Trump's Reciprocal Tariffs -- How Markets Have Responded?

Reciprocal Tariffs -- What are they?

Tariffs are usually set by a country to maintain external demand. US products may have high global demand for which other countries need to control. If a country's imports are greater than their exports, that's what results to a Trade Deficit.

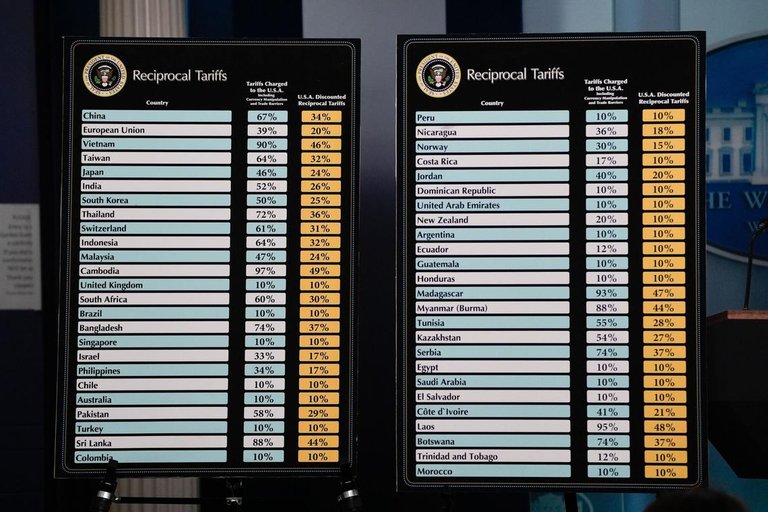

Trump administration's latest policy basically says, "if they tax us, we tax them!". At a high level, it sounds just fair. However, industries that are into international trade definitely will be impacted by this measure. The US might also be shooting its own foot by increasing tariffs on products that they need from other countries; thereby, increasing their cost.

Basing from the above image, US Tariff on Philippine products will now become 17% from what could have been 6-10% before.

Based on the Observatory of Economic Complexity , the top 3 imports of the US from the Philippines are:

1.) Insulated Wires

2.) Integrated Circuits

3.) Computers

Where else then would they get Electronic Products if they impose higher tariffs from their main sources? It's possible that such economic policies can drive new trends like shifting to different countries which may result to being cheaper or the US itself start building those industries from within.

The problem with this is that they have started broadly by such sweeping dues. Surely, there will be adjustments along the way but it's the uncertainties that makes the countries and industries at risk and worried. This causes the latest drops in markets.

US Market in Breakdown

The latest drop in response to the US Tariffs brought down the US index back to last year's levels. This may continue down in the coming months unless it stabilizes early.

Philippine Market still in consolidation mode

PSEI levels still sitting within the cloud. We'll see this week if it will be able to stay at support levels given that there are already companies that are seen as undervalued.

Watchlist: CREIT - will have to review this further. All I know for now is that it's a REIT that gives out 6.39% Annual Dividend Yield.

Crypto: HIVE - Avoid

Chart not looking good as the prices are below the 200 Moving Average, below the cloud and in negative MACD regions.

This is not financial advise. I use this as my trading journal/notes for ongoing reference for the succeeding week. The above technical analysis (charts) are just used for guidance while studying market behavior and trying my hand on market timing. Please Do Your Own Research (DYOR).

- Stock Charts from Investagrams

I'm just waiting for build up more funds to buy some dips. I'm waiting a few more weeks before the full effect of these things are realized, everything just looks bear to me at the moment.

Yep, no need to rush! I'm ready to buy but will only buy once strength has been established. Cash is King for now