Solution to Rising Obesity Rates

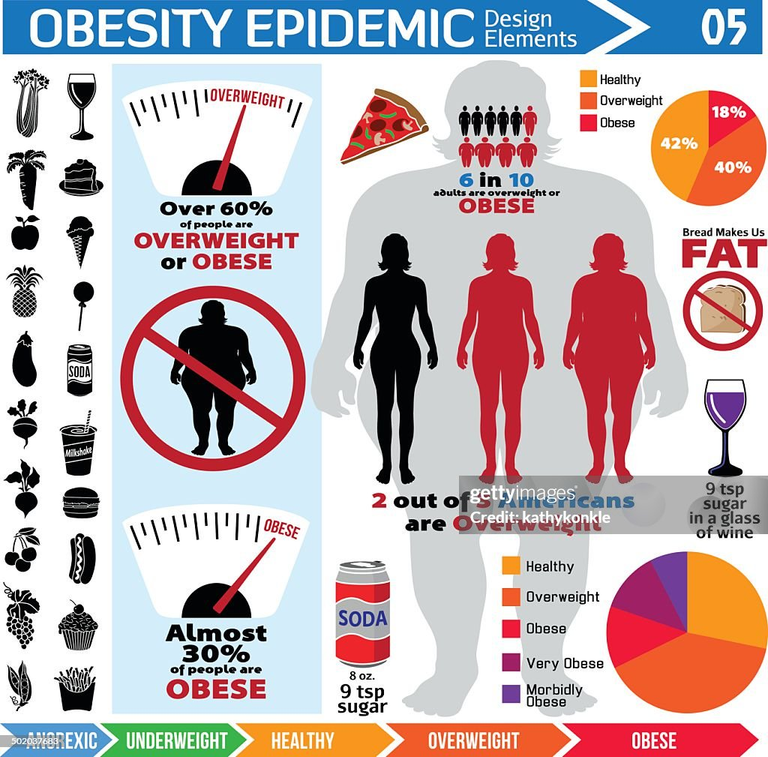

In America, the obesity rate has quadrupled since the early 1950s, rising from around 10% to over 40% today. Obesity is defined as having a body mass index (BMI) over 30. With more than 100 million Americans suffering from obesity, it has reached an epidemic level and is a leading cause of preventable death, contributing to heart disease, stroke, diabetes, and cancer. The financial burden is significant, with adults who have obesity incurring an estimated $1,861 in extra medical costs annually, totaling nearly $200 billion per year nationwide.

Causes of Increased Obesity

Several factors contribute to the rise in obesity, including the high consumption of sugar in modern foods. Americans consume an average of 80 grams of sugar daily, which is twice the recommended amount. The food industry often adds sugar to products like salad dressing, bread, and cereal to enhance flavor. An estimated 80% of grocery store items contain added sugar, even those marketed as "healthy" like protein bars and yogurt. A single Venti Pumpkin Spice Latte from Starbucks, for example, contains 470 calories and 63 grams of sugar, exceeding the entire daily recommended amount.

Another major factor is the trend of super-sized portions, with the average restaurant meal today being more than four times larger than it was in the 1950s. This, combined with increased sugar intake, has led to a rise in calorie consumption. The average American adult now consumes 2,568 calories per day, up from 2,109 in 1970, which is "the equivalent of an extra steak sandwich every day". These extra calories, coupled with an increasingly sedentary lifestyle, contribute to weight gain. According to the Centers for Disease Control and Prevention (CDC), 25% of Americans sit for eight or more hours daily, and 44% do not engage in even moderate physical activity.

Medically Based Obesity Solutions

Obesity is a global issue, a byproduct of rising global affluence, cheap food, and less physical labor due to automation. The search for a solution has been a long one. Bariatric surgery, or gastric bypass, has been the most effective solution for years, allowing patients to lose 30% or more of their body weight and reducing the long-term mortality rate by up to 40%. However, the procedure is costly, ranging from $20,000 to $30,000, and carries risks, including a 0.5% mortality rate and a 15% complication rate. Despite this, over 250,000 Americans undergo the operation annually.

A new, effective, and low-risk pharmaceutical solution has emerged in recent years. A landmark clinical trial involving 1,961 participants showed that a "Holy Grail weight loss drug" led to an average weight loss of 37 pounds with minimal side effects, primarily mild nausea. Dr. Timothy Garvey, an obesity expert, noted that this level of weight loss was unprecedented for a medication and "is beginning to close the gap with bariatric surgery".

