Investing is the art of multiplying our money [PPF vs Equity]

When it comes to investment, many people ends up with only few choices. Either people chose fixed deposits scheme in banks, or Public Provident Scheme managed by government or at the least they risk to put their money in stock market equities. Looking at some of the latest trend, the young millennial are more interested in risking their money in equities. Thanks to the technological advancement, and opening up of different application that eases the flow of money into stock market. In earlier times and in recent times too PPF had been people choice of investment that provides a secured return in specified period of time.

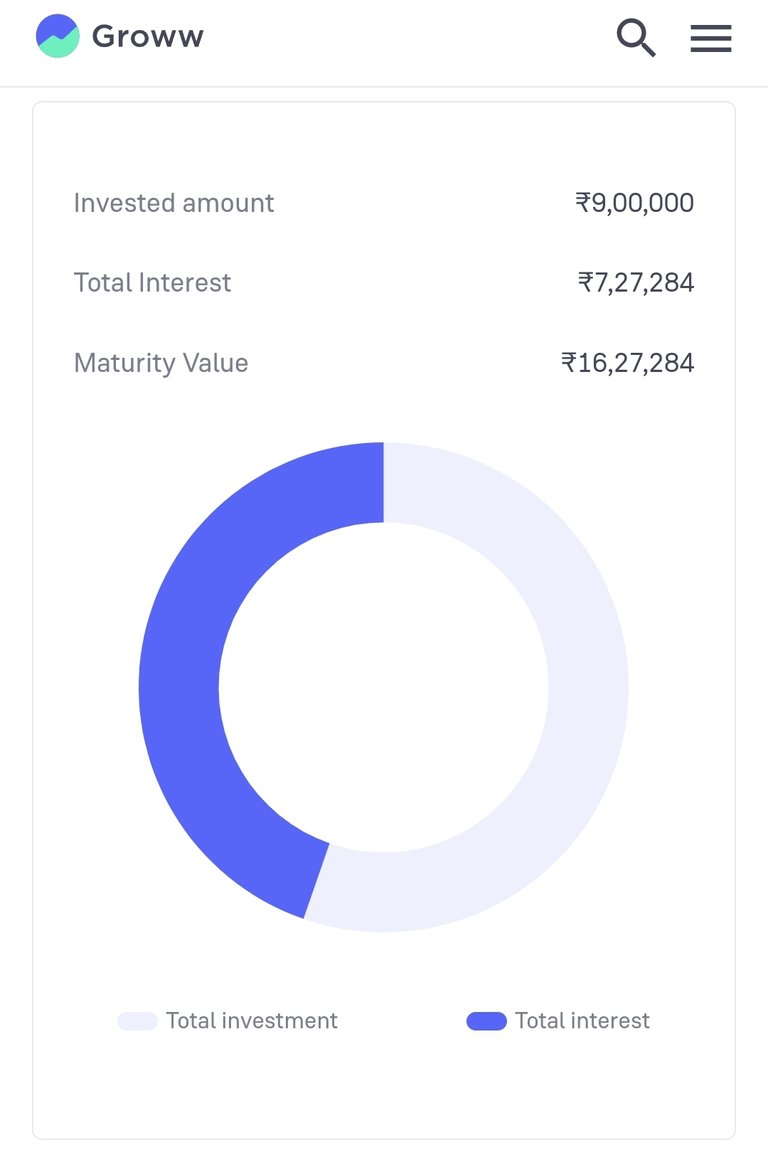

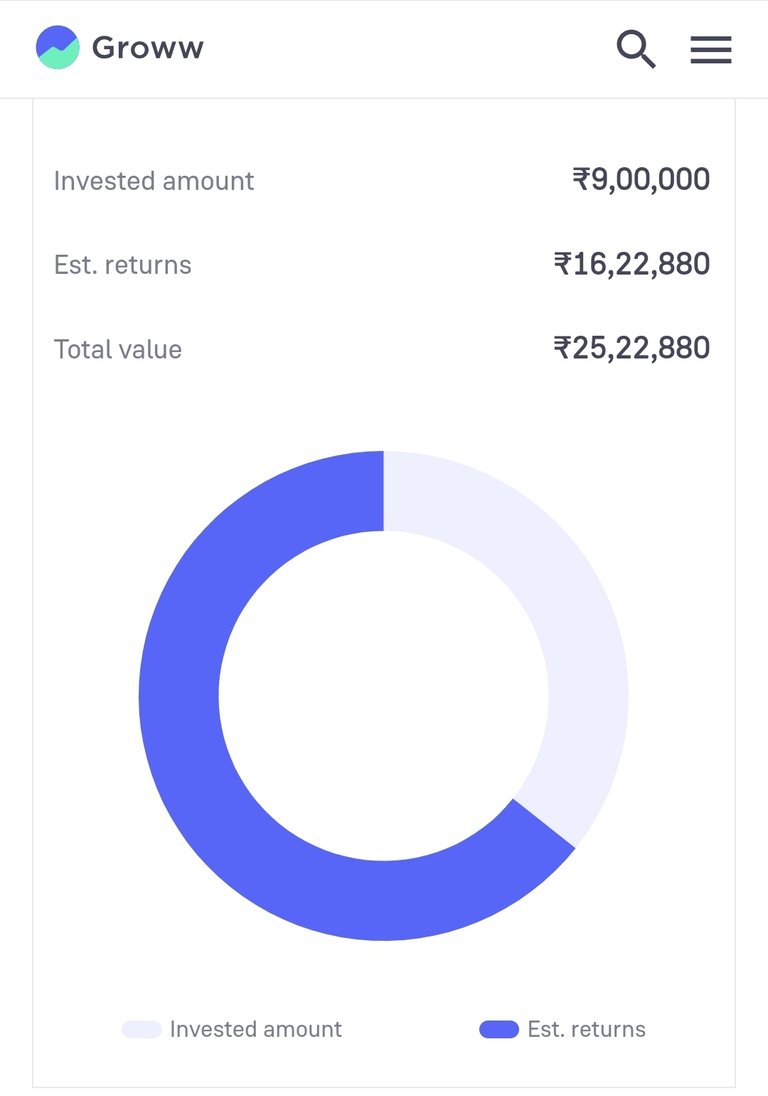

In order to find out if a 7.1% PPF returns is better than 12% returns on equity mutual find, I did a little calculation.

|  |

|---|---|

| PPF | Equity |

(image source - Grow investing app)

A monthly investment of Rs.5000/- in PPF account for 15 years will get me a sum of Rs.1627284/-. Buy at the same, the equal investment of Rs.5000 is any equity mutual fund SIP scheme will fetch me staggering Rs.2522880/- .

However there is catch, investment in equity will be liable for taxation. A person will get amount after tax deduction. But still the return amount is far better than PPF investment. Investment in equity funds is subject to market risks. All these equity calculations may be correct if market behaves same manner and give a uniform rate of return.

