Interest Rate Rises are becoming a problem!

Around 20 million people aged over 20 in Britain have an outstanding mortgage, that's 1/3rd of adults in the UK and half of 30-50 year olds.

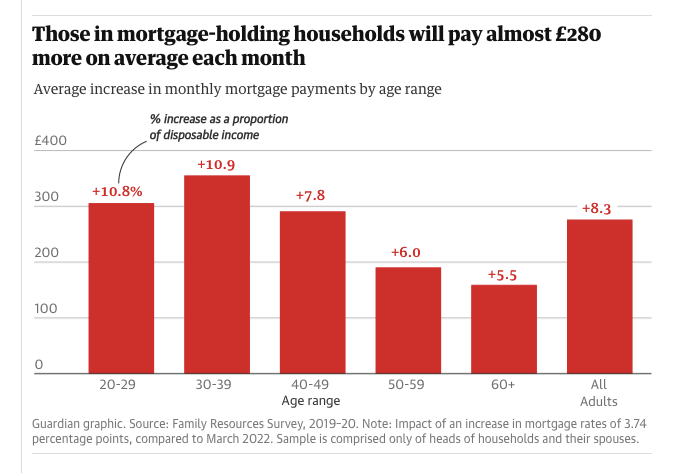

And with the Bank of England interest rates going up to 5% today, to combat the (to them) surprising continued inflation these 20M people are going to paying an average of £280 a month more on their mortgages to cover the increased cost of borrowing.

This is according to some recent analysis from the Institute of Fiscal Studies.

The amount of increase in payments varies somewhat by age, and it hits the youngest harder than the oldest because younger people generally have larger mortgages than older people...

A tale of middle class woe...

This is REALLY going to hit the middle classes with larger mortgages, hard! I mean, and there are case-studies all over the UK news media today of people who are going to have find an extra £500 a month, an extra £800 a month, some people an extra £1000 or more a month when they come off their low fixed-rate deals in the next few months...

I'm more or less OK

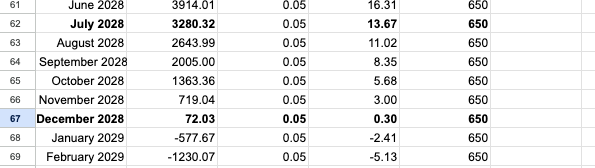

I did some basic math... I personally pay around £650 a month on £37K outstanding, and that's at 2%, and my mortgage is set to come an end by August 2028, only five years to go.

Once that goes up to 5% then I could simply keep my monthly payments the same, when I formally remortgage in September and I'd only have to carry on payments for an extra 6 months, to December, which doesn't sound like too much of a stretch....

Alternatively I could up my payments by around £30 a month that would cover the difference.

Basically I'm fine as long as I can fix below 7% I'm not too affected, it's not a disaster.

I ran the math for a hypothetical £120 000 mortgage (not unheard of, there you're talking about finding an extra few hundred squid a month, which is a bit more of a pain in the ass.

WTF did you expect?

I mean cheap borrowing for private people was never going to carry on forever, especially not with god awful economic mismanagement of the Tories - this is how it always works out, the ordinary people who were mug enough to fall for high debt pay the price in the end!

Quite a few people coming out of their low rates here in for a surprise too. The speed at which rates rose was astounding.

I'm so glad I've got a pretty low mortgage!

As screwed up as America is, at least we have the option of doing long-term locks on mortgages. 30 years is not uncommon, ours is a 15-year.

But still, lots of folks here go with variable rate mortgages where the rates can jump after a few years. Yeah, initially monthly payments tend to be a bit less, but you’re hosed if rates go up.

We have those too - a lot of the worse affected are people in their 30s on 30 yrs. Literally a life sentence!

Well, you can refinance them.

Years ago, I heard about 100-year mortgages in Japan. Don’t know if that’s still a thing. It was long enough ago that it might have been before their real estate bubble popped. I’d guess that, with their declining population, there’s plenty of housing available.

I still have two years left to run on my fixed rate. I was going it will be sort of sorted by then but I'm not so sure as the Tories are fecking everything up so bad that it might get a lot lot worse!

I don't think it's the Tories as such - it's the rise of the global middle class - I'm even thinking of fixing for 5 yrs at 5%. I can't see rates going lower.

Also the chances of getting a return greater than 5% elsewhere are pretty good too so it's a small risk - then again with <£40K it's not a huge stress!

I pity those on large large mortgages. I am halfway through my term and have been overpaying so even when it runs out I shall only have about 50-60K left which isn't ideal but better than a few hundred!

We have fixed interest rate of mortgage in my country. Those who got loan during the pandemic have been very lucky as their installments became cheaper due to the inflation.

My father bought 2 houses from his 2-3 year salaries back in 1970-1980... and he was in a "lower mid-class"... I'm 45yo guy and I didn't buy any... and it's not that I didn't want to buy, or that I spent too much money on expensive things... I hope that crypto will help me to buy one in the next 2-3 years...

But... I don't see any chance for my son to buy his home when we finish his schooling and begin to work... Prices are insane, and it looks like very few people hold a lot of real estate as usually, high prices are the product of a well-established monopoly (not just in real estate, but in other industries too)...

And when you finally get a mortgage and slowly pay it off, some "internally" created crisis occurs and you lose everything... As we all know how inflation works... the prices always go up faster than salaries...

It's a tough one for the young - if I were in my 20s I'd hang on in my parent's house for as long as possible!

The way we saw that our predecessors used to build houses very easily because their income was less but their expenses were also less. They spend more than they earn. There is a crypto with which we can build houses etc.

Do you think that brexit is a big factor in what’s happening in the uk?

It doesn't help but this is probably more global!

I read that the trade from Europe to the uk is down like 20% this make’s goods scarce and that makes them more expensive.

!PGM

!PIZZA

!CTP

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

$PIZZA slices delivered:

@torran(6/10) tipped @revisesociology

It's crucial for policymakers and financial institutions to carefully manage interest rates to strike a balance between controlling inflation and ensuring economic stability. Additionally, it's essential for individuals to be aware of these changes and make informed financial decisions accordingly. Overall, this post sheds light on an important issue and prompts valuable discussions about the broader implications of interest rate increases.

We're in a fortunate positions of having mostly paid off our mortgage. We had it through times of relatively low interest rates. Looks like it dropped a lot after the 90s. 5% is not that high really. The problem is that house prices have shot up. I think the Tories played a part in that. They sold off loads of council houses and have not created enough cheap housing. Housing is a basic requirement and there need to be affordable options everywhere.

In the UK I think it's mainly housing supply, or lack of it! In the context of more people and more of them wanting to live alone!