Headline UK CPI comes in at 1.7%

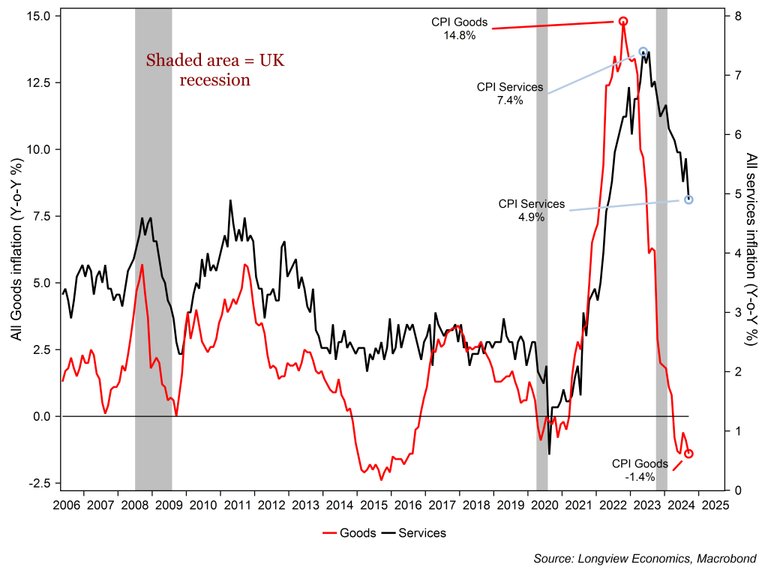

... but services inflation is still very strong. The following graph separates out goods inflation from services inflation:

Because the headline rate of 1.7% is below the Bank of England's target rate of 2%, some comentators are predicting an interest rate cuts next month. But it looks like lower petrol costs brought CPI down, and that is temporary.

Electricity and gas prices rose in October (which will show up in the next set of figures), rents are still rising, services like car insurance, childcare costs and so on are still pricey. And then there is the tricky budget to come on 30th Oct.

It looks like there will be tax rises, but also that the fiscal rules will be loosened and borrowing increased. No one knows how the markets will react to that. The 10 year bond yield has crept up from 3.77% in Sept to over 4%.

If the markets react badly to the budget, there is no way the Bank of England will be able to cut rates.

Finally, the Bank of England can't really cut rates unless the Federal Reserve cuts rates. Moving earlier than the Fed will weaken the pound, which would not be helpful as the UK is a net importer of oil and food.