Navigating Market Making on Hive-Engine and Dswap.Trade

Market making on platforms like Hive-Engine can be a nuanced endeavor. While it presents opportunities for profit, it also requires a solid understanding of the market dynamics and daily commitment. Here’s a breakdown of what that entails.

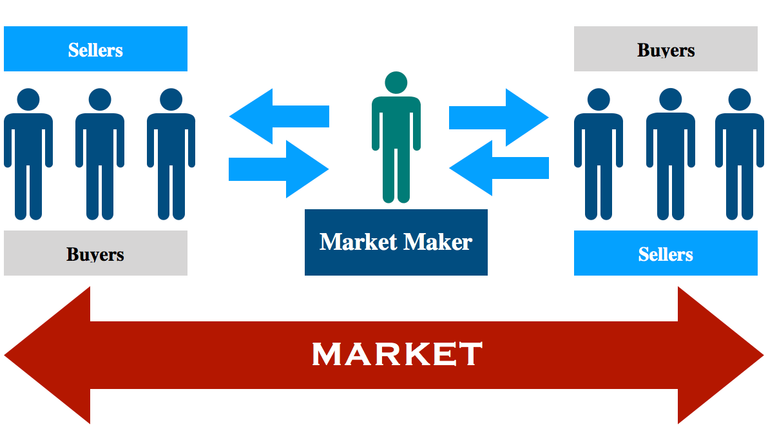

Understanding Market Making

Market making involves providing liquidity to a trading pair by placing buy and sell orders. Essentially, you help facilitate trades between buyers and sellers, earning a spread in the process. However, it’s not just about placing orders; it requires a strategy and continuous monitoring.

The Role of Hive-Engine and Dswap.Trade

Hive-Engine operates as a decentralized exchange that allows users to trade Hive-based tokens. Dswap.Trade enhances this experience by offering tools for automated market making and liquidity provision. While these platforms simplify some aspects of trading, they also introduce complexities that you need to navigate.

Challenges in Market Making

- Volatility: The prices of tokens on Hive can fluctuate significantly. This volatility can lead to losses if your buy and sell orders are not strategically placed.

Liquidity Issues: Not all tokens have the same level of liquidity. If you’re making a market for a less popular token, you may find it difficult to execute trades without moving the market price against you.

Daily Monitoring: One of the most critical aspects of successful market making is daily monitoring. Prices can change rapidly; therefore, staying informed about market conditions, news, and community sentiment is essential. This can involve checking trade volumes, price trends, and engaging with the community to gauge sentiment.

Strategies for Success

Set Clear Parameters: Define your risk tolerance and set limits for your trades. This clarity can help you avoid impulsive decisions during market fluctuations.

Diversify Your Pairs: Consider making markets for several pairs instead of focusing on just one. This can spread risk and increase potential profit avenues.

Engage with the Community: Being active on Hive.blog and other social channels can provide insights into upcoming trends or issues that may affect token prices. Engaging with other traders can also help you refine your strategies.

Utilize Tools Wisely: Platforms like Dswap.Trade offer various tools for market makers. Familiarize yourself with these tools to enhance your trading strategy, whether it’s through automated trading or analytics.

The Reward

While market making can be challenging and time-consuming, the potential rewards can be significant. A well-executed strategy, combined with diligent monitoring and community engagement, can lead to fruitful outcomes. The key is to be patient and learn from each experience, adjusting your approach as needed.

Conclusion

HIVE offers a number of ways to generate returns from posting, curation, trading and market making. Every action is another opportunity to generate profits while helping others.

I am attempting to provide liquidity to the $LEO ecosystem ($LEO, $LSTR, $SURGE) using dswap.trade on hive-engine market. I expect LEO tokens to be among the most actively traded assets on hive-engine and wish to help these markets with increased liquidity and tighter bid ask spreads.

Market Making is not for everyone, but it can be rewarding for those willing to put in the effort. By understanding the challenges and implementing thoughtful strategies, you can navigate this complex landscape effectively.

To your success,

Thomas Moore

Posted Using INLEO