The Math Behind Losses: Why Protecting Capital is Crucial?

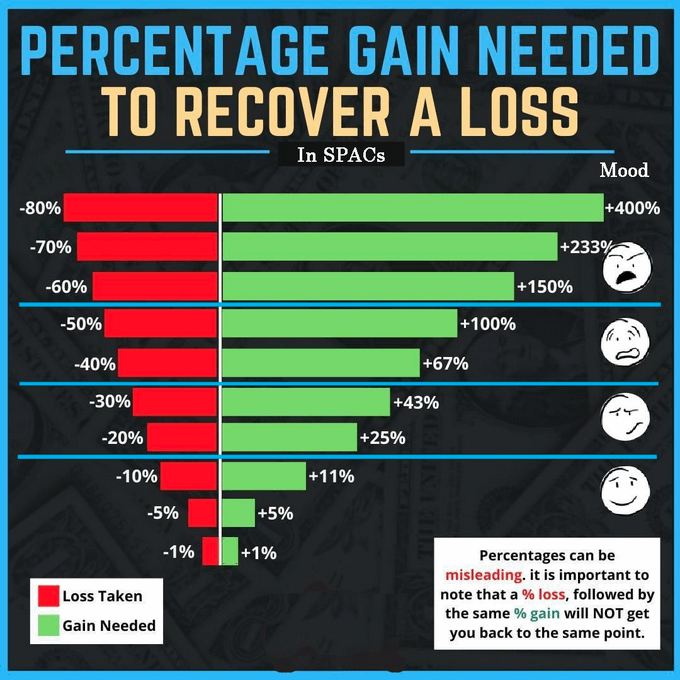

The share market roller coster ride has been ongoing since last few weeks. On some day, market shows a positive sign while , the next day it get into Red. It is hard to predict, which way the market is moving. In few trading session, I recovered some losses incurred during the recent bear market. During the downturn trend, I lost more than 100k INR in my portfolio. I have invested in different shares, and each of them took some string beating. Investing isn’t just about making gains, it’s about avoiding heavy losses. But the recovery is not as fast paced as the loss. The recovery involved a mathematical calculation to estimate the losses. As per a rough calculation, a 50% loss needs a 100% gain to break even, and an 80% loss requires 400%. This typically makes the recovery too lengthy process.

To recover a loss, the percentage gain needed is calculated using the formula:

[1 / (1 - (% loss))] - 1;

meaning, the larger the loss percentage, the larger the gain percentage required to break even. Example:

20% loss: Requires a 25% gain to recover.

50% loss: Requires a 100% gain to recover.

10% loss: Requires an 11% gain to recover.

The bigger the initial loss, the higher the percentage gain needed to recover.

This formula is based on the concept that once you lose a portion of your investment, you need to earn a larger percentage gain on the remaining amount to reach the original value.

To recover from such losses the smart investors focus on managing risks. Instead of chasing high returns blindly, protecting the capital should always come first.

“The first rule of investing is not to lose money. The second rule is never to forget the first rule.” – Warren Buffett

Protecting capital is crucial because it ensures that our initial investment remains intact, safeguarding our wealth against market fluctuations and allowing us to maintain access to funds for future needs. When you cannot afford to lose our principal, like during retirement or when saving for a near-term goal, prioritizing capital preservation often means opting for lower-risk investments with stable returns over potentially high-risk, high-reward options. In volatile markets, prioritizing capital protection helps minimize potential losses.

It is worth noting that, Small, consistent gains are better than risking huge losses for big wins.

In good faith - Peace!!

Posted Using INLEO

Namaste 🙏 @steemflow bro, thanks for sharing the loss and profit marginal calculation ratio. I also faced a huge loss in the share market 10 years back.

Hope bro you have recovered from loss and please keep patience till market will grow 😊.

!INDEED

Bhai these days...it is allmin loss...losing 0k everyday is not worth watching....so have deleted the app...for few months.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited..

This post received an extra 20.00% vote for delegating HP / holding IUC tokens.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Great article. Mathematics is very necessary in life.

It is importsnt in all part of life.

Yes, that's right, my brother.

Yes, the best explanation I read. Damn!! it is true.

On a good day, one can see 25% of the invested capital. 400% and all are mythical figures and never have I ever seen someone boasting such a recovery.

Bhai, Is there a way to calculate a standard SL based on our inputs rather than the one calculated by candles and the system? I think my next 6 months are going to be a learning period with 70Theoritical and 30Praticals.

Reminded me of my school days...I am still figuring out dear..I am not a pro yet nor a regular....wo kuch kuch Sikh leta hu kavi kavi...and I am not into swing Trade....however, check this videos.... Iska prediction bahut Sahib rehta Hai..

Bhai, pro bhi kabhi nausherkiya tha.

We will get there. Aur ye school wala formala theek laga mujhe, kya hi fiyada agar test nahi kiya knowledge ko.

Thanks for introducing me to this YT. Video dekh kar pata chal gaya badi aachi instructor hain. Dekhte hain aur kya sheekne milega. ❤️☮️

That is a very clear calculations and the explanation is great as well

This is well written and I appreciate the calculations