Stacking for Full Retirement Plans...

I haven't given too much thought to full retirement since I've been back in the UK.

This is mainly because I'm quite happily semi-retired and don't need to work full-time, and am very happy working part-time.

In fact I'm so OK with the idea of working that I've even started doing voluntary work.... two to three days a week, mainly because I actually just like working with people and the feeling of being useful.

This is something I'll happily carry on doing for many, many years to come I think, and I'm confident some of that voluntary work will translate into paid works within a year.

Of course that'll be a bit more intensive than volunteering, but you know what: I've been observing the people I work alongside who get paid, and the kind of work I'm looking to do is easy enough - turn up, work, then you can forget about it during the evenings and weekends - not at all like teaching where it just plays on your mind all the time!

And combined with the main blog and some investment income I'm OK to work just two to three days a week for the foreseeable future.

But carrying on like I am I am not really stacking any wealth, I am kind of treading water, which is fine, but I got to thinking: what if I get sick of this and just want to cut loose in a few years, and sack off work altogether before I hit 60, when my Teacher's Pension kicks in.

So I'm now considering the possibility of upping my work/ Vest game and stacking a little more, while I'm young enough and have the energy and the will, so I got to thinking through my longer term until 60 years of age stacking targets, and here you go:

Stacking targets...

I'm working on wanting £30K wealth by the time I'm 60. While that doesn't sound like a lot, I've got a decent Teacher's Pension, a state pension 8 years after that, probably a second house to rent out by that point, and crypto. So £30K stacked in non-crypto by 60 I think is a reasonable addition, just to skim off and have as an emergency fund. Also I'll have no mortgage by that point. I should kill that by 2028.

To reach full retirement I'd want £10K a year to last me through to age 60 be able to quit any work responsibilities I may pick up in the next year or so.

£10K a year isn't enough to live off in the UK, but I'm working on the principle that the blog income will continue to bring me in something, I don't really regard that as work, and crypto yields, and having no mortgage. And if I want to go abroad, which is the main thing I'm likely to do in full retirement, I'd be able to rent house 1 out too.

£10K per year is a minimum, base target.

So my stacking targets for full retirement are as follows:

This includes the £30K slush fund...

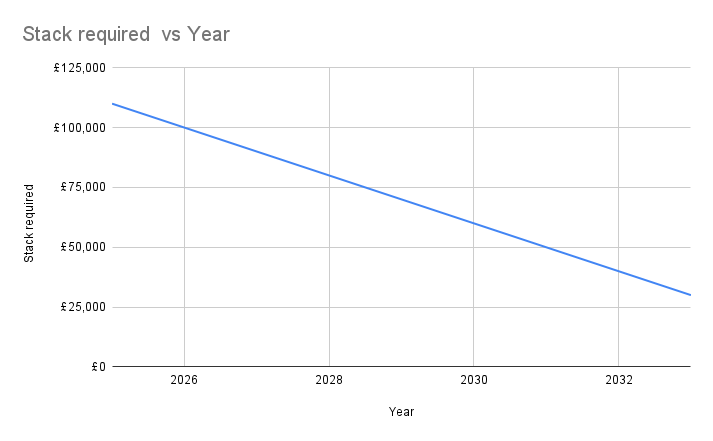

- To fully retire by 2025 I'd need £110K

- To fully retire by 2028 I'd need £80K

- To fully retire by 2030: I'd need £60K

These figures don't include house 1 as capital. That's to live in!

Should I include crypto holdings...?

If I include my crypto holdings I'm already there, but having seen my Splinterlands Assets go down and down and down in value I'm wary of including these.

My brain thing is currently telling me that I want the above sums in a diversified portfolio of non-crypto assets: cash, shares and precious metals, a classic investment portfolio you might say.

However I'm going to make one exception: HBDs. I will include HBDs in my stacking targets, I think that's reasonable!

Long way to go!

I'm not going to divulge how much wealth I've got but let's just say I've a long way to go, I'll be amazed if I hit these goals by 2028!

I just don't like the idea of working that much!

But we'll see.. possibly chasing out some crypto along the way will help, but I'm reluctant to cash out more than the capital gains allowance which is dropping to £3K next tax year. But over 5 years, that's still £15K tax free, which ain't too bad.

We'll see how it goes. As I said ATM I'm happy with my ordinary part-time working life, but I would like to start stacking some non-crypto wealth again.

Wish me luck!

