A Glimpse Of Hope Before The Economic Chaos?

A very important piece of news that somehow slipped under the radar… but it came to give us a small BREATHER in the middle of an environment full of uncertainty, amid the political turmoil caused by Trump’s new tariffs.

Because yes, everyone is talking about the new tariffs and their impact on the global economy, but amidst all this chaos, we had a genuinely positive development—one that has the potential to influence the Federal Reserve’s decisions and maybe bring a bit of stability to the market. And that is none other than inflation. Or better yet, the unexpected drop in inflation.

INFLATION

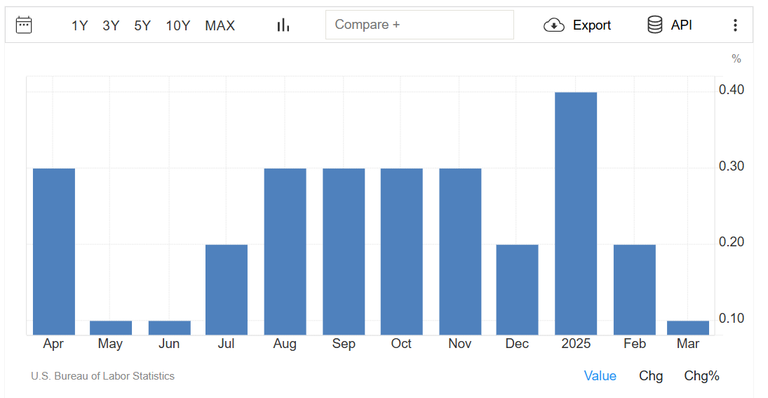

So, yesterday we got the report for the Consumer Price Index (CPI) for March, which showed a DROP of 0.1% on a monthly basis. Analysts had expected a RISE of 0.1%. And just to make it even clearer, the previous month, February, saw a 0.2% increase. So we’re seeing a definite change in direction.

That means not only did the rise not continue—but we actually saw a decline. Something nobody really expected, and of course, this directly affects the outlook for future interest rate hikes or cuts by the Fed.

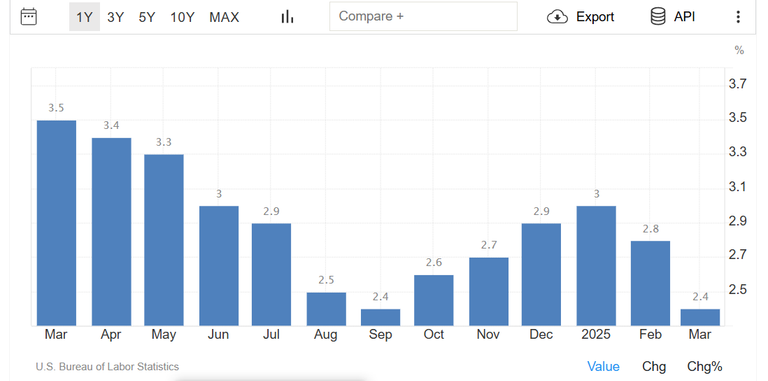

Even on an annual basis, CPI came in at +2.4%, compared to forecasts of +2.6% and the previous reading of +2.8%.

And the Core CPI—which excludes food and energy—rose just +0.1% for the month, while the forecast was +0.3%.

In fact, this marks the SMALLEST annual increase in Core CPI since March 2021. And that’s significant, because the Fed bases many of its decisions on this particular index.

