Fixed income

Today I will talk about another fixed income ETF related to inflation and comparison with variable income The profitability of this ETF over the analyzed period of 2 years practically equaled IBOV, having performed above it for some months.

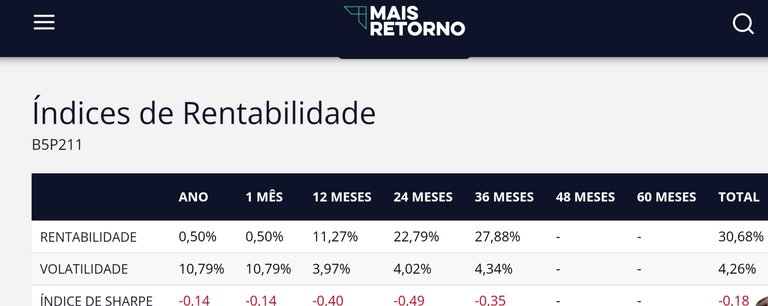

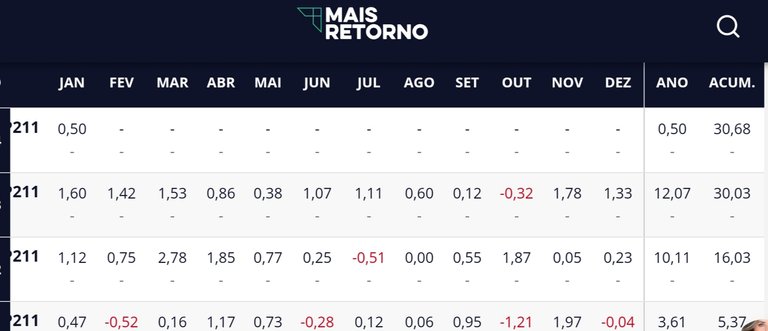

Images from the website https://investidor10.com.br/etfs/it-now-b5p2/ Acronym: B5P211 Type: Backgrounds IT NOW B5P2 is a fixed income ETF that replicates the IMA-B 5 P2 portfolio, a segmentation of the IMA-B subindex, both calculated by Anbima. Itaú Unibanco is the manager of the B5P211 fund, created in 2019. The management fee is 0.2% per year.

The IMA-B 5 P2 belongs to the IMA index family – ANBIMA Market Index, which represents the evolution, at market prices, of a theoretical portfolio similar to that composed of Brazilian domestic public debt. To portray the variety of existing securities, the IMA is subdivided into four sub-indices, including the IMA-B, from which the IMA-B 5 P2 is segmented. This subdivision considers NTN-Bs securities (National Treasury Notes – Series B or IPCA+ Treasury with Semiannual Interest) with maturities of less than five years and control of an average portfolio renegotiation period of at least two years.

The B5P211 fund is made up of NTN-B public bonds plus an interest rate https://www.infomoney.com.br/cotacoes/b3/etf/etf-b5p211/ Images from the website https://maisretorno.com/etf/b5p211

"Disclaimer: This post about my stock picking setup is for informational and educational purposes only. It does not constitute financial advice. All investment decisions should be made after research and consultation with a qualified financial professional. Past performance is not indicative of future results. I am not responsible for any decisions made based on the information provided in this post."

Renda fixa

Hoje vou falar sobre outro ETF de renda fixa relacionado a inflação e comparação com renda variável

A rentabilidade deste ETF no prazo analisado de 2 anos praticamente igualou o IBOV tendo alguns meses performado acima dele.

Imagens do site https://investidor10.com.br/etfs/it-now-b5p2/

Sigla: B5P211

Tipo: Fundos

O IT NOW B5P2 é um ETF de renda fixa que replica a carteira do IMA-B 5 P2, uma segmentação do subíndice IMA-B, ambos calculados pela Anbima. O Itaú Unibanco é o gestor do fundo B5P211, criado em 2019. A taxa de administração é de 0,2% ao ano.

O IMA-B 5 P2 pertence à família de índices IMA – Índice de Mercado ANBIMA, que representa a evolução, a preços de mercado, de uma carteira teórica semelhante à composta pela dívida pública interna brasileira. Para retratar a variedade de títulos existentes, o IMA é subdividido em quatro subíndices, entre eles o IMA-B, do qual o IMA-B 5 P2 é segmentado.

Esta subdivisão considera títulos NTN-Bs (Notas do Tesouro Nacional – Série B ou Tesouro IPCA+ com Juros Semestrais) com vencimentos inferiores a cinco anos e controle de prazo médio de repactuação da carteira de, no mínimo, dois anos. O fundo B5P211 é constituído por títulos públicos NTN-B acrescidos de uma taxa de juros

https://www.infomoney.com.br/cotacoes/b3/etf/etf-b5p211/

Imagens do site https://maisretorno.com/etf/b5p211

"Disclaimer:

Este post sobre o meu setup para escolha de ações é apenas para fins informativos e educacionais. Não constitui aconselhamento financeiro. Todas as decisões de investimento devem ser feitas após pesquisa e consulta a um profissional financeiro qualificado. O desempenho passado não é indicativo de resultados futuros. Eu não me responsabilizo por quaisquer decisões tomadas com base nas informações fornecidas neste post."

Gif by @aleister

Gif by @aleister

All photos by @pataty69

Gif by @doze

Obrigado por promover a comunidade Hive-BR em suas postagens.

Vamos seguir fortalecendo a Hive

If it's running pretty close to the same it's tough to really be making any gains in those ETF's. I prefer dividend payers personally, but do have a few ETF's that perform pretty well. As I get closer to full retirement I want more passive income!

!DHEDGE

I love dividend payers too. Dogs of the Dow is an interesting strategy if you haven't checked it out.

Thanks, I just checked it out. I'll have to spend some more time over there. You can't beat great dividends!

!BBH

@captaincryptic! Your Content Is Awesome so I just sent 1 $BBH (Bitcoin Backed Hive) to your account on behalf of @thebighigg. (15/50)

This post has been selected for upvote from our token accounts by @thebighigg! Based on your tags you received upvotes from the following account(s):

- @dhedge.bonus

- @dhedge.leo

- @dhedge.pob

@thebighigg has 7 vote calls left today.

Hold 10 or more DHEDGE to unlock daily dividends. Hold 100 or more DHEDGE to unlock thread votes. Calling in our curation accounts currently has a minimum holding requirement of 100 DHEDGE. The more DHEDGE you hold, the higher upvote you can call in. Buy DHEDGE on Tribaldex or earn some daily by joining one of our many delegation pools at app.dhedge.cc.

Thanks for the information. I'm recently retired and looking for options to continue investing. Fixed income ETFs look like an interesting option, but I would think you need to be pretty savvey to be able to be sure the ETF isn't just paying you out of what is coming in.

Your post was manually curated by @CrazyPhantomBR.

Delegate your HP to the hive-br.voter account and earn Hive daily!

🔹 Follow our Curation Trail and don't miss voting! 🔹

Yay! 🤗

Your content has been boosted with Ecency Points, by @pataty69.

Use Ecency daily to boost your growth on platform!