Why Property and Casualty Insurance Companies Are Great Long-Term Investments

When it comes to investing, finding opportunities that not only promise growth but also stability is key. Among various sectors, property and casualty (P&C) insurance companies stand out as excellent long-term investment options. P&C insurance companies represent a sound investment choice, focusing on market resilience, consistent cash flow, and diversification benefits.

1. Market Resilience

The property and casualty insurance market is known for its resilience, even during economic downturns. Insurance is a necessity for individuals and businesses alike, which means that demand for coverage remains relatively stable regardless of the economic climate. This consistent demand allows P&C insurers to maintain steady revenues, making them less vulnerable to the cyclical nature of other industries.

2. Steady Cash Flow

One of the major advantages of investing in P&C insurance companies is their ability to generate steady cash flow. P&C insurers collect premiums upfront from policyholders, which provides a significant influx of cash. This cash flow can be effectively invested in various assets, yielding additional returns. Furthermore, the time lag between premium collection and claims payout creates a unique opportunity for insurers to invest those premiums in the interim, potentially amplifying profits.

3. Strong Regulatory Framework

The P&C insurance industry is heavily regulated, which provides a measure of stability and protection for investors. Regulatory bodies ensure that insurers maintain adequate reserves to cover claims, reducing the risk of insolvency. This regulatory oversight instills confidence in the industry’s longevity and reliability, making it an attractive option for long-term investors.

4. Diversification Benefits

Investing in P&C insurance companies can serve as a strong diversification strategy within an investment portfolio. The insurance sector often behaves differently from traditional equities or fixed-income assets, allowing investors to mitigate risks associated with market volatility. By including P&C insurers in a diverse investment strategy, investors can enhance their portfolio's overall stability and potentially improve long-term returns.

5. Profitable Underwriting Practices

Through prudent underwriting practices, P&C insurance companies can achieve profitability over the long term. Insurers assess risks thoroughly before issuing policies to determine appropriate premiums. When done correctly, this results in a profitable business model where the premiums collected exceed the claims paid out, ensuring sustainable growth.

Conclusion

In conclusion, property and casualty insurance companies offer attractive opportunities for long-term investment. Their market resilience, consistent cash flow, strong regulatory framework, diversification benefits, and profitable underwriting practices make them an appealing option for investors looking for stable and reliable returns. As you consider your investment portfolio, remember to explore the strengths of the P&C insurance sector and how it can enhance your long-term financial goals.

Investment ideas to consider.

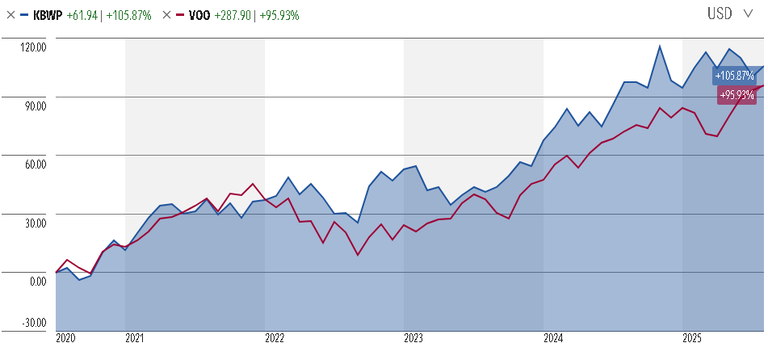

KBWP Invesco KBW Property & Casualty Ins ETF is a great choice for a simple one click access to the entire sector. Or you can research my favorite P&C Insurance companies: Progressive, Kinsale, AXIS, W.R. Berkley

To your success,

Thomas Moore

Posted Using INLEO

Congratulations @slider2990! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 83000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP