Exploring ICP | #1 - Centralized Exchanges vs. Trading On-Chain

I have been asked to detail some use cases for ICP and what swayed me to become so interested in the project. The initial focus was finding a safer and reliable way to swap and trade!

Centralized exchange nightmare hour

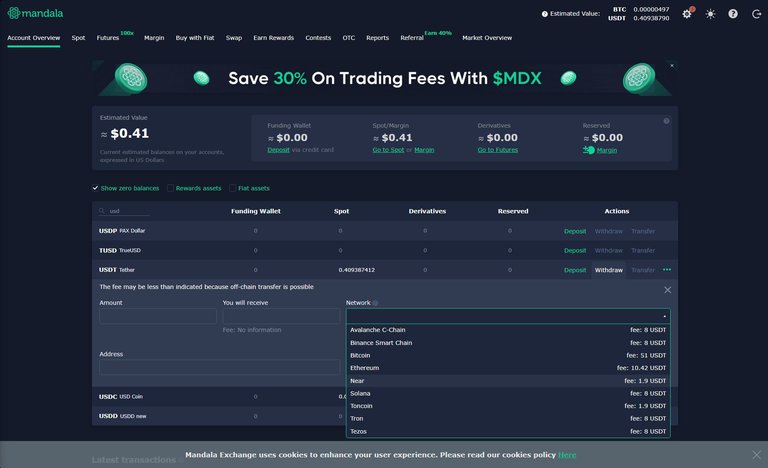

A while back I saw an opportunity in a long-term trade, but as you may know you always need some kind of platform to trade on. Having no interest to “register” a full account with any exchange, my options were really limited. I did in the end opt for Mandala exchange, that - in theory - requires no verification for daily withdrawals less than 1k dollar.

And everything looked good initially... that is until I actually tried to withdraw my funds. Then everything became quite difficult suddenly.

Customer support would not tell me any reasons, but my withdrawal attempt had been shut down. Got a notification saying "account withdrawals are suspended". I seriously felt robbed, ahahaha. One customer agent replied that the withdrawal amount may be “too high”. So I guess the 1k were a lie then, ok fine! He said I could try again, maybe with a lower amount. Went down to 600, but nope. Got blocked again for a day, had to write another email to them.

They replied: “Dear customer, Your account withdrawals are unfrozen again.”

WELL THANK YOU VERY FREAKIN’ MUCH!

Guessing in the dark what the king specifically wants from you, right?

In the end I had to go below 400 dollar withdrawal to finally be “allowed” to withdraw my funds again. No reason given, no further explanations offered.

I simply counted this as the universe’s good will to not completely take the funds away and stuck to that limit for a few days until everything was off that damn exchange eventually.

The dirty thing about it is that withdrawal fees are really high also, with the cheapest option being the ETH layer 2 chains like Arbitrum or Near. Still, ONE withdrawal would “cost” nearly 2 dollars. With a maximum actual withdrawal of 400 dollars. That is a 0.5% unexpected extra loss just to get the funds out of the damn exchange again. What a scam ahaha.

Note, they also have the nerve now to ask for cookie permission to "enhace your user experience". ahahaha. Yeah you guys know all about user experience alright...

At any time they could have just decided to freeze my funds completely and force verification in order to unfreeze my funds. In the end I considered myself lucky to be able to withdraw all funds, spending another 0.5% to the exchange on the total capital for no service other than restricting my daily withdrawal limit for no apparent reason.

What an affront ahahaha.

Long story short: As customers we are at the whim of these centralized behemoths. If their algorithm decides something, if anyone at the exchange decides something – you are screwed. That is because you have given away your funds, in order to trade with them some place.

And this is precisely why on-chain trading can be so beneficial – like ICP allows.

On.chain swapping & trading

Different swap services exist on the ICP ecosystem that leverage the power of the internet computer to swap and trade cryptocurrencies without ever giving away control of your funds.

Considering the scenario mentioned above, it is pretty hard to overstate what an advancement this is. It means that when you finally have your funds on the ICP network, locked away behind your own cryptographic keys, they cannot be taken from you on a whim by a third party.

Chain-fusion

ICP has fully integrated both the BTC and ETH ecosystems, natively.

This means you can send BTC to your respective BTC address tied to a smart contract on ICP that only you have control over. The BTC remains on the Bitcoin network layer 1, but since that BTC address is tied to a smart contract you could mint it to ckBTC on ICP (“ckBTC” stands for chain-key Bitcoin). 1 ckBTC can always be converted back to 1 “actual” BTC.

