Energy – Prevent, Solve or Manage

Hi Everyone,

It has been a long time since I have posted to the prevent, solve or manage series. Back in 2020, I considered it complete. I moved onto the blockchain economy. After reflecting on this series several years later, I can see that some important areas have been omitted. These include energy, water, law enforcement, and foreign affairs. Below are the posts already included in this series.

- Prevent, Solve or Manage

- Health - Prevent, Cure, or Treat

- Crime – Prevent, Fix, or Manage

- Housing – Prevent, Solve, or Manage

- Education – Prevent, Solve, or Manage

- Travel, Transport, and Transportation – Prevent, Solve, or Manage

- Migration – Prevent, Solve, or Manage

- Money – Prevent, Solve, or Manage

- Environment – Prevent, Solve, or Manage

- Leadership – Prevent, Solve, or Manage

Energy

Energy is essential to almost everything we do. Therefore, it is essential to ensure that we always have it and always have enough of it. For the ‘prevent, solve, or manage’ approaches, we should consider energy in terms of demand and supply. We should be focused on ensuring supply is sufficient to meet demand. This will involve considering both supply and demand.

Several factors affect the demand for energy. These include population size, wealth, technology, nature of activity, weather and climate, demographics, and geography. Several factors affect the supply of energy. These include sources of energy, types of energy, foreign relations, investment in energy, research into energy-related technology, and transporting energy.

There is a theoretical market solution to ensuring demand for energy can be met. Supply finds a way to meet demand if it can be plausibly generated and sufficient incentives exist to do so. Demand for energy is likely to remain high, and it is likely to continue growing. Demand for energy is also inelastic, as it has so many essential needs. However, in the long run, demand for particular types of energy is more elastic, as users are normally able to switch to different types or sources. There are many different types and sources of energy. These include coal, oil, gas, nuclear, and various renewables.

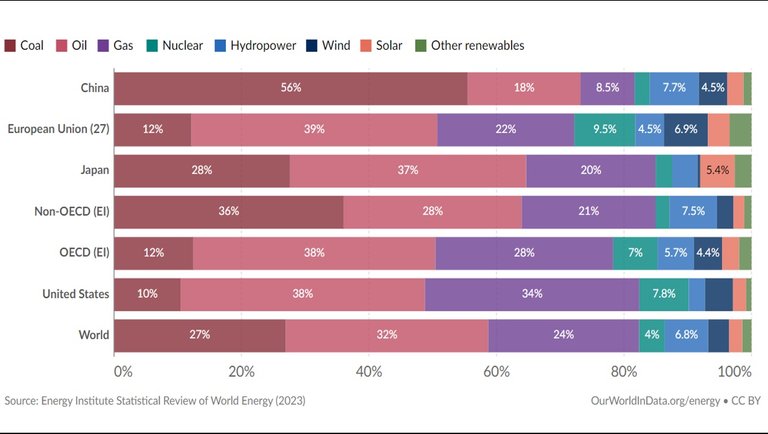

Figure 1 contains the most used forms of energy around the world.

Figure 1: Energy Usage by Type in Various Countries and Groups of Countries in 2002

Source: Our World in Data

Over 80% of the world’s energy is produced by either coal, oil, or gas. The demand for these energy types is increasing at a decreasing rate and may soon begin to decrease if alternative energies become more viable.

