Is the UK Really a High-Tax Country?

Not for Most Workers!

It's a widespread view that the UK is a high-tax country, but this not really accurate, at least for the average worker.

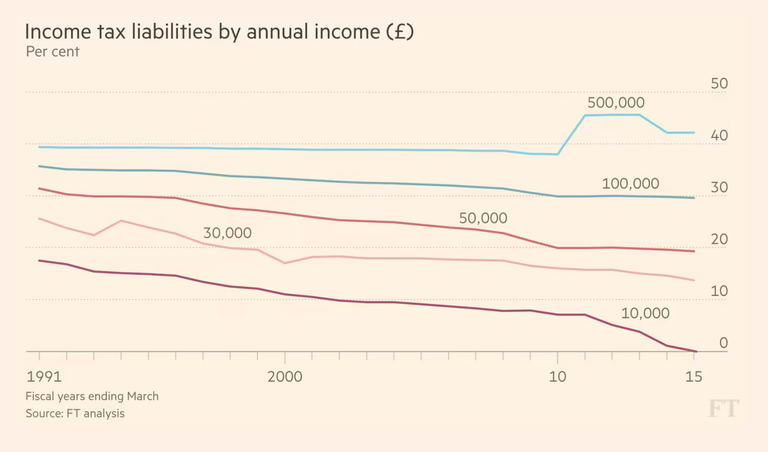

Most Britons have actually benefited from decades of tax reform, with the burden of income tax and national insurance decreasing over the years on the shoulders of average earners....

Twenty years ago, in 1990, a full-time employee on the average wage of £12,000 would have had approximately 28% of their earnings consumed by national insurance and income tax. Today, tax on the average wage of £39 000 (NOTE INFLATION!) is a total of just 19%. And for someone who is paid just half the average, the average tax rate is only 10%.

In comparison, the identical earner two decades ago in 1990 would have shelled out twice as much.

And in comparison to similar countries...?

Typical earners in Australia (25%), the United States (24%), and Belgium (a staggering 40%) hand over far more of their salary to the taxman.

And while British wages might appear lacklustre compared to Germany's, net salaries are another story. Subtract taxes and social security contributions, and the average German worker is left a whole £5,000 worse off than his or her British counterpart.

However, this relatively low burden on middle-income earners is offset by the increasing reliance on high-income earners to fund the UK's public services. Those earning over £70,000 currently contribute 60% of all income tax collected but comprise a small proportion of the population.

More disproportionately, the top 1% of taxpayers contribute 29% of all income tax receipts. In practice, Britain's progressive tax system relies on its wealthiest citizens to finance the welfare state.

This raises an uncomfortable question: should the average worker cough up a little more? With an ageing population, rising pressures on the NHS, and rising social care bills, the sustainability of a tax system where the majority of individuals pay comparatively little is being called into question.

Final thoughts...

Ultimately, then, while Britain may seem a high-tax country on paper, the reality is more ambiguous. For the average worker, the tax burden is relatively low by international standards. But with public services still groaning under the strain of cost, calls may increasingly be made for a broader, fairer spread of tax burden.

Maybe we just need to raise taxes...?!?

Posted Using INLEO

Do you get tax deductions? You can tax people more, but the smarter ones can shape their lifestyle to take advantage of deductions.

The HMRC relies on fear I think... but they can go back up to 20 years to investigate. if you are rich an accountant can save you a bit for sure!

20 years! We only go back 7. I thought that was excessive.

mm, but housing costs are increasing all the time with lots of under 35s priced out the market; living costs have increased, too - families need two wage earners now. Wealthier people have more opportunities to accumulate assets already, without taxing lower waged people more.

We need a wealth tax I think, but that won't be popular!

I was reading somewhere that modernising Council Tax (which apparently was calculated on drive-by estimates) would make a significant difference and preferable to a wealth tax.

Didn't we have much higher top tax rates years ago? Taxing the poor is wrong if they then need benefits to survive. I'm paying a higher rate, but not complaining. There has to be some compromise so you are not driving people away or causing issues with death duties. The stuff with farmers kicked off a fuss, but the idea needs to be sold in the right way. It may get distorted.

I think taxes just need rationalising... it's all too complex, NI/ Income tax should be combined, council tax needs looking at also. What a mess!

NI seems a bit pointless. Each source of income should be subject to one tax.

Don't forget the indirect taxes like N.I. VAT, Fuel duty, inheritance tax, VED, airport tax, capital gains, council tax, investment tax, dividend tax, stamp duty, All these fucking cities with their e zone taxes. I am sure there are more but I have lost the will to live

Yes we are taxed too fucking much !

Try and have a good week lol

And enjoy your council tax going out again after the two month break!

Yup, and the 9.5% increase per month!

https://www.reddit.com/r/Economics/comments/1k2gdql/is_the_uk_really_a_hightax_country/

The rewards earned on this comment will go directly to the people( @dkkfrodo ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.