Could Dollar strength help the Fed from keeping interest rate rises at bay?

The March Consumer Price Index (CPI) for the USA came in at 3.5%, which persuaded market participants into thinking the Fed had to hike interest rates to force inflation lower.

But interest rates arn't the only thing affecting inflation. To be sure, interest rates curb domestic economic activity, which curbs domestic business' ability to hike prices

But in our globalised world, the exchange rate also matters, as it determines the price of imports.

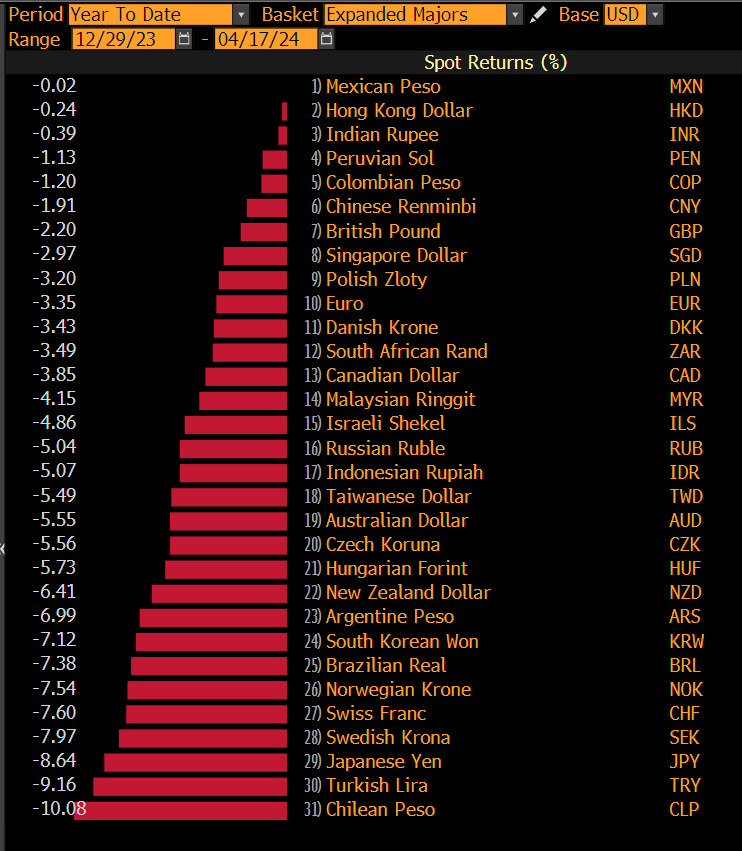

Here's the performance of the US dollar in the past year:

As you can see from the above chart, the US is importing zilch inflation from abroad. All inflationary pressures are domestic. Indeed, if the dollar wasn' so strong, US inflation would be a lot higher.

Therefore, if US inflation creeps higher, the pressure will be on for a rate hike.