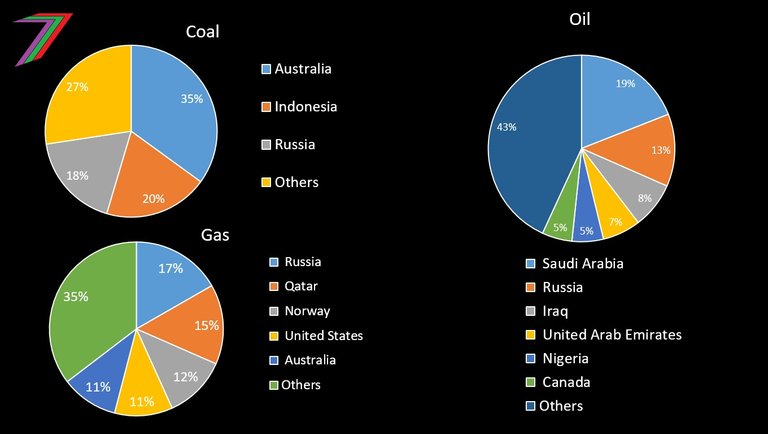

In reality, a pure market solution is not so easy. The extent of the usage of energy and the centralisation of the locations of the sources of energy require extensive international trade on global markets. Most countries are net consumers of energy (i.e. they consume more energy than they use). There are a few countries that export considerably more energy than they consume. Figure 2 contains the countries with the highest percentage of net exports of coal, gas, and oil.

Figure 2: Countries with the Highest Percentage of Net Exports of Coal, Gas, and Oil

Sources: Coal exports (World’s Top Export). Natural gas exports (The World Factbook cited by Wikipedia) and natural gas imports (The World Factbook cited by Wikipedia). Oil net exports per barrel (The World Factbook cited by Wikipedia).

The most commonly used forms of energy are not just concentrated in a few countries. Just a few mega-energy companies control them. As of 29 January 2024, the total market capital of energy companies was US$9.481 Trillion. The ten largest energy companies have approximately 42% of that market cap, and the largest energy company, Saudi Aramco, has a market of US$2.026 Trillion (almost 23%). See Figure 3.

Figure 3: Largest Energy Companies in the World (Market Cap) (October, 2023)

Source: Companies Market Cap

Note: Does not include Russian energy companies

We can consider the markets for energy as global oligopolies. A few companies and Governments control supply. As demand is inelastic, controlling supply results in controlling prices. Oil-producing companies and/or countries (e.g., OPEC) can choose to limit capacity so that it does not meet persistently increasing demand. This leads to price increases and higher profits for oil companies. This was the case in the 2000s, in the lead up to the 2008 financial crisis.

Economic downturns and recessions can cause the price of oil to plummet briefly. This was the case with the 2008 financial crisis and the 2020 Covid-19 lockdowns. However, prices tend to recover quickly. Figure 4 contains the price of oil since the 1980s.

Figure 4: Crude Oil Prices (1980 to 2023)

Source: Trading Economics

Energy Usage (Electricity)

Energy is used in various ways. It is used to power vehicles, generate heat, and generate electricity. Electricity is then used extensively in production and everyday life. This usage also includes generating heating and powering transport, but for these purposes, energy sources are typically burnt rather than converted to electricity.