Posted Using InLeo Alpha

Perhaps would not be bad to stack more in BITCOIN! 😉

This is such a big part of it. With no mortgage, a pension goes much further.

Good luck

Nobody lives forever, so you need to make the most of life. Just have to find the right balance of work and other stuff so you can get by.

I don't think anyone really knows where crypto is going, but at least Hive is fun anyway.

You should be able to achieve this if you work a little harder now. Who knows what the Bull cycle will offer up in 2025 and could set you up for a decent HBD stake. The house paid off is the most positive thing you have as that makes living a whole lot cheaper.

Started to stack HBD last year as part of my future retirement plan; and yes, diversifying is key! I do have an emergency fita fund, that I'm actually in the process of reinforcing. Might as well have back up plans, since you never know what crazy times/regulations might come our way. Cheers! !BEER

View or trade

BEER.Hey @revisesociology, here is a little bit of

BEERfrom @pardinus for you. Enjoy it!Did you know that <a href='https://dcity.io/cityyou can use BEER at dCity game to buy cards to rule the world.

Your cautious approach to including only HBDs in your stacking targets seems like a prudent move.

In the same way, a person has a routine for a long time, when he retires, it ends, so a person should not do it at all. But if he sits, his health deteriorates, so it is better that a person should do paid work in the same way and should not sit at home, it keeps the health of a person good.

Interesting times trying to work out the right work/ retirement balance. Sounds like were both in a similar spot. I am 57 eyeing off this 60 mark as well and still stacking with a full time job. I think it might take me a bit of getting used to the down graph after a life time of building.

!LUV

!LOL

!ALIVE

@revisesociology, @new.things(7/10) sent LUV. | connect | community | HiveWiki | NFT | <>< daily

! help(no space) to get help on Hive. Info@revisesociology! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @ new.things. (7/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want, plus you can win Hive Power (2x 50 HP) and Alive Power (2x 500 AP) delegations (4 weeks), and Ecency Points (4x 50 EP), in our chat every day.

lolztoken.com

The corner—they’re usually 90 degrees.

Credit: reddit

@revisesociology, I sent you an $LOLZ on behalf of new.things

(9/10)

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

What's the state pension age where you are? And do you have a private pension that kicks in earlier?

I'm quite lucky in that my teacher's pension starts paying out at 60. (At least I hope so!)

We have a good superannuation scheme in Australia which most employees should have . I can access it at 60 which should see me through comfortably to our state or aged Pension at 67. The aged pension is only just over 20k AUD per year though. !BEER

Similar to the UK, not that surprising!

View or trade

BEER.Hey @revisesociology, here is a little bit of

BEERfrom @new.things for you. Enjoy it!Did you know that <a href='https://dcity.io/cityyou can use BEER at dCity game to buy cards to rule the world.

Good luck 🍀on your plan, @revisesociology

Started this year, and about two months ago, to buy some Hive and to convert to HBD and place it in Savings... Well, I can say that the value is nothing compared with I had in my mind has a profitable gold, but it's something.

I haven't made a true plan, so my moves are very erratic ones, and maybe not the rational ones, or the best at my life time. I'm currently almost 45 yo, and I cannot picture myself doing what I'm doing (job) at the age of 67 yo (that is the minimum retirement official age in my country, if I'm not confused).

I wish I could settle down a little bit earlier, since I don't feel the mental strength to keep pushing up the hill the next 20 years plus..

Wishing you the best luck for your plan!

I'm paying a monthly fee to bank. I had the lucky move to ask for only 70% of the total value of my apartment as credit, and I've already bought it 13 years ago...

In the mean wile, let me see if I can be more prolific in engaging with the self vision of planing my retirement. Couple of years ago, I've played regularly (week basis) on the big euromillions lottery. I've dreamed about earning 1M € and to continue my simple live without any excess or money waste. You know, simple live. With no big changing in my lifestyle... These days, I thing that spending that 5 euros per week is just throwing money away, when I can but some Cryto on a DCA mode.

Let's see what plan I would draw for myself :)

Cheers

If you own your own flat you should have a reasonable capacity to save for retirement, it compounds so the sooner the better.

Maybe start looking at other jobs you can do as well - it took me years to get out of teaching, working evenings, weekends and holidays but I managed it!

You have got that absolutely right. To getting outside of the personal comfort bubble gives us many abilities, and tools. I consider so many persons like you a true example!

Cheers!

BEER