Should we tax the top 1% more...?

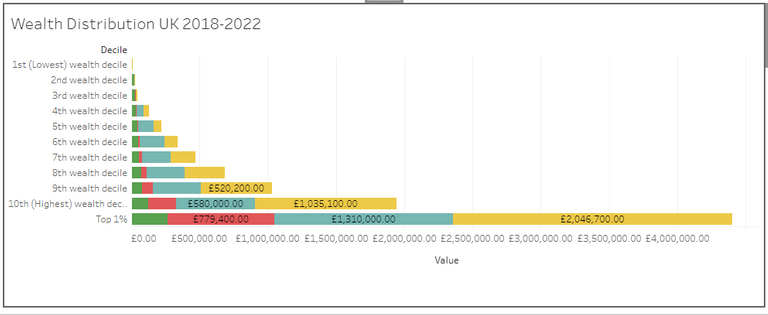

Wealth distribution in the UK is very unequal.

If we compare the average (median household) wealth of the top 1% in the UK to the bottom 10%, the top 1% are more than 500 times wealthier....

I got to wondering what the redistributive effects might be of taking just 50% of this wealth from the top 1% and just giving it to the bottom 10-30% of households might be....

NB the median household worth of the bottom 10% is just £8K.

50% would still leave the top 1% with £2M of household wealth, richer than the average 10% still.

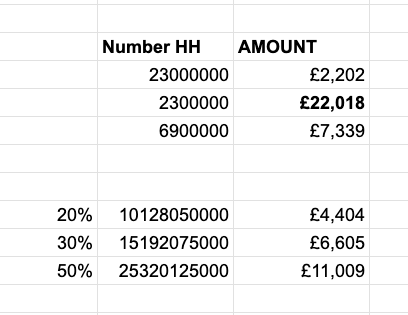

The calculations are based on there being 23 Million households in the UK, so the top 1% = around 230 000 households, the bottom 10% would be 2.3M and the bottom 30% 6.9M.

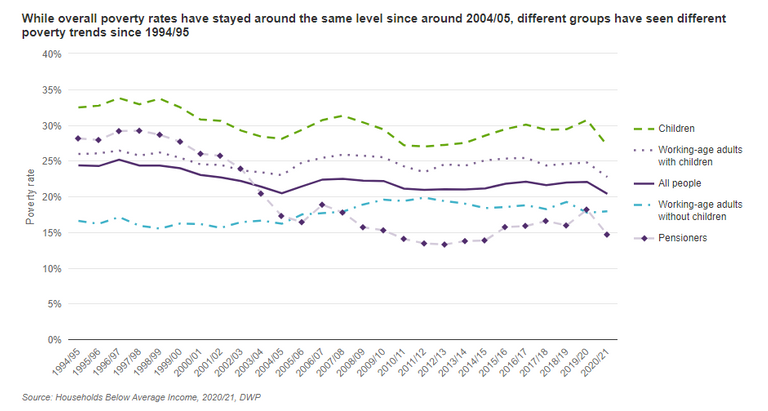

The Joseph Rowntree Foundation calculates that around 20% of households in the UK are in poverty, increasing the wealth of bottom 10% would tackle the worst of this. (I just looked at the bottom 10% to 30% for fun!)

The (quite profound) results...

Obvs I did a spreadsheet...

So £4M * 50% / 230K (HH) and then that / 23M (HH) would give each of the HH in the bottom 10% £22K each....

And if we did a 20/30/50 split for the bottom 3rd/2nd/ 1st decile respectively they'd each get an extra £11K, £6.5K and £4.5K respectively.

Now I'm not advocating for this but £22K on average per household - that's insulation, damp-proofing (a lot of these HH would be in poor condition), maybe debt-relief, maybe paying for an L4 course for one of the members...

There's a whole lot of social good that could be done with that money, rather than it sitting in wealth funds and being skimmed by the very rich and then passed down to their undeserving kids!

Really this was just a numbers exercise not a political statement!

It’s not just in the UK it’s global. And it seems the 1% are not ready to let go of their wealth for anything. The policy makers are part of the 1% too you know…

Yes I never said it was an easy 'fix'!