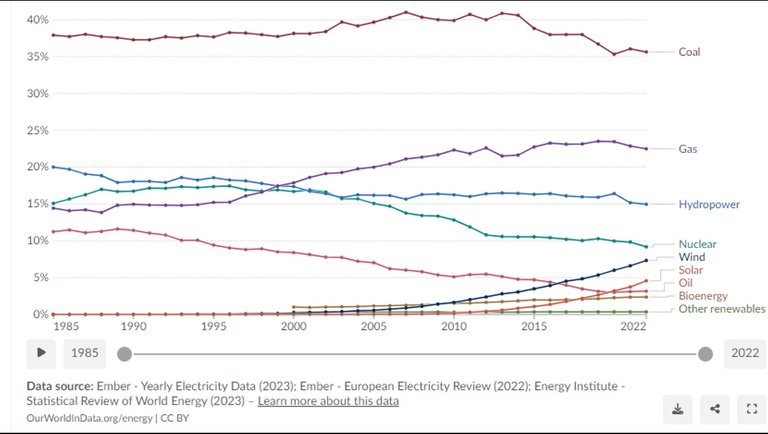

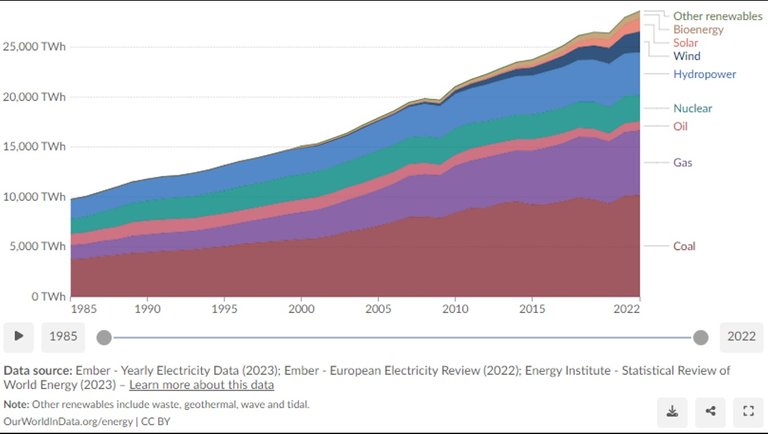

Coal, gas, and hydropower are the three most common sources of electricity production. The usage of solar and wind to generate electricity is growing, but they still generate a relatively low percentage of electricity globally. Figure 5 contains the percentage of electricity produced from various sources.

Figure 5: Share of Electricity Production by Source (1985 to 2022)

Source: Our World in Data

In percentage terms, there has been a shift to renewable sources and cleaner energy. This shift has been slow. In 1985, approximately 63.5% of the world’s electricity was generated by coal, gas, or oil. In 2022, this dropped to around 61%. However, in real terms, the use of both gas and coal has dramatically increased since 1985 (more than tripled). Almost every year, it has consistently increased. See Figure 6 below.

Figure 6: Electricity Production by Source (1985 to 2022)

Source: Our World in Data

Even if the demand shifts from the direct use of oil, gas, and coal to electricity, which indirectly uses them, the overall demand for oil, gas, and coal is unlikely to be greatly affected. For example, switching to electric cars might not reduce energy consumption by the extent many people hope.

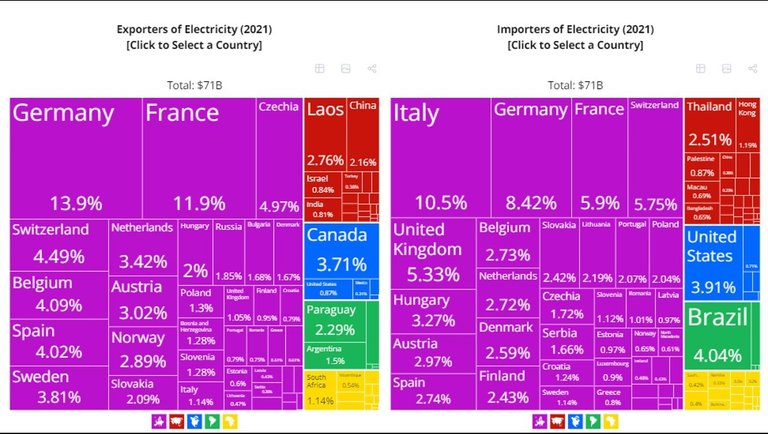

Most countries domestically produce their own electricity. Europe is a little different from the rest of the world. The European Free Trade Association minimises the costs of trading electricity between participating countries. The two largest exporters of electricity are France and Germany. The largest importer is Italy. Despite being the largest exporters of electricity, Germany and France are also the largest importers, ranked second and third, respectively. See Figure 7 below.

Figure 7: Trading Electricity

Source: OEC World

Even though Italy is the largest importer of electricity, it still supplies 94% of its own electricity (Worldometers). The total value of electricity traded was only US$71 Billion, which is relatively small compared to other markets.

Electricity markets could be considered oligopolies at the national level. In most countries, only a few companies produce all of the country’s electricity. Of these few companies, it is often just one or two that completely dominate production, thus giving them huge monopoly power. Figure 8 compares the market cap of the largest company with other largest companies in the electricity market (e.g., Compares the largest UK electricity provider with the next 4 largest)

Figure 8: Largest Electricity Companies Market Cap and Share

Source: Companies Market Cap

Will the Largest Always Dominate?

Energy markets are dominated by a few large businesses because of the way they are set up. A few countries that have an excess of oil, gas, and coal dominate these markets. Therefore, competition is automatically restricted based on access to these resources.

