Britain's Public Sector Pension Issue... Too Generous to maintain...?

While I am set to be the beneficiary of one in the not-too-distant-future, public sector pensions are a huge burden on the state, simply because they are so generous and so many millions of people are entitled to them!

Moreover, the disparity between pension rights in the public and private sectors has not only become economically untenable but also morally unjust...

The amounts quoted are stark. The private sector employer pays a average of around 6% of a worker's salary towards their pension, whereas the state pays considerably more:

- 23.7% for NHS workers,

- 28.9% for civil servants,

- and a whopping 35.3% for police officers.

In short, ther is a massive gulf between two halves of the workforce.

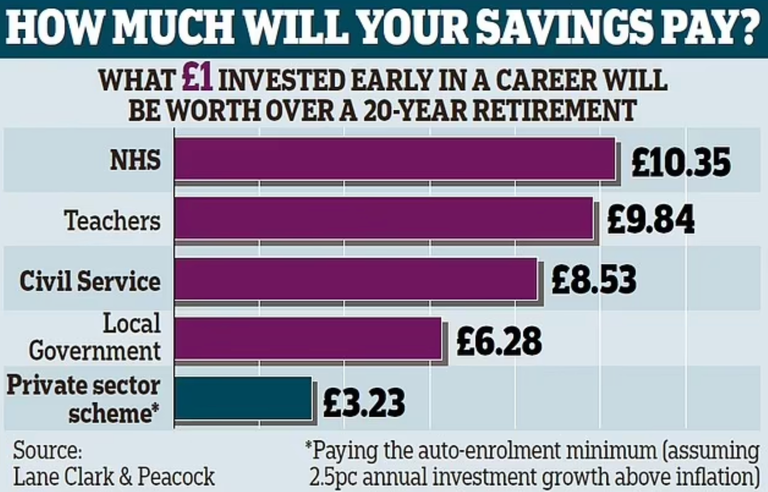

A recent study found that for every £1 put into a public sector pension for an NHS worker, the eventual payout after 20 years of retirement could be £10.35. In the private sector, you'd be lucky to receive more than £4 for the same contribution.

This is mainly because public sector pensions are guaranteed and inflation-proofed, whereas private pensions are at the mercy of market forces and that great wearer-downer: inflation.

Trust me, when I look at my teacher's pension, I'm glad for it, even after only 16 years of contributions, it's a TASTY amount of money to contribute towards my retirement, not enough on its own, but a VERY NICE base amount, and sufficient when the state pension is added!

Previously, generous public pensions were justified on grounds of lower public sector pay, but this arguement doesn't really work anymore. Today, public sector pay has caught up with private sector pay, especially when job security and benefits are taken into account. So why should the private-sector taxpayer continue to support such a disparity?

A £2.6 Trillion Liability!

Britain's public sector pension liabilities are estimated at a massive £2.6 trillion, this is higher than the country's entire annual GDP. And EVERY SINGLE taxpayer is effectively underwriting this regardless of whether they benefit from it or not.

And to make matters worse, the Labour Party plans to award additional above-inflation salary rises to many public sector worker, which threatens to drive this already unaffordable cost even higher.

Unfair to those who don't work in the public sector...?

A two-tier pension system—a guaranteed, state-backed retirement for one cohort, and a scramble to save for another—is socially divisive....

In the private sector those who earn above say £50K per person for a good couple of decades of their working life are probably going to do OK, probably those who earn £40K for a couple of decades, but those on median and especially the rest of 50% of the workforce on less than that who aren't in public sector jobs are going to have tiny pensions contributions, it's not fair that their taxes pay for people like me!

Change coming...

They've already made changes to the TPS, since a few years back they ended final salary pensions, increased contributions and put the age back from 60 to 65 (I'm still in the custhy times group!), and maybe worse is to come, I can't see how we can sustain this otherwise!

These numbers are okay if there won't be high inflation.

Many of those public sector pensions, if not all, are inflation linked. Maybe that's part of the problem!

I agree with you that the huge gap between public and private sector pensions raises serious questions about economic and social fairness.

https://www.reddit.com/r/unitedkingdom/comments/1kx9pwx/britains_public_sector_pension_issue_too_generous/

This post has been shared on Reddit by @flummi97 through the HivePosh initiative.

Hmm... my place gives me double what I put it, so if I add 7%, it totals to 21%. That's good for the private sector. I had no idea about these other percentages.

Us public sector workers do get the decent pension bone at least. Of course some private sector pensions are also very good, sounds like you've got a good deal!

Hi, it seems that working in the public sector in the UK is great in the long run. Nice post, my friend.😀

If you factor in the pension and can hold out for 20 years, it's a good deal!