Volatility good or bad?

Hello!

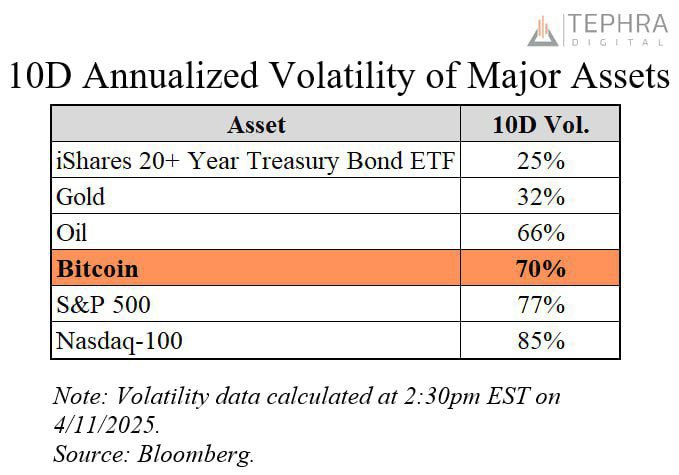

I was reading twitter today and found some information about the 10 day volatility of some major assets. The photo was published by @Eric_BIGfund but the information collected by Tephra digital.

In the photo we can see what has been the annualized volatility for the last 10 days of Gold, Oil, Bitcoin, S&P 500, Nasdaq 100 and iShares 20+ year treasury bond ETF.

Here you have the information:

As you can see, the S&P 500 and the Nasdaq 100 had experienced more volatility than Bitcoin. This is a huge milestone, in the past when there was uncertainty in the markets Bitcoin corrected more than the S&P 500. This time was different.

Some people are talking about the decoupling of Bitcoin from the S&P 500 and the move towards a safe heaven asset. Of course we all know that Bitcoin is a safe heaven asset, but the market still don't believe it.

It will be a gradual transition, over time Bitcoin will be viewed as the place to move when there is uncertainty, just like Gold, it will get a bunch of capital looking for safety.

Fair Bitcoin price?

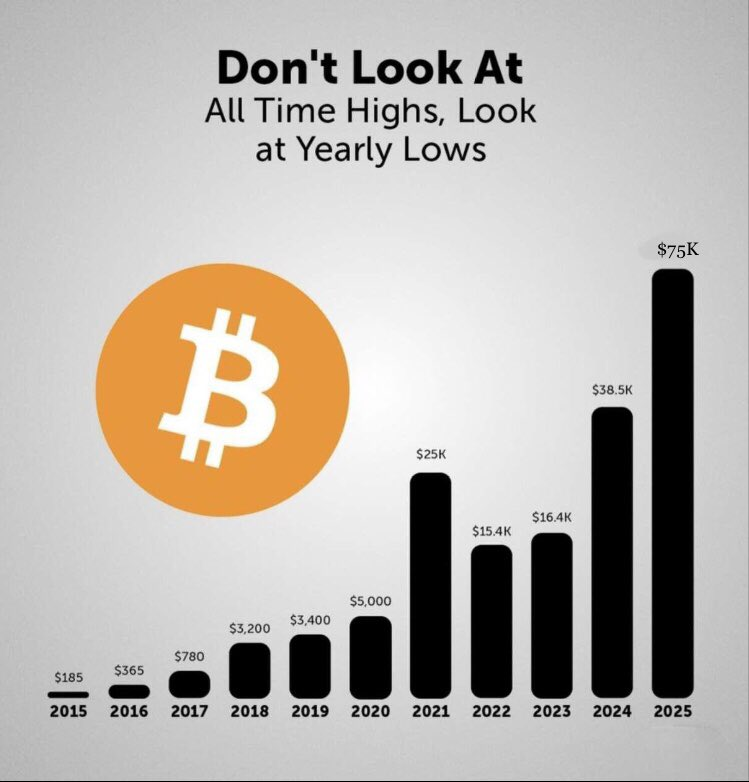

What is the fair Bitcoin price? Well, the twitter user @Kluckies_ published a chart with the yearly Bitcoin price lows since 2015. The Bitcoin price lows are a good indicator to see that the Bitcoin price is trending upwards. A lot of people say that looking at the Bitcoin lows instead of highs is a better way of measuring the Bitcoin network success.

Here you have the chart, it's easy to see where Bitcoin is trending:

Sometimes you just need to chill and relax. The most difficult part of the journey is to not make stupid moves. This has been specially true for those hodling Bitcoin. You just have to sit and wait. But that is specially difficult.

I hope you have a great week!

Posted Using INLEO