Google Beat The Expectations

Alphabet , the parent company of Google and YouTube, absolutely crushed it in Q1 2025.

QUARTERLY EARNINGS

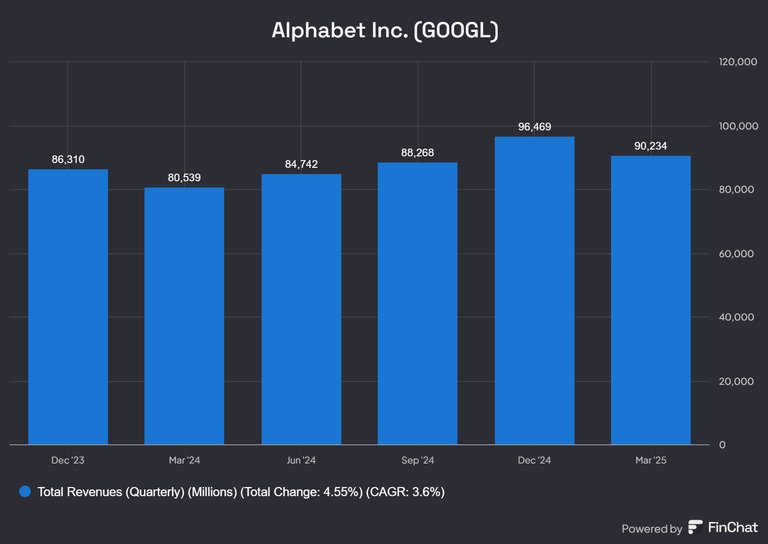

Alphabet reported revenue of $90.23 billion, marking a 12% increase compared to the same period last year. Market expectations were at $89.12 billion, and this beat clearly demonstrates the company’s strength.

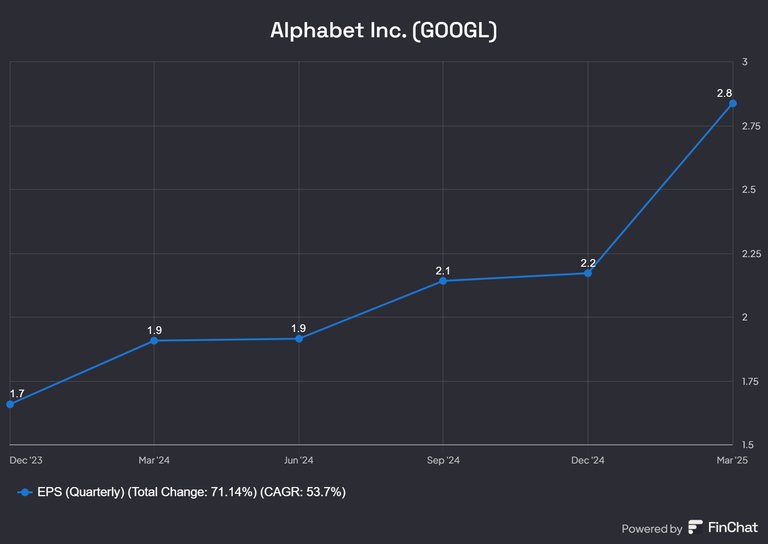

If we account for constant currency, the revenue increase hits an impressive 14%. Earnings per share came in at $2.81, far surpassing analysts' expectations of $2.01. That’s almost 40% above estimates—something you rarely see in companies of this size.

Alphabet’s net profit totaled $34.54 billion, showing a massive 46% increase year-over-year. Operating income hit $30.61 billion, with operating margin improving by two percentage points, now standing at 34%.

Where’s all this money coming from?

Well, the Google Search segment brought in $50.7 billion in revenue, a 9.8% increase, proving that the heart of Google is still beating strong. YouTube also had a great quarter, with ad revenue climbing to $8.93 billion, up 10.3%, reflecting continued support from content creators and advertisers.

Google Cloud delivered stunning growth too, with revenue reaching $12.26 billion, a 28.1% increase. It’s a sector where Google has been investing heavily, and it’s now paying off—especially with the boost from AI and Gemini 2.5-powered solutions.

Lastly, Google’s subscriptions and devices pulled in $10.38 billion, up 18.8%, showing that its subscription-based business model is gaining serious traction.

And all this is happening while Alphabet continues to invest aggressively in AI infrastructure, spearheaded by the new Gemini 2.5 system, which is expected to radically transform how businesses leverage artificial intelligence.

On top of that, CEO Sundar Pichai announced that AI Overview—Google’s AI tool featured at the top of search results—now has 1.5 billion monthly users, up from 1 billion back in October! Just imagine the scale and momentum of that growth.

But it doesn’t stop there. The total number of paid subscriptions, including Google One and YouTube Premium, has surpassed 270 million. That’s a growing audience generating a stable and rising revenue stream for the company.

Investors were thrilled… And how could they not be, right? These exceptional earnings were followed by a 5% dividend increase, now at $0.21 per share, with a 0.52% yield. For dividend lovers, it’s yet another sign of Google’s maturity and strength.

Posted Using INLEO

All good Numbers. I am only a bit surprised that they didn‘t increase the dividend further. 5% is not much for sich a growth Company and payout Ratio is very low. What do you think?

They constantly expanding and investing in new technology it is common to give lower dividends but 5% is still high compared to other companies

Coke is doing the same hikes and they are not investing that much. 🤷🏼♂️

¡Qué trimestre impresionante para Alphabet! Romper las expectativas con un aumento del 12% en ingresos y un crecimiento del 46% en ganancias netas es sencillamente asombroso. Google Search y YouTube siguen demostrando su fuerza, mientras que Google Cloud y las suscripciones no dejan de sorprender. Con inversiones en infraestructura de IA y más de 270 millones de suscripciones pagas, el futuro de Alphabet luce más brillante que nunca. ¡Felicidades a todos los inversores, esos dividendos adicionales son un dulce bonus! 🚀💼

https://www.reddit.com/r/Finanzen/comments/1k8cop3/google_beat_the_expectations/

The rewards earned on this comment will go directly to the people( @tsnaks ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.