Copper futures in New York are now 25% higher than in London

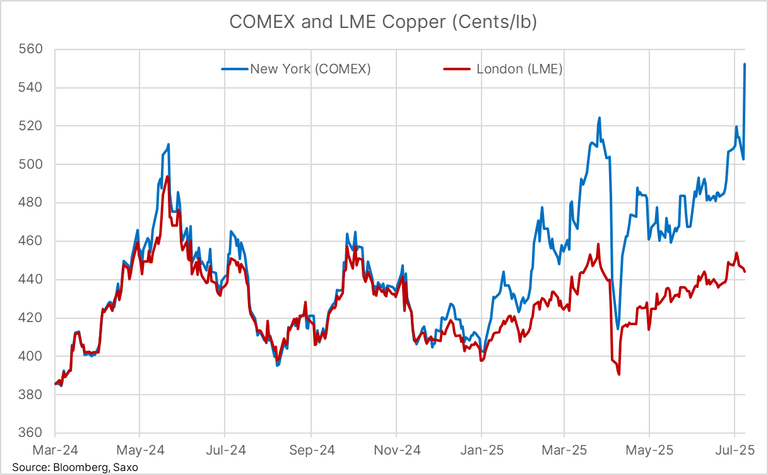

Here is the chart comparing the futures price of copper on New York's COMEX exchange to the price on London's LME exchange:

Until Trump's inauguration in January, the prices on the two commodities exchanges moved in sync.

Then came Trump's tariffs on copper. He imposed a blanket tariff of 10% on imported copper and is now talking about a 50% tariff.

As you can see from the chart, the New York price started to diverge from the London price in April when the 10% tariff came into effect. Remember this is the raw price - the tariffs will be added on top.

So why is the raw price going up? While the US imports 45% of it's copper, US copper consumption is only 7% of global copper demand.

Some copper suppliers have decided simply not to sell to the US anymore - they don't want a shipment to be halfway to the US and the tariff changing before it arrives with the customer cancelling the purchase.

So supply has dried up and the price is climbing on New York's COMEX to make it worthwhile for foreign suppliers to ship to the US again.

Having to pay such a high price for copper compared to the rest of the world is bad news for American manufacturers, especially as they have to pay the tariff on top.

It will take years before American domestic copper production ramps up. So US manufacturers are probably hoping Trump changes his mind.

https://www.reddit.com/r/economy/comments/1lvg3lr/copper_futures_in_new_york_are_now_25_higher_than/

https://www.reddit.com/r/MetalsOnReddit/comments/1lvgohd/copper_futures_in_new_york_are_now_25_higher_than/

This post has been shared on Reddit by @rose98734 through the HivePosh initiative.

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @rose98734, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!We love your support by voting @detlev.witness on HIVE .

View or trade

BEER.Hey @rose98734, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Did you know that <a href='https://dcity.io/cityyou can use BEER at dCity game to buy cards to rule the world.

Congratulations @rose98734! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 1250 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP