How I’m Navigating the Current Economic Storm: Simple Finance Lessons That Are Working for Me

It’s no secret that things have been tough lately. Prices keep going up, income isn’t catching up fast enough, and for many people, just making it through the month feels like a win. I’ve been trying to stay on top of my finances and I want to share a few things that have helped me recently, nothing fancy, just real stuff that works.

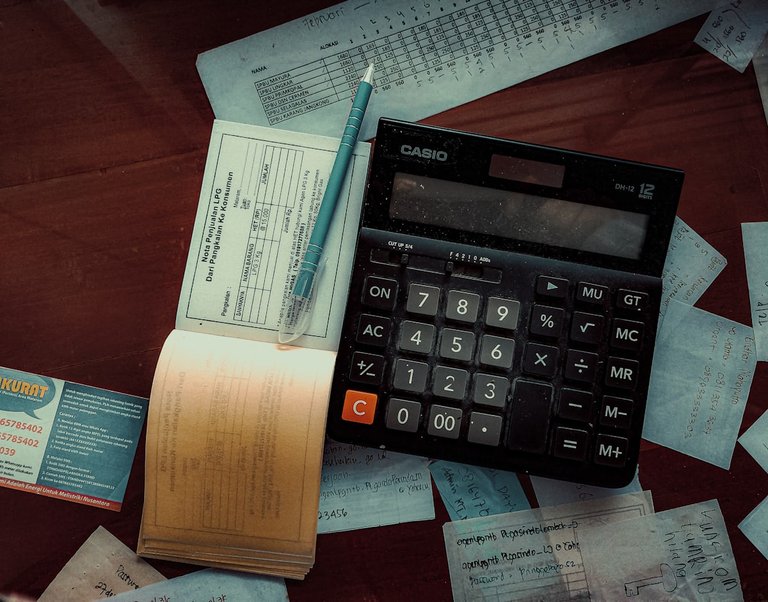

1. Tracking Every Naira (or Dollar, or Cedi)

This is the first thing I changed. I used to think budgeting was boring and complicated, but once I started tracking what I spent every day, even the small stuff, I realized where my money was going. You’d be surprised how fast small things like snacks, airtime top-ups, or random online purchases add up. I started using a simple note app on my phone to record everything, and by the end of the week, I could clearly see where I was wasting money.

2. Focusing More on Needs Than Wants

Let’s be real, most of us want the soft life. But with inflation the way it is, I’ve had to get serious about cutting out the things I don’t really need. Instead of constantly eating out, I cook more. I stopped upgrading my phone “just because.” And I try not to chase trends. It hasn’t been easy, but it’s helping me stretch my money further.

3. Saving in Small Bits

There’s this idea that you need to save big chunks of money to make it count. But I’ve learned that small, consistent savings matter a lot. Even saving ₦500 or $1 a day adds up over time. I created a separate account just for savings so I’m not tempted to touch it. I also use a local thrift group (ajo/esusu) to stay disciplined because once you commit, you have to follow through.

4. Looking for New Streams of Income

One income stream is just not enough anymore. I’ve been exploring small side hustles, things like digital writing, helping people with CV reviews, and affiliate marketing. None of these are overnight money-makers, but they bring in something extra. On Hive too, I’ve started engaging more and posting regularly to slowly build my presence. I know it's a long game, but consistency is key.

5. Investing Cautiously

With all the Ponzi schemes and “get rich quick” platforms out there, it’s easy to get scammed. I learned the hard way once and now I’m more careful. I do basic research, ask questions, and never invest money I can’t afford to lose. I also follow updates about Bitcoin, stablecoins, and even local investment opportunities like government bonds or cooperative societies.

6. Cutting Down on Debt

This one is hard, but I’ve made it a personal goal to stop borrowing for things I can live without. Debt might solve a short-term problem but it creates long-term stress. Now, I only borrow when it’s absolutely necessary and I try to pay back fast to avoid interest piling up.

Final Thoughts

Managing money in today’s economy isn’t easy, especially with how unpredictable things have become. But the little changes I’ve made have brought me some peace of mind. I don’t have it all figured out, but I’m learning every day.

If you’re reading this and also trying to stay afloat financially, just know you’re not alone. Start small, be consistent, and give yourself time. The road might be rough now, but things do get better.

Let me know in the comments how you’re handling your finances in this economy. We can all learn from each other.

You received an upvote ecency