In India, PPF (Public Provident Fund) has been the ideal way investment since many years. But looking at the returns on equity, many investors are pitching in stock market. It is important to know that PPF and equity investments differ in several ways:

Returns: Equity investments can potentially yield higher returns than PPF, but they also come with more risk.

Lock-in period: PPF has a 15-year lock-in period. There is certain in case of premature withdrawl. On the other hand most mutual funds don't have a lock-in period.

Tax benefits: Both PPF and equity investments offer tax benefits, but PPF's interest and maturity amounts are tax-free. Where, long terms equity returns are liable for tax deduction.

Investment flexibility: SIPs allow for more flexibility in investment amounts and duration than PPF. A person can deposits a fixed amount in PPF during a year.

Risk: Equity investments are subject to market volatility, while PPF is considered a fixed-income investment with guaranteed returns.

Inflation: PPF barely manages to outperform inflation, so it may not create wealth over time.

The amount of equity investment you should make depends on several factors, including our age, risk tolerance, and investment objectives. In equity market, it is important to consider our investment time horizon. Investing is more about how long our investment has to grow than how much we invest.

Peace!!

Namaste @steemflow

Posted Using InLeo Alpha

🎉 Upvoted 🎉

👏 Keep Up the good work on Hive ♦️ 👏

❤️ @bhattg suggested sagarkothari88 to upvote your post ❤️

@tipu curate

Upvoted 👌 (Mana: 29/49) Liquid rewards.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited..

This post received an extra 19.57% vote for delegating HP / holding IUC tokens.