Milky Way mPoints - Celestia ($TIA) DeFi, Leverage, Vaults, And Beyond

This weird journey in the Cosmos ecosystem started when I was one of the 576,653 addresses meeting the criteria for the Celestia Genesis Drop. The new modular data availability network that securely scales with the number of users was ready to storm the Cryptoverse.

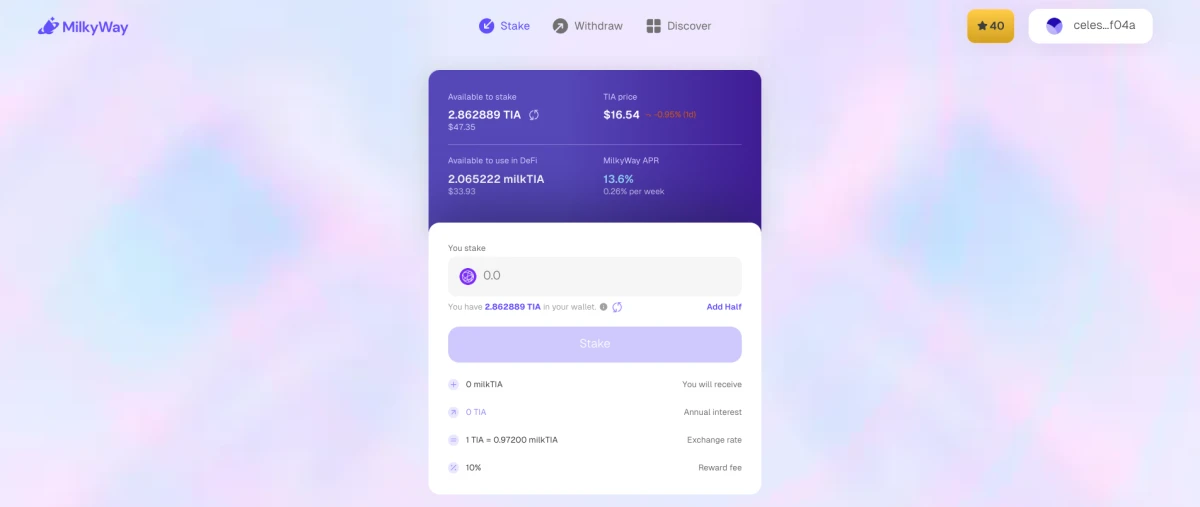

Keeping in mind that my previous interaction with the Cosmos ecosystem was null, I had to read and take on-board a huge amount of information. I had to explore what other options and earning opportunities I can explore with $TIA ... and this is how I discovered MilkyWay! I dived into $milkTIA, as an option where I could stake my assets while retaining liquidity.

Let's enjoy a glass of milk while we chat about this! You can stake $TIA tokens on MilkyWay to mint $milkTIA, a liquid staked derivative that you can then use as you wish! You can dive into DeFi with liquidity pools on Osmosis, where the $milkTia/$TIA pool has has deep liquidity and good rewards. Or you can check Quasar Finance where the dynamic S+ vault has a stablecoin oriented concentrated liquidity pool!

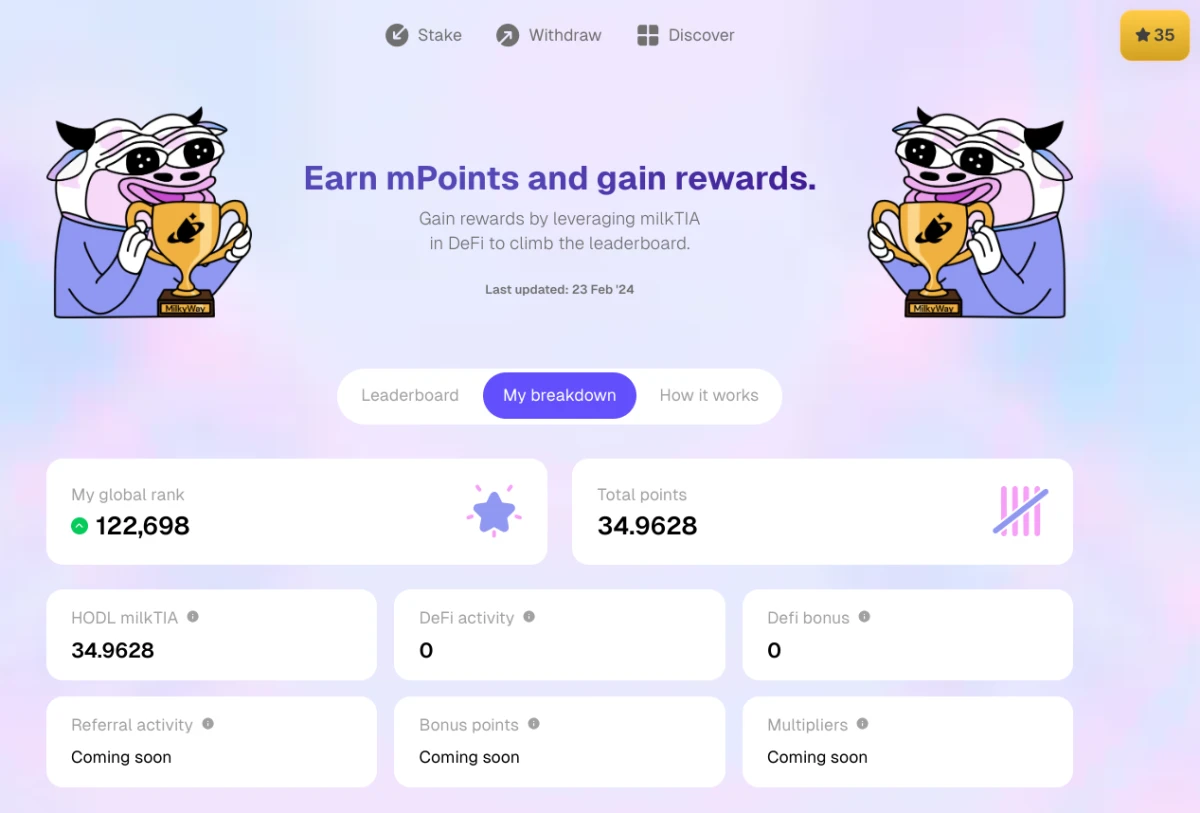

The most important part is this... Earn mPoints and gain rewards. Gain rewards by leveraging milkTIA in DeFi to climb the leaderboard. MilkyWay announced a point system that will lead to the $MILK airdrop. I staked $TIA for $milkTIA to have an early start and used the farming rewards for the cross-wallet strategy.

How mPoints Work? Earning them is straightforward! Whether you're holding milkTIA, using it in liquidity pools across the ecosystem, or lending... you'll be milking points. Holding milkTIA accrues mPoints, added after daily snapshots!

The math is simple, for each milkTIA you hold, you will accrue 1 mPoint on a daily basis. There is no minimum amount required, but the milkTIA has to be on the Osmosis chain, which is where it’s minted, in order to be eligible. I had 2.86 milkTIA staked on MilkyWay and accured 40 points so far. I feel this is not good enough, as 122,698 in the global rank is a laughable position.

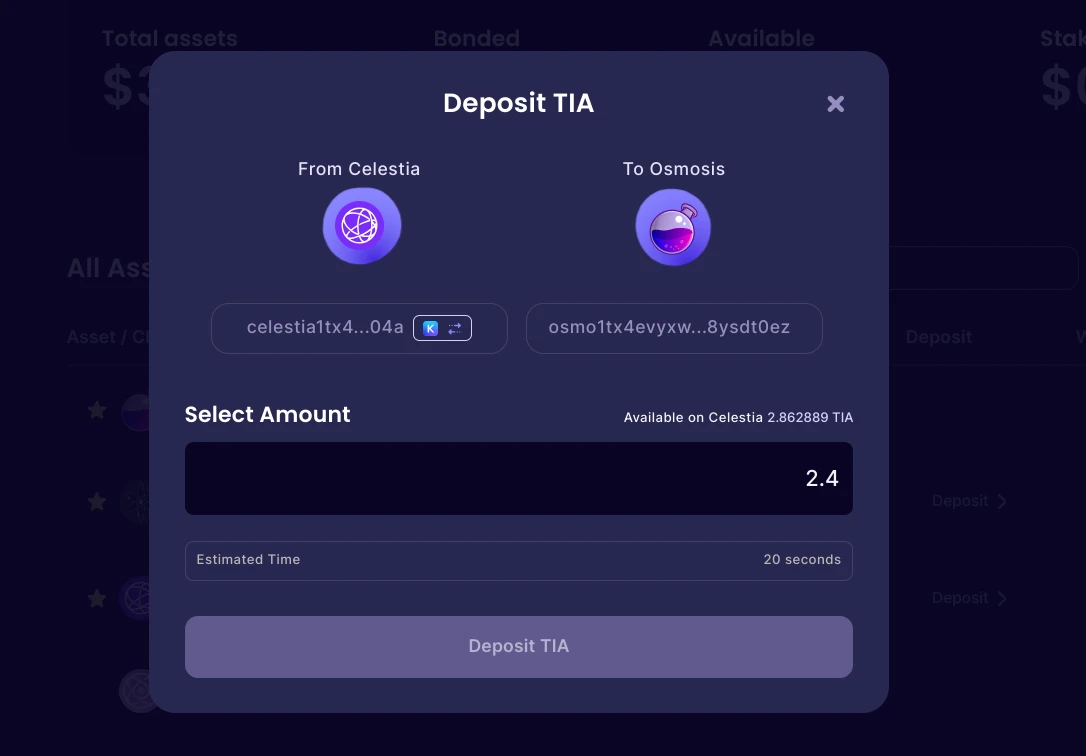

Therefore I moved more $TIA to Osmosis, and looked for DeFi options to boost my MilkyWay points. Putting your milkTIA to work accrues more points than merely holding milkTIA. Currently, milkTIA is compatible with Osmosis, Levana, Mars, Demex, Quasar, and Margined.

Daily snapshots will be taken of your milkTIA that are working merrily at these protocols on your behalf, and each token in the whitelisted set of protocols will accrue at least 1.2 mPoints per day. It's time for a big glass of DeFi milk and some yield cookies!

Multipliers are awarded per week based on your ranking in the leaderboard. The higher your ranking, the higher your multiplier. All multipliers are only applied at the end of this season of mPoints.

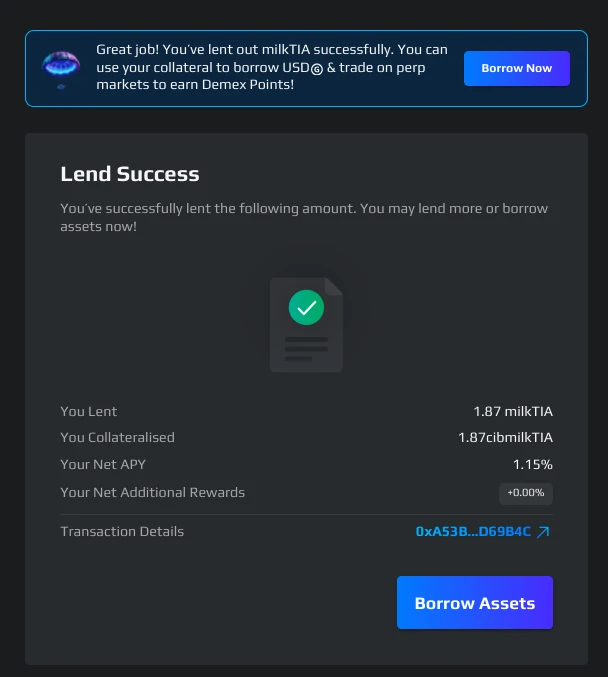

Then DeFi is the way... as will generate more points. I landed at Demex, and let out milkTIA succesfully. I could use it as collateral to borrow USD, then trad on perp markets to earn Demex Points... but we all know that PVM is a bad trader!

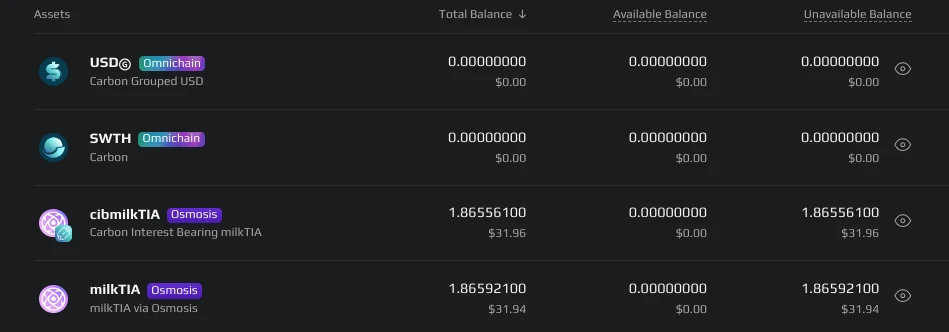

Supplied 1.87 MilkTIA at Demex for some small APY and the opportunity to earn MilkyWay points. The dashboard shows two assets, milkTIA and cibmilkTIA as the Carbon Interest Bearning Milk TIA. All this is too complicated for my simpleton mind!