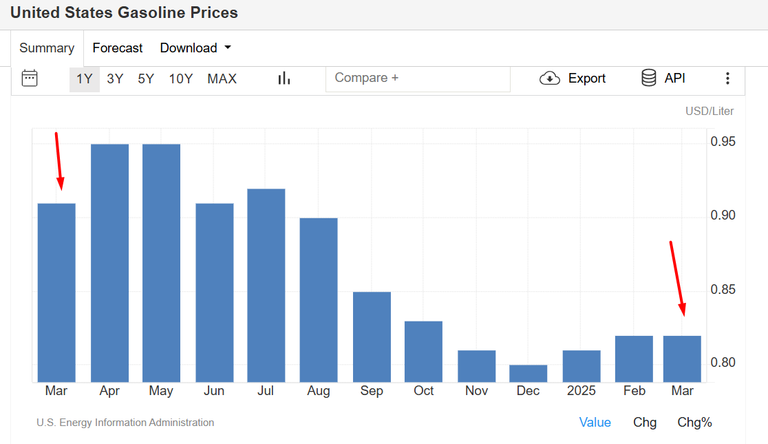

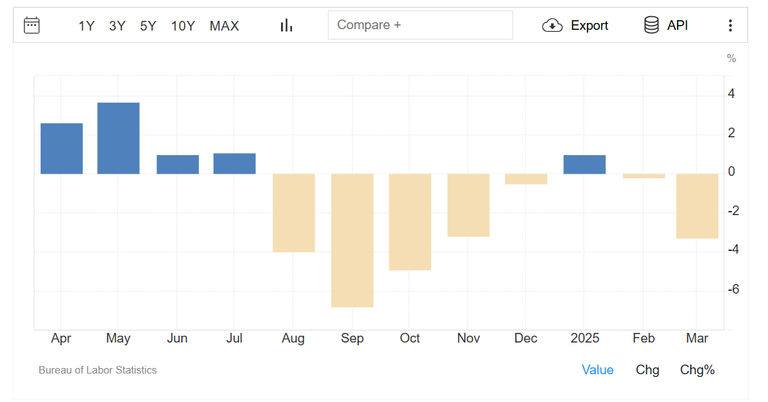

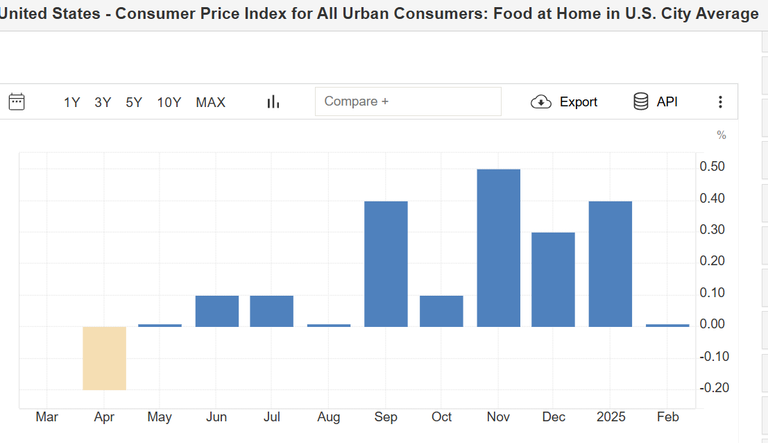

And what caused this drop? First off, the dramatic 6.3% fall in gasoline prices. That significantly lowered transportation costs and had a positive impact on the overall index. Secondly, there was a slight increase in food prices (+0.4%), but not enough to offset the overall decline.

The index for food at home rose by 0.5%, while food away from home rose 0.4%, so these increases stayed within reasonable limits. Unfortunately, we can’t say the same for rent, where the pace of increase is still higher than analysts would like.

The Fed will welcome this figure, especially since it covers both goods and services. At the same time, they note that many companies had already stockpiled goods before the new tariffs, so we haven’t yet seen the full impact of Trump’s policies on final product prices.

MARKETS

As for the markets, they didn’t react as positively as one might expect. The major indexes closed deep in the red once again.

Why? Because, as always, markets don’t just move based on numbers. They move based on EXPECTATIONS. And right now, no one is quite sure what the tariff situation will bring—especially as the trade war with China has reached extreme scenarios.

Now, regarding interest rates, the probability that they’ll remain steady at 4.25%–4.50% currently sits at 75.1%.

Posted Using INLEO

https://www.reddit.com/r/Economics/comments/1jxlc6b/a_glimpse_of_hope_before_the_economic_chaos/

The rewards earned on this comment will go directly to the people( @loading ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

75.1% ?