Competition is restricted further as extracting these resources requires large capital expenditure. Very few companies have the financial capacity to acquire this capital. In some cases, these companies are state-owned. For example, Saudi Aramco (Saudi Arabia) and Sinopec (China). Even if capital expenditure were reduced by state ownership of infrastructure, the number of businesses that could operate on that infrastructure would be limited. Energy markets would remain oligopolies.

Large firms will continue to dominate energy markets because of the centralization of access to sources to produce energy and the infrastructure used to distribute energy. Large energy companies have no incentive to challenge this model because it is very profitable for them. However, that does not mean there is no incentive to challenge this model. Most users of energy would prefer to have reliable and cheaper energy. Cheaper energy directly reduces all costs. Reliable energy indirectly reduces costs by reducing the need for contingency, as supply shocks would be less common.

Many big businesses may prefer the existing system. This might seem odd, as this system increases their costs. Higher costs are not always bad for big businesses. This is the case when they are able to pass these costs onto the consumers. They are able to do this when competition is limited. Competition is limited when smaller or new businesses struggle because of high and unstable energy costs. Therefore, big businesses that consume large amounts of energy have no incentive to challenge the current model.

Energy surrounds us. Yet, the preferred sources of energy, such as coal, oil, and gas, are underground and difficult to access. We do not harness the energy around us because the investment in technology to do so has not been made.

Could Alternative Energy Sources Become Viable?

Over 80 years ago, Nikola Tesla was on the verge of capturing the earth’s natural electrical charge to generate electricity. He believed he could build a device that would enable us to access unlimited energy, which he believed could power the world (Vaibhav Raj Singh). His biggest problem was that building and perfecting his work would be costly. He was unable to sufficiently finance his work because it was deemed a threat to large companies tied into the existing models of providing electricity. For example, possible financial backer, J.P. Morgan, felt free energy or free energy transmission was a threat to his copper industry (The Fifth State).

Other attempts to continue Tesla’s work have also been thwarted because of a lack of funding (Gaia). Some small-scale experiments have shown electricity can be pulled from the atmosphere (Scientific Thoughts). Without adequate funding, we will never know the full potential of this method of harnessing and distributing energy.

Investment has gone into harnessing wind and solar energy, but these energy sources are limited and unreliable. Wind turbines only capture a very small percentage of wind that happens to pass through them. Solar panels only capture a limited amount of sunlight that happens to hit the surface of the panels. Investment needs to go into creating devices that draw in the available energy around us not just a tiny sample of it.

Scientists from the University of Massachusetts have discovered a method of generating electricity from humidity. Their process of generating electricity resembles the way clouds generate electricity (Smithonsian Magazine).

Generating electricity from humidity might be far more efficient than generating it from the wind or the sun. This is because it could be more widely drawn in and, unlike wind and solar, it is around us all of the time. Thus, it is likely to be considerably more reliable. Imagine if vehicles could charge themselves while on the go using the humidity around them. Energy cost would plummet.

If this approach is proven to be successful, will it receive all the funding it needs to operate on a large scale? If it is a genuine threat to the existing system, big business will not fund it. Crowdfunding is a possibility. More people support green energy solutions than ever before.

Application of Prevent, Solve, or Manage

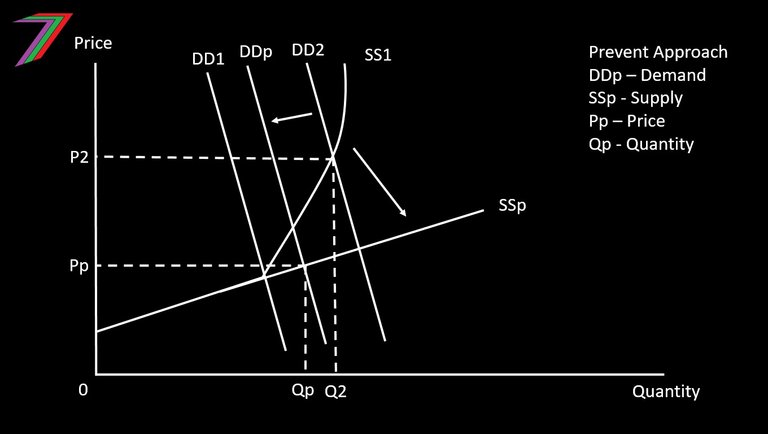

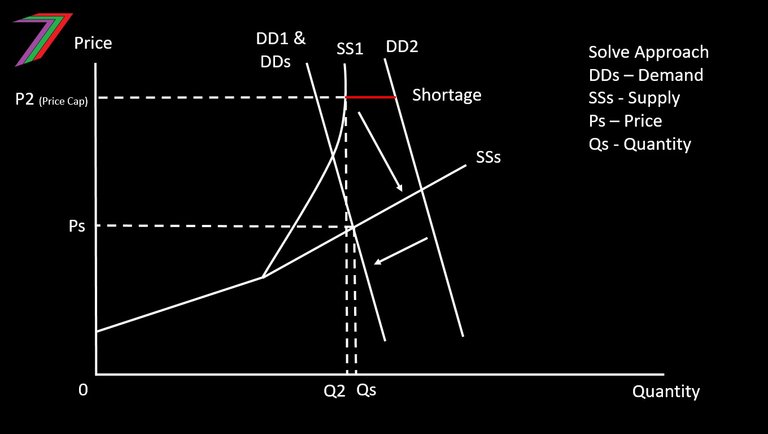

How can we apply the ‘prevent, solve, or manage’ approach to energy? This depends on whether there is a shortage of energy or the potential for shortages of energy. If there is the potential for shortages, the focus should be on preventing future shortages. If there is a shortage, the shortage needs to be either resolved or managed. These approaches are briefly described and supported with simple demand and supply diagrams.

Prevent

The ‘prevent’ approach would involve ensuring that supply is always sufficient to meet demand. On the supply side, this can be achieved by having reliable sources of energy. On the demand side, this can be achieved through more efficient use of energy.

Solve

On the supply side, the ‘solve’ approach would involve gaining access to more sources of energy. This would involve moving away from centrally controlled sources of energy such as coal, oil, and gas. The focus should be on energy sources that are accessible to everyone, or at least to smaller communities. On the demand side, greater attention would need to be focused on reducing energy consumption or at least slowing its growth.

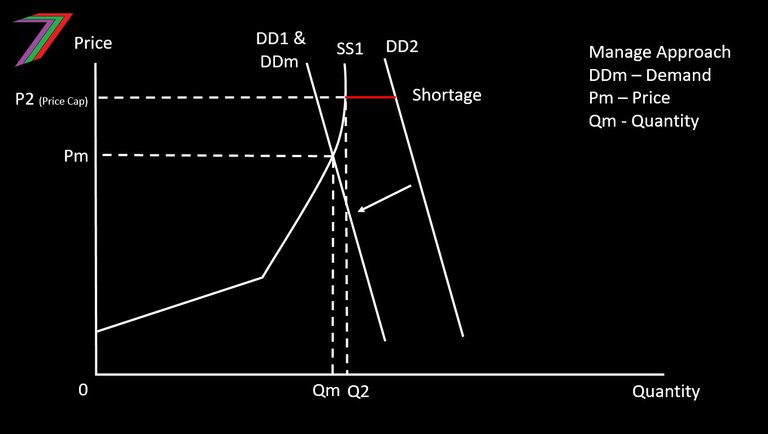

Manage

On the supply side, the ‘manage’ approach would involve prioritising the usage and distribution of energy. This can be done by raising prices, or by limiting access to certain customers or at certain times. On the demand side, certain energy-consuming activities would need to be reduced. This could involve reduced usage of vehicles, machinery, and appliances.

Overview

‘Prevent’ is by far the best-case scenario. ‘Prevent’ approaches are only possible if there are no existing shortages. Many countries are not in a position to prevent shortages, as they already exist. Ideally, they need to be working on solving the problem. Solving aligns well with prevention, as the measures to ‘solve’ align with the prevention of future shortages.

