China resumes outright selling of US Treasuries

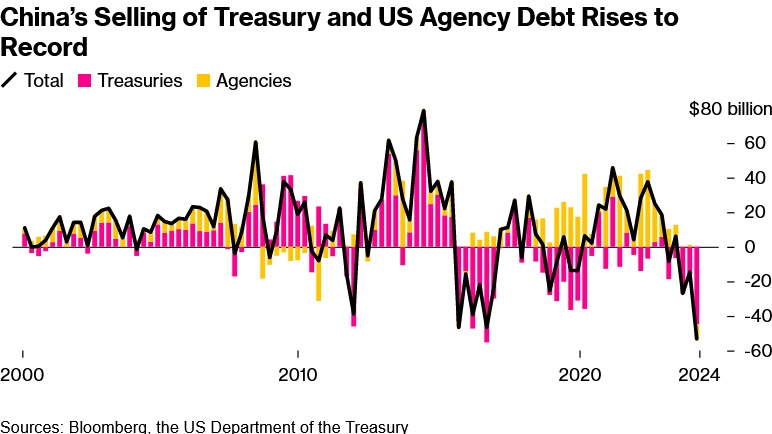

China has sold about $53 billion of US Treasuries in the first quarter of this year (2024). Belgium, often seen as a custodian of China’s holdings, also sold $22 billion of Treasuries during the first quarter. Here is the chart:

As you can see from the graph, it's not the first time China has sold Treasuries.

They sold in 2013, during their banking liquidity crisis. They sold again when Donald Trump became President, spooked by how unpredictable he was. And they sold during the pandemic.

The jury is out about why China is selling.

Some analysts think it's because they are diversifying into gold as distrust of the US grows. Others point to China's ongoing property crisis, with the yuan at the bottom of it's range. China can't afford to let the yuan fall too much as they import oil in dollars. They may be selling Treasuries to get liquid dollars which they are using to buy yuan to prop it up.

Either way, the US can no longer rely on China to buy it's bonds.