I think UK's poors would be rich in my country due to x 34 currency rate :)

Fair point, but they feel relatively poor!

It's an interesting and illustrative exercise.

But what you're talking about isn't tax, it's expropriating 50% of the wealth (including illiquid assets) of the 1%. Rich people can afford good accountants, and you'd suddenly find that they all claimed to be as poor as church mice, with all their "wealth" having moved to trust funds, offshore, corporate accounts etc.

I feel that a better solution isn't to tax more, it's for governments to spend less. Around 50% of the workforce are in the public sector. That means they don't make anything, export anything, or generate any direct contribution to GDP. Some public sector is essential, but it needs to be a minimum. It's not a wealth generator, it's an enabler that allows those who make, sell or export something to create taxable wealth. When only 50% of the workforce are paying for the other 50%, it makes for high taxation and international uncompetitiveness.

I also feel that instead of punishing the rich (some at least who got there through their own efforts), we need to devote significant time to alleviating poverty at the bottom of the scale. Not by throwing money at the problem (which just causes dependency), but by improving opportunities for people to improve themselves, earn more, and have better lives. That's a complex (and in some areas controversial) discussion in it's own right, though !

An alternative interpretation might be that it is re-distributing wealth that has been extracted from the other 99% of the population. I agree with you, though, whatever the analysis, actually getting hold of any resources is fraught with difficulty, with very rich people able to move assets and themselves very easily to wherever there is a flag of convenience.

I'm not sure about this. Some of those jobs do contribute directly and indirectly to GDP, others maintain the hard and soft infrastructure necessary for a developed society including education and health, and many of them exist to compensate or ameliorate the problems created by inequality and poverty. As a rich country there are arguments for both having apparently surplus to requirements jobs and it is more convenient to have those jobs rather than to address fundamental problems of inequality.

Again, an alternative interpretation might be that it is reasonable and in the interests of rich people to contribute to the well-being of the wider society from which they have gained their wealth.

Great answer, couldn't have done much better myself, been away took a bit of time to reading!

I'm with @shanibeer on this all of that wealth isn't earned on the back of talent, it's extracted from ordinary people. Of course if people can prove they've earned it on merit: I'm happy for them to keep it! I was thinking of redistribution being put into improving opportunities too of course, that's the way I'd do it.

But I'm also reticent about nation states, it's the problem of our times!

One thing we can probably agree on is philanthropic projects aimed at solving global problems - big fan of those.

The distribution charts in the U.S. are quite similar. The middle deciles seem to increase arithmetically but the ones at the top seem to grow exponentially.

It's financialisation... more returns to the top, it's grim and not earned. Extracted!

always tax richer they use so many ways to escape taxes

Don't forget to deduct overhead costs. Government doesn't just take and redistribute. They need to hire expensive administrators to manage the giving away of money. Drop that £22K down to maybe £16K.

Yes fair point, I'm not a fan of big government either!

Yeah but that is taxed a lot as inheritance tax, for what i understand. so UK would rather tax on your money from work, is that fair or not? the more you are paid, the more you pay. seems fair for CEO paid millions, but for 42K (is that it?) to pay 40% is quite a lot.

Yes most tax is from work and income, although when it comes to CEOs you have to ask what it is they actually do, most of them are just there because of privileged access to networks based on their private school backgrounds. Most not all.

It could solve so much pain and suffering! For those who prefer visuals rather than numbers, check this out: https://mkorostoff.github.io/1-pixel-wealth/

Thanks for the link, certainly worth a viewing, lots of thought gone into that, got a bit sick scrolling after a while mind!

The rich can certainly afford to pay more tax and the government needs to close the loopholes they use to avoid it. When you see people begging when surrounded by wealth then something is obviously wrong.

I wonder how many people who defend the rich just hope to join them.

I think there's a lot in people wanting to be rich, thinking they have a chance however is largely mistaken!

Tax haven loop holes and more tax transparency methinks!

We always want to tax more. We never want to look into our processes and cut where the money isn't being used properly or the intended effects of the programs for which taxes are stolen.

Posted using Proof of Brain

I'm all for doing that, but I think redistribution has a role too!

They will fly to Dubai!