Stock Idea of the Week: Uber Technologies (NYSE: UBER)

Uber Technologies (NYSE: UBER) is the world’s top ride-hailing platform, completing over 30 million trips each day.

Uber is a Great Buy

Uber started as a ride-hailing company and transformed into a global leader in on-demand mobility, facilitating the efficient transport of billions of people and goods annually.

Uber is commonly known for its ride-hailing operation however they also run one of the largest food-delivery platforms in the world, UberEats, which transports food and groceries from over 800,000 stores to 95 million consumers. A less known segment is Uber Freight which operates a digital freight-brokerage platform by connecting with individual truck drivers. Uber will generate $51 billion in revenue in 2025, up 17% from 2024.

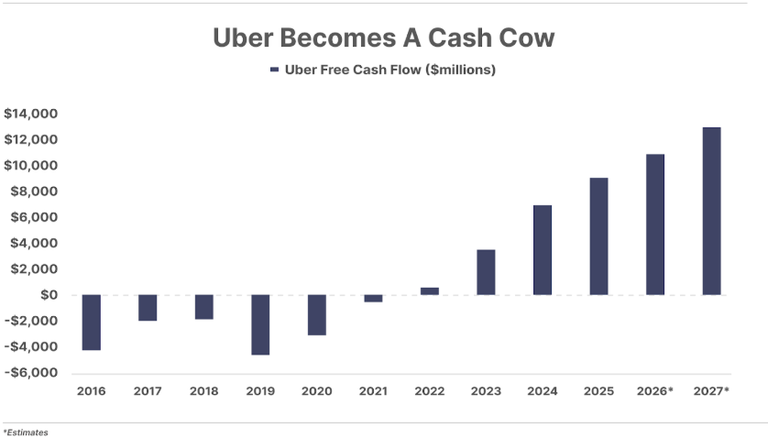

The company's financials have changed drastically since its IPO with revenue increasing at a faster rate than its operating expenses and generating sustained profitability and cash flow. Uber turned the corner toward positive free cash flow in 2022, when it generated $390 million, followed by $3.4 billion in 2023, and then $6.9 billion in 2024.

Uber holds a 76% market share in the U.S. and the economies of scale are now growing at a rapid rate, with current analyst estimates projecting $9 billion in free cash flow in 2025:

Why Everyone Should Own Uber

Uber has built the world’s most valuable transportation network of 180 million consumers, 8 million drivers, 76% U.S. ride-hailing market share. This scale creates a defensible moat in both customer demand and supply-side distribution. This network flywheel is extremely difficult for new entrants to replicate: every additional rider attracts more drivers, and every additional driver improves reliability, pricing, and wait times, which in turn draws even more riders.

Uber’s continued growth will be driven by autonomous mobility (self driving cars). It has partnered with Google’s Waymo, the leader in driverless ride-hailing, and 19 other autonomous vehicle (AV) companies. Uber’s scale should allow the company to offer services at lower costs than standalone competitors like Tesla.

Uber trades at just under 23x free cash flow which is undervalued versus the S&P 500 and given the company’s dominant market share, accelerating free cash flow and huge runway for revenue and profits lead to shares being a great buy.

Trade Action 1: Option alpha trade (Sell a Put to Buy a Call).

Sell to Open January 15, 2027 $92.5 Put for $13.3, you will be paid $1330 upfront for every put sold.

Buy to Open January 15, 2027 $110 Call for $11.5, this will cost you $1150 for every call purchased.

You will receive a net credit of $1.80 per option or $180 deposited into your brokerage account.

If shares trade over $110 per share during the next 518 days you have unlimited upside.

If shares trade below $92.5 on expiration day you will have purchased shares at a fantastic price given the expectation of the company’s financials.

Trade Action 2: Straight put sell to be paid to acquire shares cheaper.

For those that want a shorter timeframe play you can simply sell a put option for the next month or two and collect a solid annualized return.

Sell to Open September 26, 2025 $90 Put for $2.58, you will be paid $258 upfront for every put sold. This is an annualized return of 24%. If at expiration shares trade below $90 you will purchase shares at a great price and can hold on for the long term or turn around and sell covered calls for additional income.

To your success,

Thomas Moore

Disclosure: The author plans on being long UBER within 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.

Posted Using INLEO