Naming and ranking all of Hive-Engine investment tokens

Hello SPIers, today we look at how SPI values its token and at the difference between marketcap value and liquidation value.

Market Cap

We all hear this term alot and its basically the value of all circulating tokens multiplied by the last sell price. For this reason, the crypto value is speculative. You could create a new crypto and mint 1 trillion for yourself and then buy one from yourself on a dex for $1 and BOOM, your a trillionaire.

When we see that the BTC marketcap is worth over $1 trillion, this does mean that $1 trillion is available to buy all the BTC at that price or that $1 trillion has been used to buy BTC. It's just the last price paid times the circulating supply. When more people are buying, the price and marketcap increase, when more people are selling the price and marketcap decrease, simple as that. Selling Supply vs Buying Demand

When it comes to buying and selling, moving large numbers through BTC/ETH/HIVE is not a problem but for small marketcaps with low volumes buying and selling only a few thousand dollars can move the price up are down. When investing in new crypto, always check liquidity, you dont wanna be a real-life broke paper millionaire, haha.

Liquidation Value

SPI uses liquidation values for its token price because SPI is not a crypto, its a token of ownership of the assets held by SPI. This means 2 things, 1/ the value of the token is dependent on the assets it's backed by and not the free market and 2/ If SPI is valued at 5 HIVE each, SPI can buy back every token in circulation at that price because it has 5 HIVEs worth of assets to back each SPI token.

The value you see attached to SPI in its weekly reports is worked out by adding up every asset we hold in our HIVE, hive-engine and non-HIVE wallets and dividing that number by the amount of SPI tokens in circulation. 90% of what own is very liquid with the remaining being some HE and HIVE gaming NFTs.

Because SPI values its token on its liquidation value, it is able to offer a buyback deal for investors to exit. SPI will buy back pretty much any amount of tokens at 95% of the liquidation value for either HIVE or BUSD, seller's choice.

Fundamentally, SPI is made up of assets based on speculative price/market caps but because we are a very small fish in a big ocean and well diversified, we can enter and exit full positions in 1 trade. EG, selling $10,000 of HIVE is easier and can be done in 1 transaction compared to selling $10,000 of some hive-engine token with no liquidity offered to exit. For this reason, SPI can lock in that price and use it as our liquidation value.

Which is best?

The markets are driven by speculation and always will be. Tesla's marketcap is maybe 80 times its annual earnings and 10 times its assets but ask people and they will tell you, it's cheap.

SPI is a fully backed index fund if it had to summed up in 3-4 words. This is very different from being a pegged index fund where tokens are pegged to a price but not backed by assets of the same value. Pegged tokens/indexes are ultimately built on faith. Backed means the assets are in the bank and redeemable much like gold was to money 60-70 years ago. HIVE being SPI's gold.

Because anything roots back to speculation-driven marketcap values, there is no real best because there is only 1 option. SPI is maybe more controlled and stable because it is fully backed and holds a range of investments acting as hedges against others.

We need more backed projects where tokens/cryptos are issued pre-backed by actual assets. How can use USDT or other stable tokens when they are not fully backed, they are no better than real-world PONZI dollars.

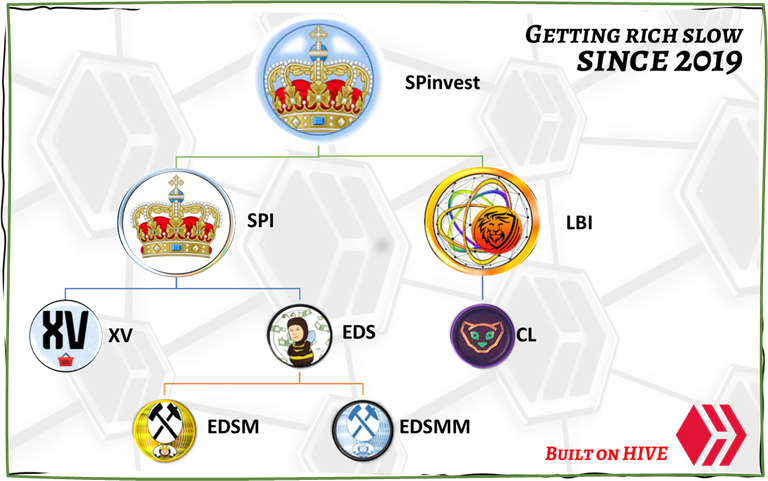

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS mini miners | @eddie-earner | EDSM |

| EDS micro miners | @eddie-earner | EDSMM |

| CUBlife | @lbi-token | CL |

Stay up to date with investments, fund stats and find out more about SPinvest in our discord server

Thank you for the update.

I do !luv your liquidity strategy for #spi and it is one of the reason I am trending its trading pattern as part of evaluating assets held.

I use a Price-to-Book ratio as a fundamental measure of valuation for my #PEPT token. I don't see many token holders and traders talking about P/B values. !lol

Looking forward for SPI to display a more consistent upward trend above the 4 mark. It seems stagnant with some buying opportunity for traders.

Have a great day.

!ctp

!beer

!pizza

Excellent comment,

P/B valuing SPI just makes sense to me as a fund token but your right, not alot of people on HIVE really care about this as long as the price is going up.

Im thinking we are still in a bearmarket and because HIVE is a small marketcap token, it is alot more volatile compared to BTC/ETH are anything ranked in the top 50. If the market cycle repeats as it did between 2017-21, i think the SPI HIVE value could increase a bunch and we'll see SPI at 5-8 HIVE before we enter the next bull market. I think SPI peaked at 7-8 HIVE last cycle before HIVE mooned from 11-12 cents to over $3.

Thank you for your comment and enjoy the rest of your day.

PS, i'll need to check out your token as well.