UK debt reaches 100% of GDP for the first time since 1961

Because the UK is a very old country, it has had debt super-cycles before. However it has never defaulted, because it somehow got itself out of the problem.

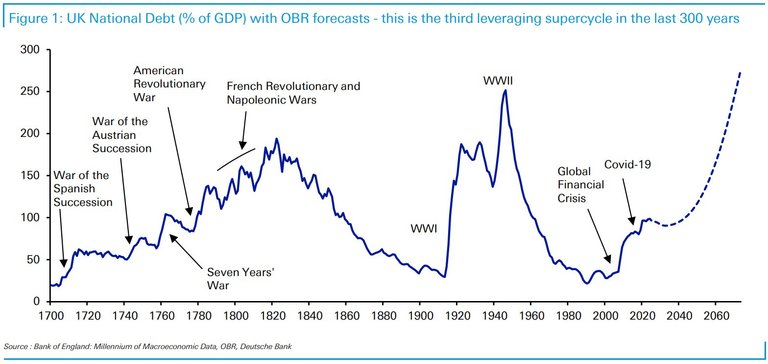

It now looks like it's commencing on it's third debt super cycle. Here is the chart of debt as a percentage of GDP going back to 1700:

The first debt super cycle was resolved by Britain inventing the Industrial Revolution. This turbo charged the 19th century British economy, and the accompanying taxes generated by growth reduced debt.

The second debt super cycle was caused by borrowing to fund two world wars. Post WW2, there was a five year period of severe austerity to pay for some of it. Wages were frozen for five years and rationing was also extended for five years so people didn't consume much and certainly didn't import much.

During this period Britain ran both budget and trade surpluses. Everything produced was exported to earn gold to pay down debt. By the 1960's the global post war boom was generating enough growth to take care of the debt.

This time the debt has been caused by the Great Financial Crash and it's bank bailouts, plus covid. The Office of Budget Responsibility is projecting that debt will hit 270% of GDP by 2073 (see dotted line on graph), if something isn't done.

But what should be done?

The country has no appetite for the sort of 1945 - 1952 hardship people underwent to pay the world war debts. And an excess of regulation means it will be difficult to replicate 19th century innovation.

Someone needs to either cut welfare or cut regulation, but the new government doesn't look like it will do either. The French Revolution is what happens if you don't sort out debt and run out of money as a result.

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @rose98734, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Do you want to win SOME BEER together with your friends and draw the

BEERKING.Thanks