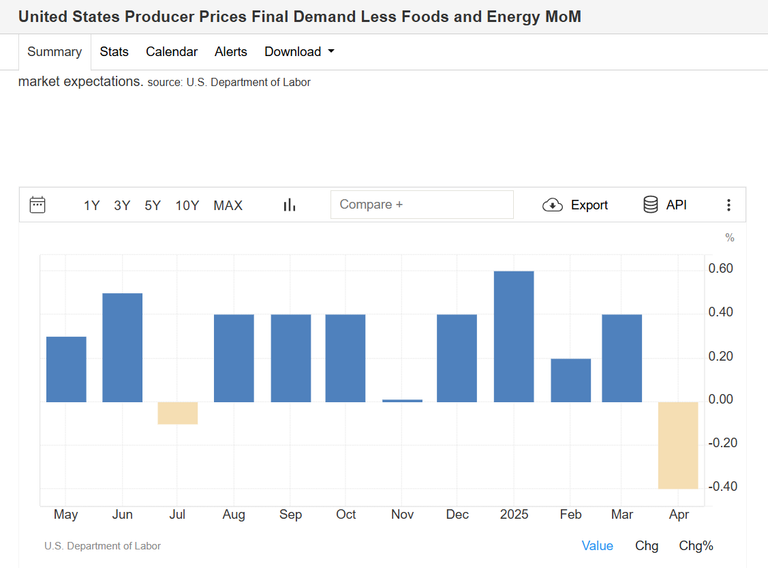

Even the Core PPI, which excludes food and energy, also fell by 0.4%. The annual rate? It dropped from +3.4% to +2.4%. That’s a significant slowdown.

Why, you ask?

The biggest drop came from the services sector, specifically wholesale sales of machinery and automobiles.

And this tells us one thing: inflationary pressures are easing. The market is starting to “calm down” after the storm of the past few years.

What’s even more interesting is that this is the first time in a while that we’ve seen such a significant decline in both the headline and core indexes. This could indicate a more stable disinflationary trend.

JOBLESS CLAIMS

Similarly, the labor market also seems to be on a solid footing.

Initial jobless claims for the week ending May 10th came in at 229,000 – exactly what the market expected. No negative surprises. Meanwhile, continuing claims came in slightly lower than expected at 1,881,000.

At the same time, the four-week moving average ticked up slightly but remains close to historic lows. And this means just one thing:

The labor market remains stable. No signs of mass layoffs, no signs of a recession.

And all this, even with interest rates above 4% for months now.

So, as much as we fear rising interest rates, the reality is that the economy seems to be holding up for now but can those numbers suggest recession?

Posted Using INLEO

https://www.reddit.com/r/Economics/comments/1kpj4a6/high_interest_rates_and_strong_number_suggests/

https://www.reddit.com/r/economy/comments/1kpukoe/high_interest_rates_and_strong_number_suggests/

This post has been shared on Reddit by @tsnaks, @stekene through the HivePosh initiative.

How do we fix international supply shocks?

Producing goods at home. 😃

No I don't believe this be the solution because we cannot all produce everything at home. Things that are build today need materials from different countries . A smart phones needs materials from 10 different countries. And at this point the US for example cannot produce the cheap products because the average American is getting paid 5-7 times more than the average Chinese . What we need is more free trade without any protectionism unless it is a key sector ( In my opinion )

Congratulations @steemychicken1! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP