A few thoughts on our 40% tax bracket, ouch!

I've had a quick look at Labour's Spending Review, and all I can see in it TBH is looming tax rises.... the government's going to be spending more on just about everything and the whole forecast depends on positive economic growth and ABSOLUTELY NO GLOBAL DISASTERS over the next four years.

So unless the government is intending to just default on its debt at some point in the next four years (possibly that's the plan) that means tax rises for most of us.

Too much tax higher up...?!?

The problem here is that the current higher rate of tax of 40% on incomes over around £50K make it quite unappealing (IMO) to earn more....

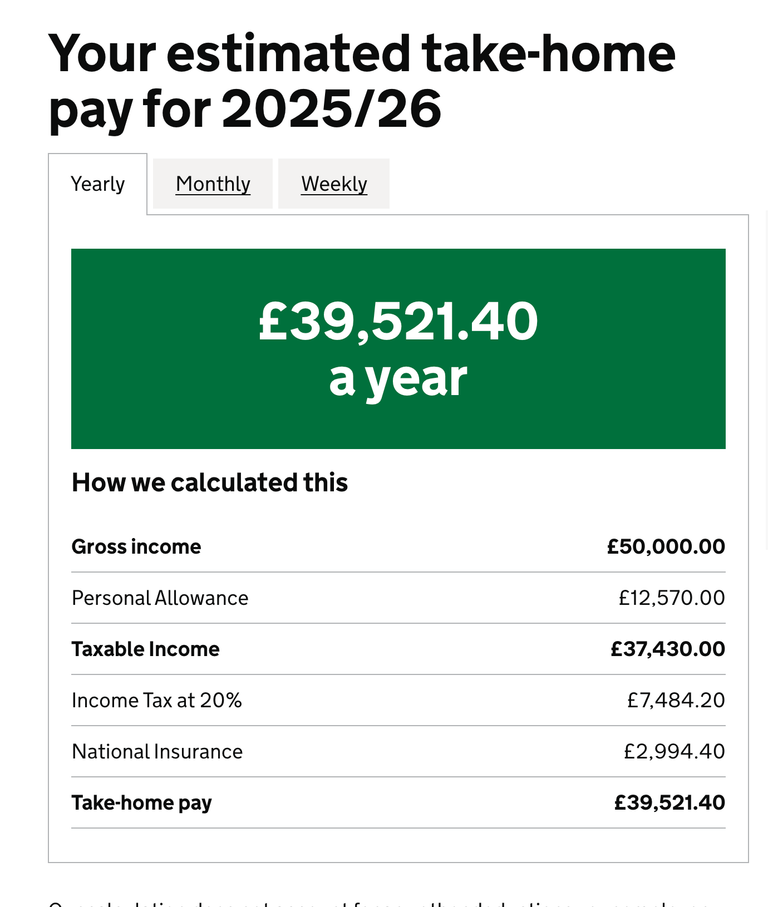

- On £50 000 earnings you'll pay £11K tax and take home £39K, sounds OK!

- On £75 000 you'd pay an additional £9K in tax on the next £25K meaning you'd take home £54K a year

- On £100K you'd take home £68.5K a year.

So in a nutshell, that's double the gross income, but only 2/3rds of an increase net.

While £100K sounds A LOT MORE than £50K.

£68.5K compared to £39K sounds a lot less great! - because you're paying an astronomical £20K extra in tax! Somewhat obviously as 20 is 40% of 50!

I'm looking at this and not seeing much incentive to earn a wage over £50K! And that's a problem where the government's going to be looking to raise taxes, they suck!

Final thoughts...

Personally I'd rather stick below £50K and take an extra day off a week if I was gonna go up into that higher band.

Failing that, I'd just SIPP everything over £50K and claim that 40% tax relief, but they'll probably get rid of that going forwards!

Posted Using INLEO

We pay 42% on anything over 43Kish. It's brutal!

I think If the government doesn't take proactive measures to tackle these challenges, it might end up in a vulnerable situation concerning public finances.

Yep, they're taking away the incentives to work hard or invest. Levelling everyone down to the same common state.

Big businesses and the super-rich can afford to relocate (and already are). Small businesses are being targeted by this government with all kinds of additional regulations and legislation. They're being killed by increased taxes and general costs, so won't be paying as much tax even if they survive, nor will they have the cashflow and margins to expand and create jobs.

So the government will have a choice between defaulting and increased borrowing at higher interest rates. I suspect they'll choose the latter so that they aren't in office when the chickens come home to roost.

You have to think in terms of take-home pay anyway. I don't think that someone on £100k will be working twice as hard as those on £50k. We had much higher tax rates in the 70s, but possibly for a pretty small fraction of the population. It may a bigger problem that things like housing are so expensive now. Have you heard about the Patriotic Millionaires who are happy to pay more tax? There are people with more than they can spend. The government ought to be happy to take their money and not worry about the moaners who will say they will leave the country if they can only afford one big yacht.

There is basically no reason to live in the uk.If you can afford to leave at this point!

Here is the budget of our country and once again 18 percent tax has been imposed on solar systems and a lot of taxes have been imposed on other things like food and drinks, chips, bottles, everything has been taxed.

and that is just the obvious tax, add in the stealth taxes then disposable income decreases further

Personally I'd rather stick below £50K and take an extra day off a week. Very funny friend, you chose a lazy to avoid the tax trap. Anyway it can be a pain on the neck when you realize you are working yourself out to give it back to the government

Anything over 48,320 euros?

=> 50%