Philippine Stock Market Analysis (As of March 9, 2025) -- PSEI Stabilizing!

Philippine Market (PSE Index): Buy

Finally, after more than a month we see some sense of stability in the Philippine market! I was really planning to buy more of a PH fund; however, I got busy last week.

While this is not yet going to be a bullish reversal, at least we'd know that the bleeding will stop. The latest chart is so wonderful.

- Trend: Negative channel has been broken, moving to sideways

- MACD: incoming zero cross

- Bollinger bands: pushing upper BOL bands

New Resistances:

- Kumo cloud: entered lower region, posing for breakout?

- 200 MA: next resistance. Mean reverting?

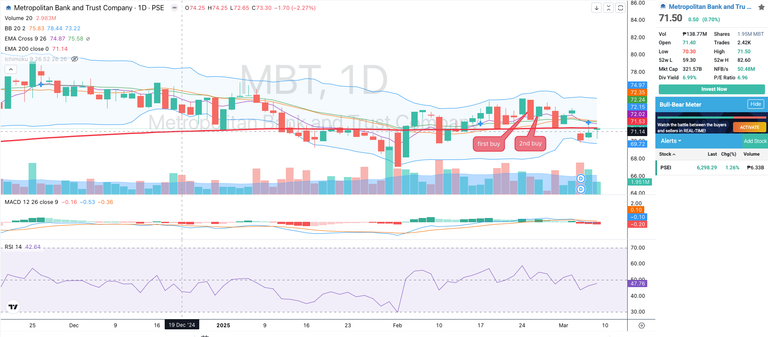

Monitor: Metropolitan Bank (MBT)

The MBT shares I bought last week allows me to receive annual dividends with gross yield of 4.76%. As usual, the shares dropped after ex-date but days after prices went up again. This is a very good sign where long term investors are still holding in.

Others:

PCOR - awaiting kumo breakout; near MACD zero cross; below 200 MA

This is not financial advise. I use this as my trading journal/notes for ongoing reference for the succeeding week. The above technical analysis (charts) are just used for guidance while studying market behavior and trying my hand on market timing. Please Do Your Own Research (DYOR).

- Charts from Investagrams