BTCs declining volatility...?

For the most part it has been a pretty dull year to date for the BTC price...

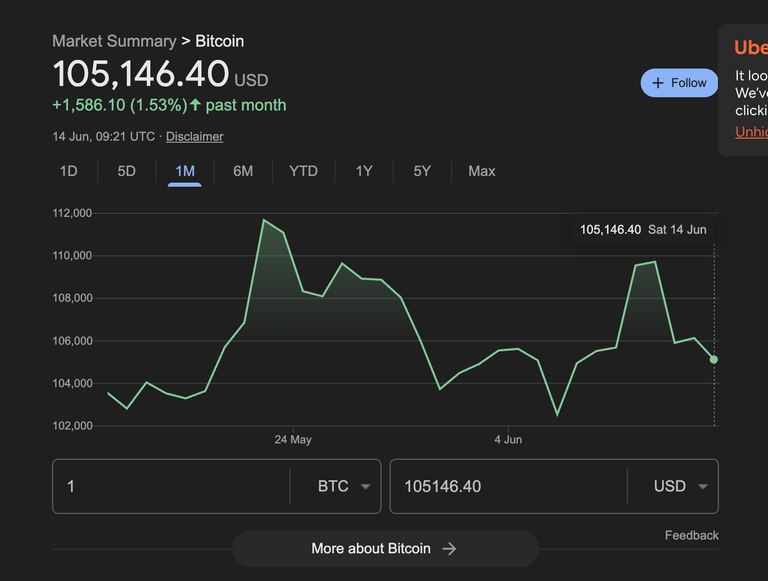

Looking at the last month it's been up and down a little, starting at $104K, going up to $112K, dropping to $102K, and now settling back at $105K

I mean one can't predict these things, but there's been some decent opportunities to trade those lower and upper ranges.

I asked chat GPT how BTC volatility compared to previous months, it came up with this:

I mean I'm not even sure what 1.82% volatility means, something to do with standard deviation, but whatever, the point is I wanted a relative score, and the price is LESS volatile than the previous 30 days and much less volatile than the last couple of years and before.

Something else it threw out was that... BTC volatility now resembles that of risker equities...

I guess that's down to institutional investment.

Why the recent spike..?

That doesn't make BTC immune from degenerative behaviour.

According to Coin Telegraph the reason for the spike in price is a millionaire going long...

I did a little digging around and from what I can tell the guy who opened this position (this is speculation) hasn't done that well on his bets so far, but this is gambling and this time who knows, he might get it right!

Final thoughts...

Based on the above one might be inclined to be a bit bolder and sell more BTC as the price goes up, and then just set buy backs $3-4K lower than one sells for, I mean that's only making 2-3% profit per trade, but in a relatively short time-frame that is perfectly acceptable to me!

Posted Using INLEO

Capturing small profits consistently can indeed be a sound approach in a fluctuating market.

The point of reducing volatility is really fascinating and it's true that the entry of large institutional investors has somewhat stopped the market’s wild swings.