Investment Opportunity

The company behind the miracle drug is Novo Nordisk (NYSE: NVO), a leading global drugmaker with a long history of developing diabetes treatments. Since its IPO in 1993, a $10,000 investment in Novo Nordisk has grown to $1.26 million, compared to $83,300 for the S&P 500 over the same period. The company's historical focus has been on diabetes, a disorder caused by the body's inability to regulate blood sugar.

The pancreas produces insulin to help cells use glucose for fuel and to store excess sugar as glycogen in the liver. Diabetes is a disruption in this process, leading to high blood sugar levels. Type 1 diabetes is a genetic disorder where the body produces little to no insulin, affecting about 9 million people worldwide. Type 2 diabetes, a more prevalent condition driven by lifestyle choices, affects over 500 million people globally and is expected to reach 700 million by 2045.

Novo Nordisk, which became the first large-scale producer of human insulin in 1923, has a long history in diabetes treatment. They have also developed "modern insulins" that control the speed and duration of insulin delivery, which make up about 84% of their insulin portfolio. Last year, Novo's insulin portfolio generated $7.3 billion in revenue, roughly 40% of its total sales.

For Type 2 diabetes, a new class of non-insulin drugs called GLP-1s have become highly effective. These drugs mimic natural GLP-1 hormones, boosting insulin production and reducing glucose from the liver. Novo Nordisk was a pioneer in this field with liraglutide, sold as Victoza for Type 2 diabetes in 2010. Further research found that a higher dose of liraglutide could also aid weight loss. In 2014, the FDA approved a high-dose version, Saxenda, specifically for weight loss, which delivered 5-10 pounds of additional weight loss in clinical trials compared to a placebo.

The second generation of Novo's GLP-1 compound is semaglutide, which is more effective and longer-lasting than liraglutide. The company's first semaglutide drug was Ozempic, a once-weekly injection approved in 2017 for Type 2 diabetes. Ozempic sales skyrocketed from $240 million in 2018 to $4.5 billion in 2021. High-dose semaglutide, the "Holy Grail" drug, showed a weight loss of 30 pounds more than the placebo in a landmark study and received FDA approval in 2019 under the brand name Wegovy. Due to strong demand, Wegovy sales grew from just under $760 million in 2019 to $1.21 billion in 2021. Despite production shortages that led to a temporary halt in sales and marketing, the drug has gained widespread attention, including an endorsement from Elon Musk.

Novo Nordisk's main competitor in this space is Eli Lilly (NYSE: LLY). Eli Lilly's GLP-1 compound, dulaglutide (Trulicity), was approved in 2014 and resulted in an average weight loss of up to 10.4 pounds. Their next-generation compound, tirzepatide (Mounjaro), was approved for weight loss in May 2022 and showed 23 pounds of additional weight loss over a placebo. Both companies are expected to thrive in the growing obesity market, much like they have in the diabetes market. The obesity market is potentially much larger than the diabetes market, with an estimated 200 million obese individuals in the U.S. and Europe alone. The annual opportunity for GLP-1 drugs for this population could be a $200 billion market, or $100 billion for Novo Nordisk with a 50% market share. Including overweight individuals, the addressable market could expand to over 600 million people across the U.S., Europe, and Japan, representing a $600 billion opportunity, or a potential $300 billion in sales for Novo Nordisk.

A significant development for Novo Nordisk is its acquisition of Emisphere Technologies, which provides the company with the only FDA-approved technology to put GLP-1 drugs into pill form. The company used this technology to create Rybelsus, the world's first pill for Type 2 diabetes treatment, which uses the same semaglutide compound as Ozempic. Rybelsus was approved in 2019 and had sales of $640 million last year. With clinical trials underway for a high-dose semaglutide pill for weight loss, Novo Nordisk is positioned to potentially dominate the market by offering a needle-free solution. The potential for a weight loss pill is seen as the "real upside" and could help the company capture a significant share of the massive weight loss market.

NVO Stock Cheapest In Three Years

Novo Nordisk's business is stable and well-suited for an uncertain economic climate. Its core business, which includes insulin and diabetes treatments, is not a discretionary purchase. The company also has a stable segment of drugs for growth hormone disorders, which made up 16% of sales last year. The business is highly capital efficient, converting about 35% of sales into free cash flow and generating $9 billion in free cash flow over the last year. Novo's balance sheet is strong, with more cash than debt, allowing it to avoid issuing new debt or refinancing at higher interest rates. The company demonstrated its stability by posting an average of 13% revenue growth from 2007 to 2009, navigating the Global Financial Crisis successfully. GLP-1 in pill form could be a game changer by targeting a wider audience who does not wish to use the current needle based solution.

To your success,

Thomas Moore

Posted Using INLEO

Congratulations @slider2990! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 5000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: