Crypto Income - Trading Is Still King!

Stacking Sats

Whether you are accumulating Bitcoin or altcoins, earning additional Crypto has become more prevalent. As the industry has evolved, more individuals have turned to the concept of ‘stacking sats’. SoFi has been a great avenue to explore in this regard, primarily due to ease and accessibility. However, SoFi has been battling of late. Even more established platforms like Hive are battling.

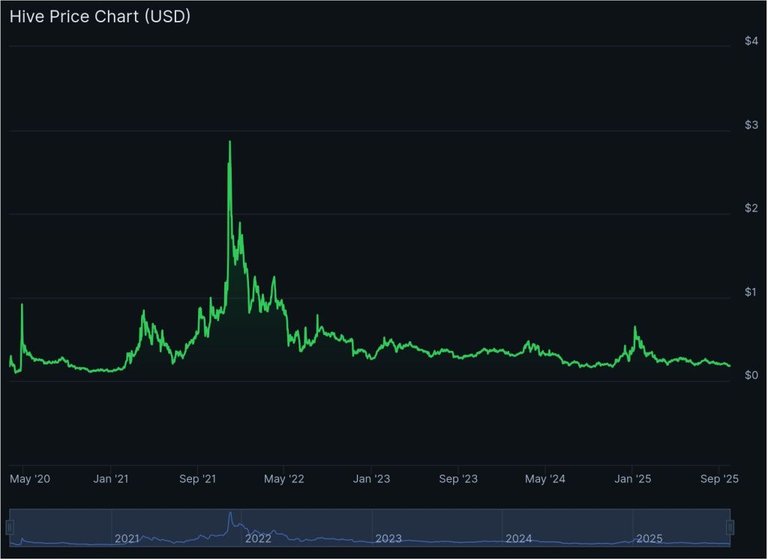

Apart from a brief pump at the beginning of 2025, HIVE is not looking good. The current price of HIVE is $0.17, representing a 95% decline from its all-time high of $3.41. This is a bitter pill to swallow for those who have dedicated themselves to creating and publishing content on Hive. That being said, Hive is one of the stronger and more established platforms, which indicates just how much the sector is battling.

An important ratio to consider is the one between time and reward. One cannot spend copious amounts of time creating content for a minimal reward. The ratio has to make sense. This is why I always advocate passive and semi-passive ways of earning Crypto. Browser extensions such as Slice are a good example. Users can earn 30 sats per day just by visiting their dashboard. Furthermore, additional sats are earned as ads are displayed.

It’s a similar system to Brave, a quick and effortless way to earn Bitcoin. Slice uses the Lightning Network, which eradicates the issue of transaction fees. The problem with SoFi and similar models is that earnings can take a serious knock. In some instances, this removes the viability, which is why trading remains my number one choice for earning additional Crypto income.

Provided you know how to trade, income remains stable and consistent. Sure, a large unexpected move can put your earnings on hold for a time. However, if your strategies are effective, even this can be an opportunity. Trading remains viable regardless of the market. I use Crypto as collateral in bull markets and USD as collateral in bear markets. This way, my collateral increases in a bull market and remains stable in a bear market.

Using Crypto as collateral in a bear market is counterintuitive. It’s unwise and should be avoided at all times. The opposite is, of course, true in a bull market; it’s a double whammy in the trader’s favor. Trading is a skill well worth acquiring. Putting in the time and research pays off over the long term.

Final Thoughts

Trading can be a great little side hustle, especially once effective strategies are in place. However, trading is not for everyone. Starting with a demo account is the safest way to begin. As always, this should not be considered investment advice. These are merely my views. All the best, see you next time!

Disclaimer

First of all, I am not a financial advisor. All information provided on this website is strictly my own opinion and not financial advice. I do make use of affiliate links. Purchasing or interacting with any third-party company could result in my receiving a commission. In some instances, utilizing an affiliate link can also result in a bonus or discount.

This article was first published on Sapphire Crypto.

Posted Using INLEO

Trading is definitely a skill worth acquiring for those in the crypto space. The market is largely inefficient for now and there are always opportunities to take advantage of provided one has the skills to spot them. Great tip on using USD as collateral during bear markets :)

Yes, USD during bearish times is definitely the way to go!