The ‘manage’ approach is by far the worst-case scenario. It, essentially, involves making the most of a currently bad situation. This is the approach most often adopted by most countries. If shortages are not close to being solved, managing them might be the only approach. If this is the case, I would argue that a solution should be worked on while the ‘manage’ approach is being applied.

Impact on Exporters of Energy If We Shift to Alternative Energy Sources

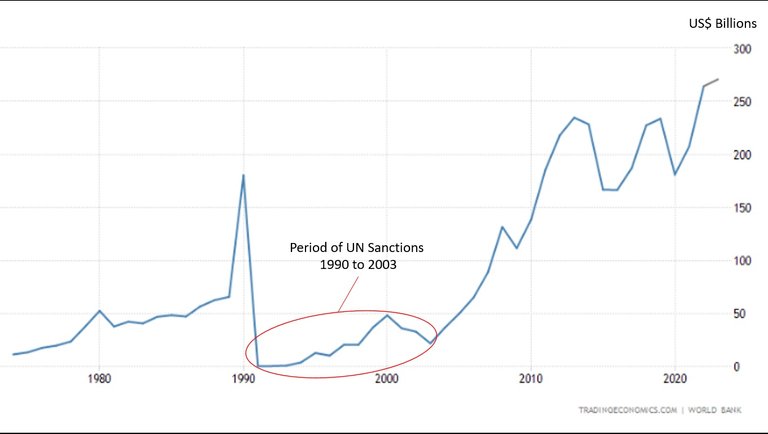

This post has focused on the users of energy. The types of energy we use greatly affect those providing it. The most affected are the countries that rely heavily on income from the export of energy. For countries such as Iraq, Kuwait, Nigeria, and Qatar, gas and oil exports make up over 80% of total exports (OEC World).

A move away from gas and oil could be disastrous for these countries. A relevant example would be the sanctions the UN Security Council placed on Iraq during the 1990s. The sanctions caused the entire economy to rapidly collapse, causing widespread poverty for the majority of Iraqis (MERIP). However, the sanctions did very little harm to the wealthy Iraqi leadership (Global Policy Forum). See Figure 9 for the impact on the Iraqi economy.

Figure 9: Iraq GDP (1973 to 2023)

Source: Trading Economics

If the change is more gradual, these countries will have time to change the focus of their economies. Even then, some of these countries would fail or be forced to shrink. Successfully changing the entire direction of an economy is incredibly difficult. Saudi Arabia and the UAE have shown some capability to diversify, but they are still heavily dependent on oil exports.

The countries most dependent on oil and gas exports predominantly trade with China, Japan, and India (OEC World sources). How likely is it that these countries will move away from oil and gas? There appears to be very little incentive to change when alternates such as wind and solar are not viable for the extent of production that occurs in China or India. Even if humidity became a viable source of energy, would the long-term savings be considered sufficient to cover the costs of transitioning? How big a threat will decentralised energy production be to the existing centralised production?

Conclusion

It appears the world is locked into relying on gas, oil, and coal as the major sources of energy. There is no incentive for large businesses to invest in alternative forms of energy that have the potential to replace gas, oil, and coal. Doing so would likely create more opportunities for competition. This is especially true if this energy is easily available to all.

Instead, these businesses are more willing to support alternative energies, such as wind and solar. They are not viable on a wide scale or even competitive in terms of cost. This is an attempt to appear to be supporting the green agenda. Therefore, these large companies also support regulations that pressure other companies to invest or use the more expensive energy. This ultimately hurts smaller businesses and further reduces competition.

Governments are unlikely to invest in alternative forms of energy as they generally support large businesses or have alternative motives. This is already apparent with most Governments lack of interest in investing in nuclear power (still far from ideal). Government investment in nuclear power is suboptimal. For example, uranium-based power is preferred over thorium-based power. This is despite that thorium is both more abundant and safer than uranium (Freethink). Uranium is most likely preferred because of the military applications of the by-products of reactions (e.g. plutonium-239). This can be used to build nuclear weapons (EPA). I discuss the relationship between Government and big business in many of my other posts. Two good posts to read are The Establishment and Power, Money, and Me Me Me.

