Holding off to top up my Retirement Pot...

Trump's efforts to induce global financial turmoil (with the obvious intention of making him and his billionaire buddies wealthier) are somewhat annoyingly timed for me.

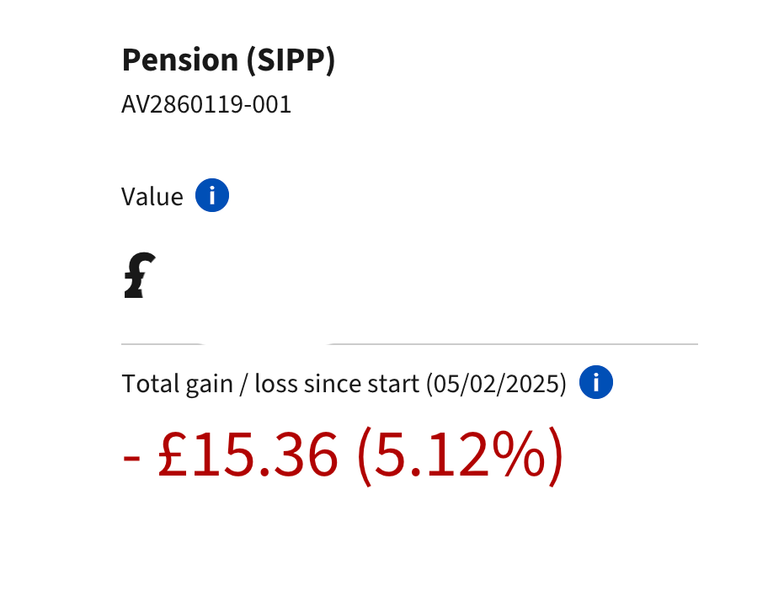

Although really only because I've been itching to top up my SIPP which is mainly stocks for months now, and especially the last couple of months as I've had some spare cash.

Thankfully I've held off, for the most part, I only put in a few hundred squid over the last couple of months, and luckily somehow about a third of that got held as cash anyway, rather than going into the stock fund options....

(The payment system is a bit clunky which explains that, human error, there's no point just that holding cash for no interest, but given that stocks are gonna go down for the foreseeable future it's worked out well, I can just transfer over later.)

Anyway, the market news at the beginning of this week looks like it's a great time to NOT buy stocks, one has to now wait I think until all this tariff fall-out has worked its way out.

I don't think we're going to see too much of a recession, maybe a technical one, but it's only one country, don't forget, and only, what 200 million Americans have enough cash to really be proper consumers, the poorest 40% are just too poor to be significant , that's America.

And there's only so many trainers and cars rich people want.

Meanwhile there's plenty of scope for the rest of the world to take up some of that slack, albeit with some pain.

I think America's mainly gonna get cut of the trade-loop.

But anyway, short term pain to come, for me it means holding off on SIPPING, or buying stocks in a pension wrap and just putting all my spare cash in an ISA.

It's an opportunity...

Eventually I think there will be a time I can start buying, buy the dip, after say a 20% downturn, and then there should be more upside.

TBH it was all looking a bit too pricey recently, which is I why I went gentle on the Vests until now, buying at the top, not a fan of that, but now rather than seeing say a 30% return over the next decade, maybe I'll get a higher one.

Who knows, for now it's OK, who knows what'll be the case by the time I come to cash out!?!?

Posted Using INLEO

Congratulations @revisesociology! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 118000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

no harm in waiting just now, it's all looking very uncertain.

Mr Buffett was bang on the money moving into cash when he did, ppl laughed at him for selling Apple and holding so much cash, but my holding of APPL in my ISA has gone from +20% to +1% since xmas , so who's the fool here !!!

My best performer has been a somewhat shunned stock, dirty old BATS, a nice 7.5% divi paid quarterly, and no drop in value in these turbulent times ( so far ).

BATS has been the only stock I've added to recently, I have taken some profits on others over the last few months, but maybe I should have taken more...c'est la vie, I'll not be panicked out now though, no company fundamentals have changed, just market sentiment, and that is fickle at the best of times

I'll be interested in what my pension adviser has to say next week. We need to ride this chaos out, but there will be many losers. We know who to blame and it's not Liz Truss this time...

I bought quite heavily. Down to 10% cash now in the portfolio, but that's fine. I'm still bullish on the next decade :-D