Using Lombard and Aave Combo For More Katana Krates

I am not that smart to combine DeFi protocols like this, so all the credit for this experiment goes to my fren' Travis and his big crypto brain! I used Lombard and Aave to get more Katana Krates ... and the results are awesome!

Katana is a new DeFi-native Layer 2 blockchain incubated by Polygon Labs and GSR, designed to unify liquidity and deliver sustainable yields. It launched the private mainnet at the end of May, while the public mainnet expected by later this summer.

Why the Hype? There will be a mix of unified liquidity, high yields and institutional support! Katana aggregates liquidity from multiple protocols, including Morpho, Sushi, and Vertex, to reduce slippage and provide more predictable lending and borrowing rates.

The alpha is given by the yields! By concentrating liquidity and collecting yields from various sources, Katana aims to offer higher and more consistent returns for DeFi users.

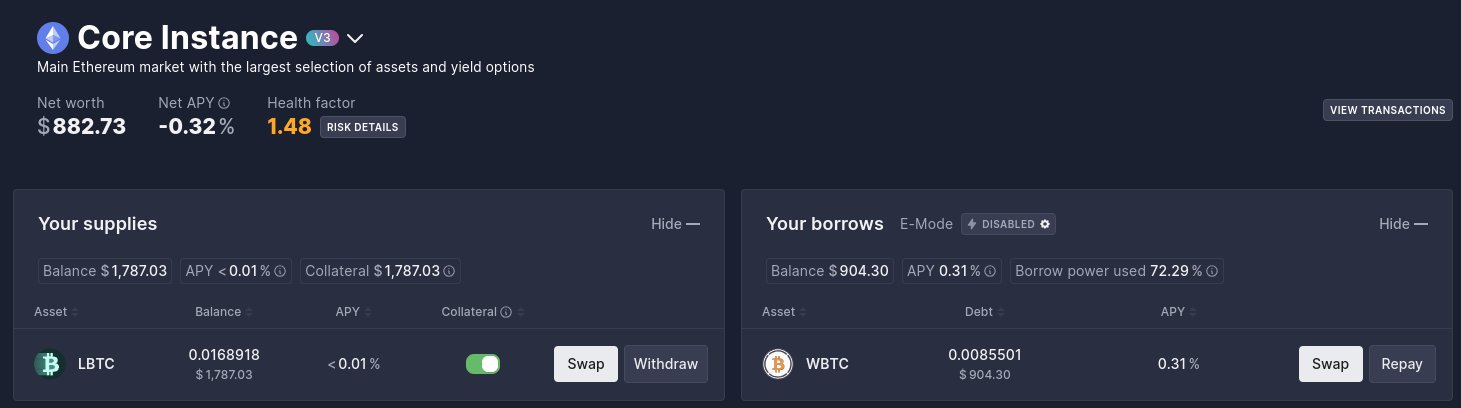

So here’s how I’m farming points across protocols while keeping things tight on risk and yield. I got LBTC from Lombard and then went to Aave, where I deposited the asset as it's accepted as collateral.

I went with LBTC because it earns a multiplier in the Lombard points campaign. Double DeFi utility in one go, securing my Aave loan and stacking Lombard points.

Lombard Finance is one of the leading liquid staking protocol for Bitcoin, offering users a powerful way to earn yield and access DeFi with their BTC. At its core is LBTC, a liquid staking token that’s pegged 1:1 to Bitcoin.

Users stake $BTC and receive LBTC, which allows them to earn staking rewards while using their Bitcoin across various DeFi platforms. Lombard rewards active users through its Lux points, reflecting engagement and unlocking special perks over time.

Once the collateral’s in you could scout for an asset to borrow. Look for something that’s accepted by Katana and has a low interest rate. I picked WBTC, currently sitting at just 0.32% APY. That’s insanely low, like $0.25 per $1,000 borrowed if you only hold it for a month.

I then borrowed WBTC and deposited on Katana or whatever you’ve chosen. Keep in mind to pay close attention to your risk factor. This is tied to your collateral ratio on Aave, the difference on how much you’ve borrowed compared to the value of what you’ve deposited.

Keep it healthy because liquidations aren’t fun. Now, here’s where it gets interesting! WBTC and LBTC are essentially the same underlying asset, so you're minimizing volatility exposure. You're borrowing one version while collateralizing the other, creating a kind of stable loop.

Once you’ve got the borrowed asset in your wallet, deposit it directly into Katana. You’ll start farming points for their upcoming launch. My first two krates were god-mode, with 165 $KAT wrapped in the shiny boxes!

The Katana is expected to TGE this June, so the deposited assets will be locked until Katana and $KAT go live. Once they do, you’ll be able to claim your earned points, potentially rewards, and also repay your borrowed tokens on Aave.

Or... if Katana launches more DeFi features or campaigns... you might just want to keep playing and rolling with it. That’s the move. Smart yield, minimized risk, and multi-protocol farming.

The pre-deposits reached $113 mill so there's a big focus on the chain. My current pre-deposits reached $1800 in $ETH, $USDC and the freshly added $wBTC! Earned 13 krates and the tracked referrals got 15 as well! It's $KAT time!

Residual Income:

Claim your Zerion XP!

Sonium: Sake Fi / Kyo / Arkada / Algem / Untitled Bank

AI Agents & Mindshare: Kaito / Newton / Humanity / Theoriq / FantasyTop

Play2Earn: Splinterlands & Holozing

Succes in continuare!

!BBH

Katana looks cool.

!BBH !ALIVE

Katana for my Samurai!

!BBH

!BBH

!BBH