Let those points accumulate at 1.2 milkTIA per day, earn some multipliers and climb the leaderboard. There's a not saying that "The mPoints system's mechanics, including point calculation and distribution, are flexible and likely to evolve, ensuring equity in the ever-changing DeFi world". Does this mean that points can be slashed or the rewards could take into consideration some other aspects?

Wen token? The MilkyWay mPoints System will be in full swing throughout early 2024, with an airdrop of 10% of the total supply planned for mPoints holders at TGE. The "Put your assets to work and accomplish so much more with leverage, vaults, and beyond." powers my crypto ethics so more options to explore.

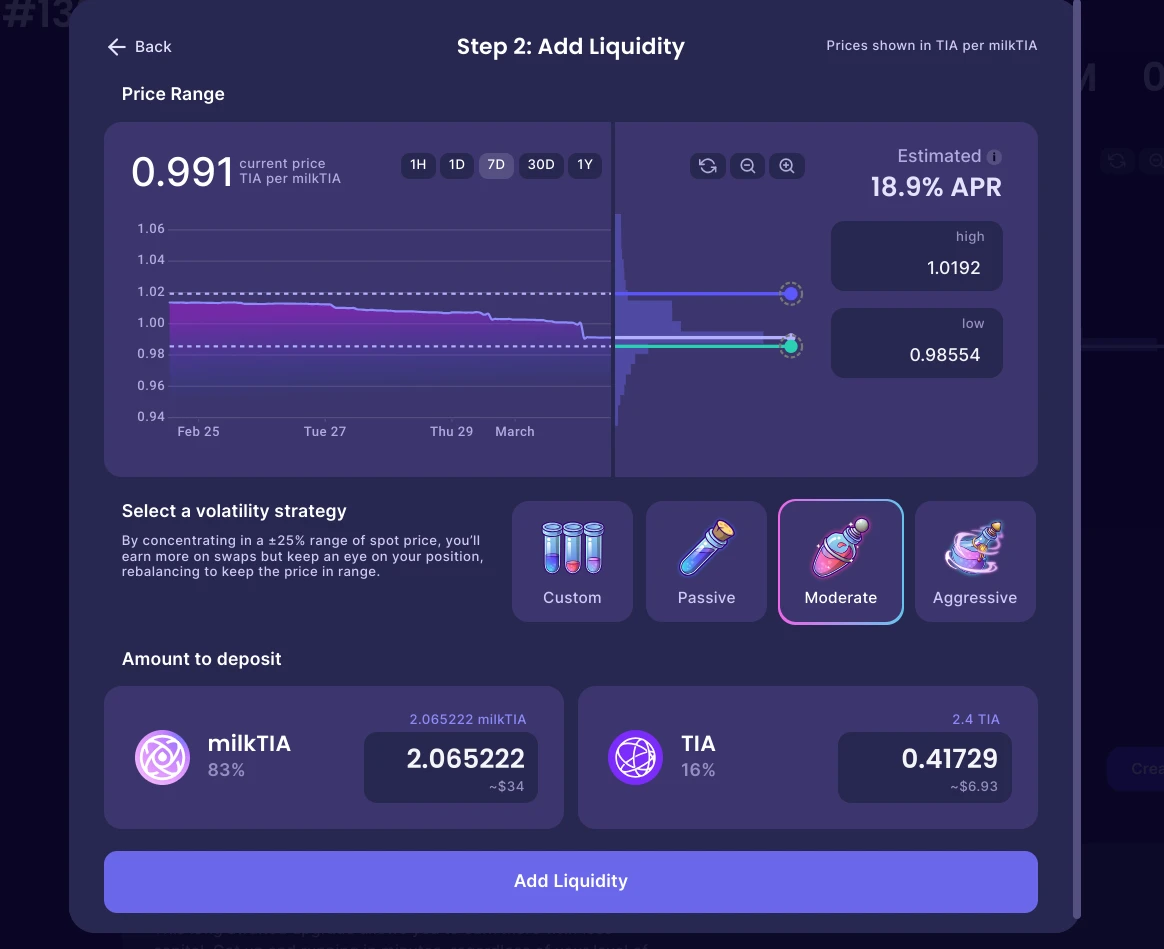

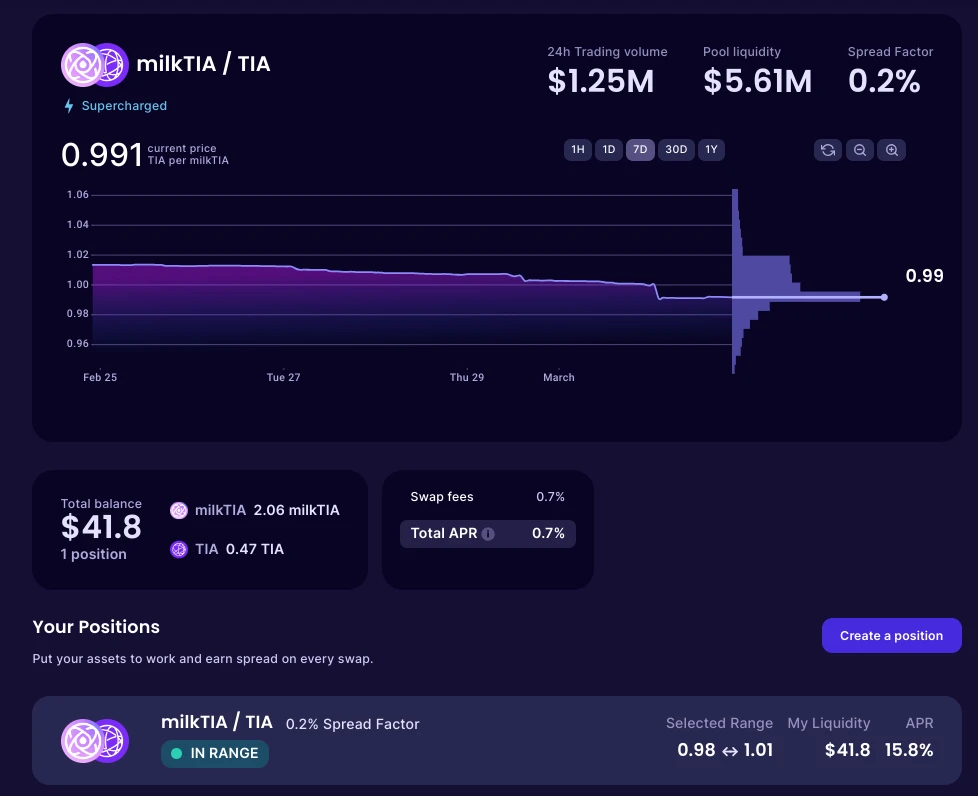

I seen that I could provide liquidity on Osmosis, in a MilkTIA - TIA superpool! The estimated APR was 18.9% plus the bonus mPoints earned for supplying the LP. By concentrating in a25% range of spot price, I will earn more on swaps but also enjoying the rebalancing of the pool.

The recommended 25-75 volatility choice was in fact 83% in MilkyTia and 16% in $TIA... but where's 1% gone? My pool balance was $41.80, with perpetual gains from swaps and daily points.

No idea how the 0.98 - 1.01 selected range affects my gains and APR percentage, as the effort is for a higher goal! I want bottles of $MILK... no... I want barrels of $MILK! Let the milk pour and all the kittens feast upon this airdrop!

Residual Income:

Games: Upland / Splinterlands / Doctor Who

Cashback Cards: Plutus Card / Crypto.com

ZCash: PipeFlare / GlobalHive

Publishing bundle: Publish0x, Hive & Presearch

PVMihalache The Author — My Amazon Books

GrillApp — New Write2Earn Dapp

Claim Your Mode Network Points

Post voted 100% for the hiro.guita project. Keep up the good work.

New manual curation account for BEE and Cent

need to check them too, to see what is happening there.

Not enough time for it!

!ALIVE !BBH

@pvmihalache! Your Content Is Awesome so I just sent 1 $BBH (Bitcoin Backed Hive) to your account on behalf of @heruvim1978. (5/50)