SEC charges Binance and CZ with 13 crimes!

US Regulator SEC goes after Binance and their CEO CZ

Multiple charges..13 to be exact

- The charges are a large list including;

- Selling unregistered securities

- Purposefully allowing US investors to trade on Binance by not doing KYC

- Purposefully encouraging investors to use VPNs to avoid or evade detection of U.S. investors

- Comingly funds of Binance and investors

- Creating Binance.US to allow KYC for American Investors and then conducting all their trading on regular Binance

- Front running his own customers on all their trades

- And the list goes on.

SEC website summarizes the four areas of charged crimes:

UNREGISTERED EXCHANGE, BROKER, AND CLEARING AGENCY

The SEC’s complaint, filed in the U.S. District Court for the District of Columbia, alleges that, since at least July 2017, Binance.com and Binance.US, while controlled by Zhao, operated as exchanges, brokers, dealers, and clearing agencies and earned at least $11.6 billion in revenue from, among other things, transaction fees from U.S. customers. The SEC’s complaint alleges that (1) with respect to Binance.com, Binance should have registered as an exchange, broker-dealer, and clearing agency; (2) with respect to Binance.US, Binance and BAM Trading should have registered as an exchange and as clearing agencies; and (3) BAM Trading should have registered as a broker-dealer. The SEC also alleges that Zhao is liable as a control person for Binance’s and BAM Trading’s respective registration violations.

UNREGISTERED OFFER AND SALE OF CRYPTO ASSETS

The SEC charged Binance for the unregistered offers and sales of BNB, BUSD, and crypto-lending products known as “Simple Earn” and “BNB Vault.” Further, the SEC charged BAM Trading with the unregistered offer and sale of Binance.US’ staking-as-a-service program. The complaint also notes that Binance secretly has control over assets staked by U.S. customers in BAM’s staking program.

FAILURE TO RESTRICT U.S. INVESTORS FROM ACCESSING BINANCE.COM

The SEC’s complaint alleges that Zhao and Binance created BAM Management and BAM Trading in September 2019 as part of an elaborate scheme to evade U.S. federal securities laws by claiming that BAM Trading operated the Binance.US platform independently and that U.S. customers were not able to use the Binance.com platform. The complaint alleges that, in reality, Zhao and Binance maintained substantial involvement and control of the U.S. entity and that, behind the scenes, Zhao directed Binance to allow and conceal many high-value U.S. customers’ continued access to Binance.com. In one instance, the Binance chief compliance officer messaged a colleague that, “[w]e are operating as a fking unlicensed securities exchange in the USA bro.”

MISLEADING INVESTORS

According to the SEC’s complaint, BAM Trading and BAM Management misled Binance.US customers and equity investors concerning the existence and adequacy of market surveillance and controls to detect and prevent manipulative trading on the Binance.US platform’s crypto asset trading volumes. The complaint further alleges that the strategic and targeted wash trading largely perpetrated by the Binance.US platform’s primary undisclosed “market making” trading firm Sigma Chain, also owned by Zhao, demonstrates the falsity of statements BAM Trading made about its market surveillance and controls.

The actual filing from the SEC website

- It is 156 pages, but here are the first six pages with all 13 charges, followed by a thorough explanation of what the SEC believes Binance did.