We are in a difficult place in regards to energy reliability and security. Change can occur if people and small to medium businesses jointly fund research in alternative energy. This can be done through crowdfunding. Considering the extent of the current economic crisis, it will be difficult to convince struggling businesses and households that such investment is worth the risk.

Another approach is to pressure Governments to divert funding from wasteful projects to support research relating to alternative energies such as humidity power and/or the continuation of Nikola Tesla’s work. It is believed that the US Government has continued Tesla’s work in the creation of HAARP (gaia). It would be good if there were more transparency and accountability regarding Government spending.

More posts

I have several collections of posts. I have organised these collections based on content and purpose.

The first collection contains six collection posts created before PeakD had the collection feature. Four of these posts relate to the core of my content; one of them contains all my Actifit Posts, and one of them contains my video course, ‘Economics is Everyone’.

The second collection consists of the posts that I consider define my channel. These posts are significant in terms of content as well as how they contribute to the growth of the channel. These posts reveal the most about what I believe in.

The third and fourth collections are what I call my ‘Freedom-based Economics Living Book’. They contain all the posts that support my ideas about the value and power of freedom. Some of these posts explain what we can achieve with freedom and what we need to utilise it for. Some of them explain how we are deprived of freedom and how we often give up freedom for security and comfort. The third collection concludes with possible scenarios depending on what we (society) choose to do.

Hive: Future of Social Media

Spectrumecons on the Hive blockchain

Quite an interesting and informative post.

I do feel that coal, oil and gas is a commodity that countries won't easily seperate from.

I'm from Nigeria and although we have other exports in agriculture, our already failing economy is still dependent on the dwindling crude oil wells.

Changing entirely to only agriculture would make the ecosystem which has already adapted to our constant rigging shift again to the now increased rate of farming.

Even if the change of export produce were to happen gradually, it's uncertain (personally, I feel impossible) for our country to adapt fast enough.

Maybe after a few generations...

It is extremely difficult to change course. Countries like the UAE and Saudi Arabia are working on developing the service sectors of their economies so that they can still be competitive without oil and gas exports.

If the day comes when demand for oil and gas is limited, I think they will still struggle. However, it is still possible, out of pure necessity, they could turn move their economies in another direction.

I hope Nigeria is able to change course. The key is offering something other countries want.

This post has been manually curated by @steemflow from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @steemflow by upvoting this comment and support the community by voting the posts made by @indiaunited.

It's informative and I gain much knowledge from this post. Yeah well developed and strong economy is all the country need and 1st They have to work on that

It is a lot more complicated than that. Check out some of my other posts.

The world can't live without energy and to me instead of it to be used in a more positive way in our society, reverse is the case

Thanks, keep bringing that positive energy.

This is very informative. From what I know, Nuclear energy is the best and cleanest option available that can replace coal, gas, and oil. Solar technology has been improving, and is great for households. Unfortunately, coal, gas, and oil bring in a lot of money, so it is unlikely that they will be replaced anytime soon.

People tend to be afraid of nuclear energy because of the potential for disaster. Modern nuclear power plants are incredibly safe. With the amount of energy they produce, costs could potentially remain reasonably low.

Like coal, oil, and gas, control would be centralised. Very few countries have large reserves of uranium they could export. The generation of electricity would also be centralised because of the costs of building and running nuclear plants as well as the safety requirements. So many of the problems that I highlighted in this post would remain.

I don't see the problem with centralized control of nuclear as long as it is by the government. I know you said they aren't keen to do it because they support businesses, but I think it is a matter of who are voted in position.

I searched online, and it seems uranium is a cheap and abundant metal. I agree that the cost of building a plant is high, but it should pay for itself eventually from the savings of not buying as much oil and gas. Going nuclear may not solve all of the problems, but I think it is a step towards it. Reliance on gas and oil will decline, the power of those companies will dwindle, and renewables will be more effective as a supplemental power source.

The growth in the use of nuclear energy has stagnated over the past 20 years. See Our World in Data. It will be interesting to see if any countries make any major investments in the next decade.

I have no trust in my own government or any other government for that matter.