Ark Invest - Realistic Predictions...?

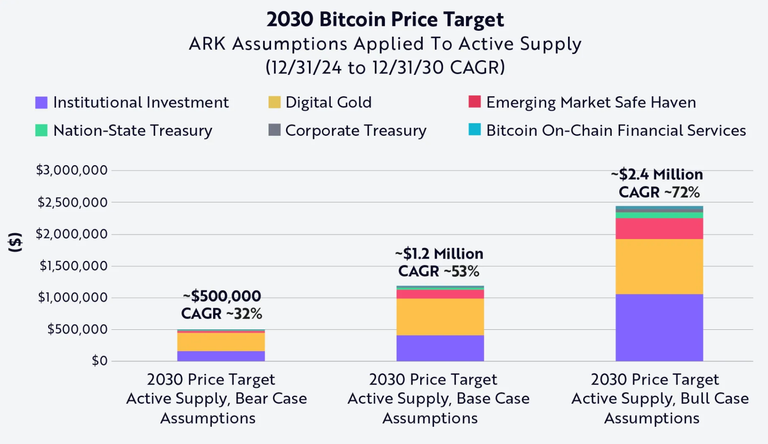

Cathie Wood's Ark Invest recently raised its long-term Bitcoin estimate, opting for a full-on bull-case potential price of $2.4 million per coin in 2030.

This (to say the least) upbeat forecast comes from a new model anticipating strong institutional investment over the next 5 years....

Ark's new model presents three scenarios for the BTC price by 2030:

- Bear Case: $500,000 per BTC

- Base Case: $1.2 million per BTC

- Bull Case: $2.4 million per BTC

What I like about the above breakdowns are the different types of holding, and from this it's clearly people seeking BTC as digital gold and institutions that are leading the way.

Estimates are based on a compound annual growth rate of 32% to 72%, depending on the scenario, which isn't entirely unreasonable based on previous trends...

Institutional Adoption: Who's Buying Bitcoin?

Institutional buying of Bitcoin has grown significantly in recent yeaers , with various institutions adding it to their investment portfolios:

Pension Funds: Wisconsin and Michigan state pension funds have also invested in Bitcoin ETFs, such as BlackRock's iShares Bitcoin Trust and the ARK 21Shares Bitcoin ETF. The State of Wisconsin Investment Board, for instance, held a significant position in BlackRock's ETF, valued at approximately $155 million.

Corporations: Corporates like MicroStrategy have subsequently purchased additional Bitcoin as a strategic reserve asset. MicroStrategy, as of March 2025, held over 553,000 BTC, reiterating corporate treasury diversification into digital assets.

Investor's Business Daily

Investment Firms: Major financial institutions, including BlackRock and Fidelity, have launched Bitcoin-linked investment products, including ETFs and custodial services, to facilitate broader institutional access to the cryptocurrency market.

Barron's

Government Initiatives: President Trump signed an executive order in March 2025 to establish a strategic U.S. Bitcoin reserve, which will enhance the nation's standing in the digital asset market. This move will drive more institutional investment and can serve as a stimulus for global adoption.

Final thoughts...

The path to $2.4 million per BTC is speculation, but the confluence of institutional adoption and strategic action could result in significant growth.

The only problem I've got with this model is the 30% growth target per annum, that's relatively easy to achieve for the next couple of years, but then 30% means ever increasing amounts of money having to find its way to BTC year on year.... like 30% of £100 K means plus £33K in a year, but 30% of £200K would mean plus £66K, that's a hell of an ask....

Source: Decrypt

Posted Using INLEO

Let's see $150k at first :)

Those numbers seem a bit exaggerated..

I think they just depend on a certain amount of money finding a way to BTC..

In a way it's irritating, it's a sign of just how much money there is sloshing around doing nothing!