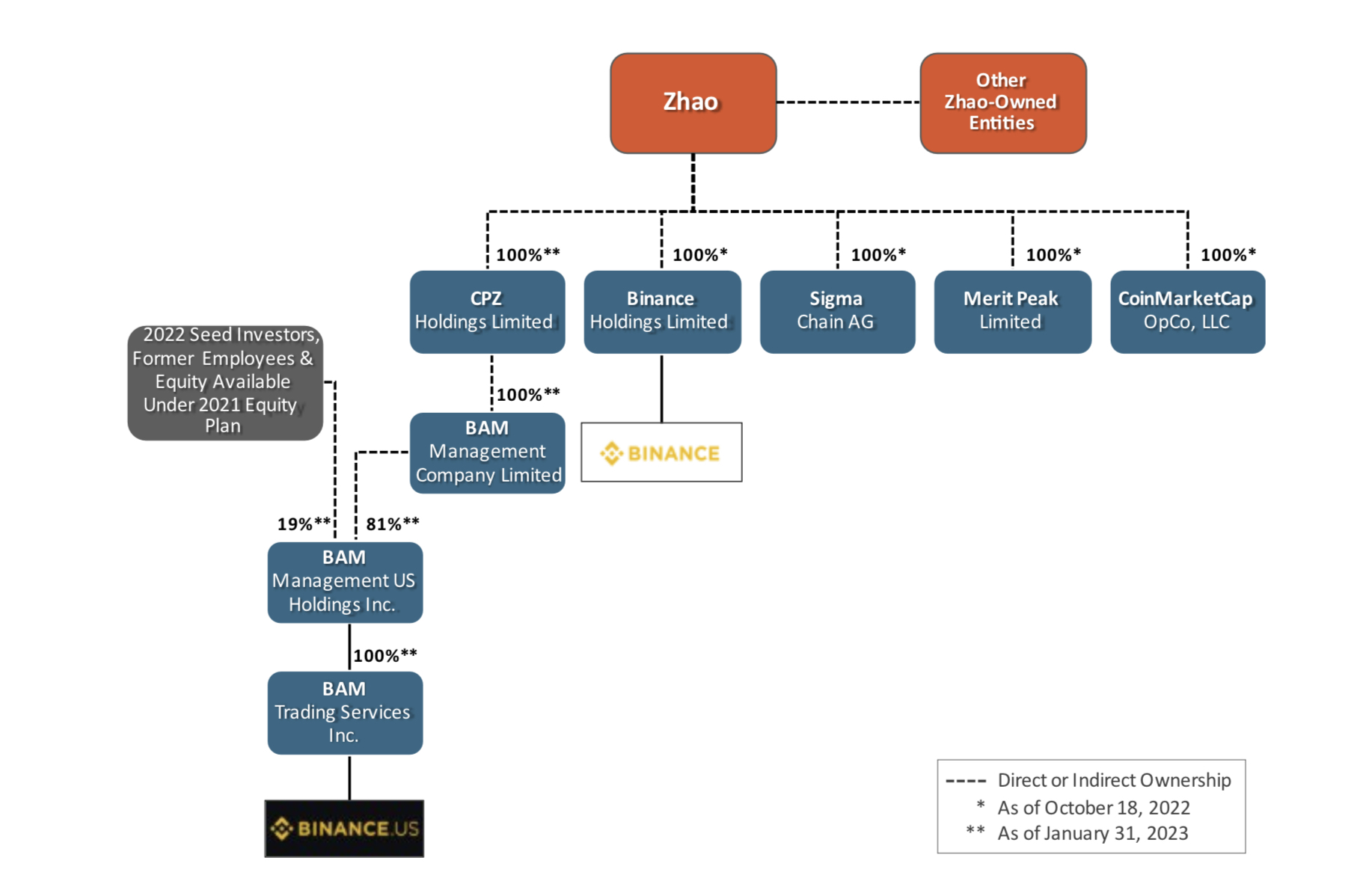

The SEC also accused CZ of being the owner/controller of multiple companies engaged in illegal activities:

SEC names 12 other cryptocurrencies traded on Binance.US which the SEC says are unregistered securities…

- .. meaning the leadership of those tokens could be charged with trading unregistered securities in the US.

- This could result in millions of dollars of fines.

Notably, the SEC complaint against Binance lists twelve different crypto assets as securities that were made available for trade on Binance's platforms. The crypto assets specifically called out by name are: Solana (SOL), Cardano (ADA), Polygon (MATIC), Filecoin (FIL), Cosmos (ATOM), The Sandbox (SAND), Decentraland (MANA), Algorand (ALGO), Axie Infinity Shards (AXS), and Coti (COTI). However, the complaint adds that this is not an exhaustive list of all securities available for trade on Binance's platforms.

Additionally, the complaint points out that Binance made available for trade on its platforms various crypto assets that have already faced enforcement actions, including but not limited to Amp (AMP), Augur (REP), TerraUSD (UST), and Tron (TRX).

Source

This announcement rocked the crypto markets

- .. and almost all crypto tokens were down for the day.

- Many blamed the SEC for the drop in token prices

- Some accuse the SEC of market manipulation

- Others condem the SEC for trying to destroy crypto.

- A few said it was a perfect buying opportunity.

- I agree that all may be true to some extent.

- In any event, it’s never a dull day in crypto!

Thanks for the info! 😀

Your welcome.