Using ckBTC on ICP has several advantages. You pay next to no fees to send it places, you can trade it against stablecoins, against ckETH or ICP itself, and you get finality of transaction in under 2 seconds. Boom!

ICP in this way can be used as a layer 2 for BTC or ETH. But not just one or the other: It is both at the same time and all of it is fully on-chain and never leaves your sphere of influence. I think they have integrated dogecoin, and are working on Solana next.

You will no longer need bridges nor individual layer 2 chains like Arbitrum, Polygon or Optimism because ICP offers all that natively.

DFINITY calls it blockchain singularity.

Since the ICP ecosystem allows people to build on-chain there are different swap and trading platforms, many come with their own terms and conditions. I read that KYT (know your transaction) is also something dexes on ICP practice, meaning that if you own Bitcoin from a known “criminal” source, it can be automatically frozen as the coins are “tainted”. I never had that happen though.

The platform risk in using centralized exchanges has entirely vanished since trades take place on the same blockchain, and are sent within 2 seconds. It’s pretty comparable to trading hive engine tokens against swap.hive, or even Hive against HBD – because it’s all on-chain and you never have to send your funds anywhere dodgy in the meantime. Only on ICP you can truly swap from one chain to another and then send funds on its respective layer 1 without friction.

Initial experiences with ICPswap

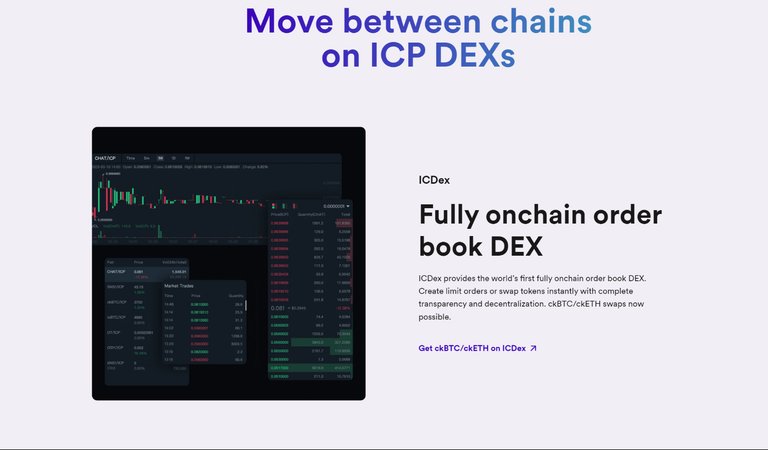

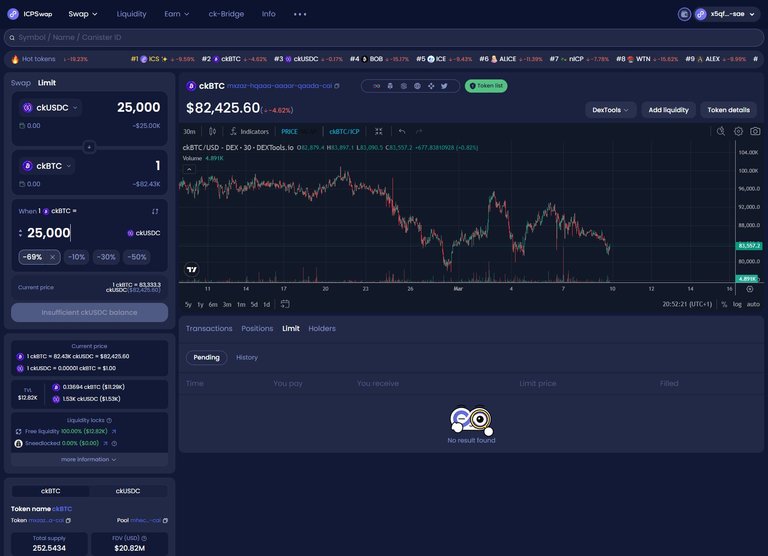

Dexes like ICPswap work like a charm, and it effectively means I can trade stablecoins for ICP on-chain! Not only that, they have also integrated a limit order feature! In this example setting a limit order for ckBTC at the price of 25k.

I am not limited to swapping at market price any longer, I can instead set a limit order as I would on a centralized exchange, and have it execute when the price reaches that level. Because I am effectively providing liquidity now, instead of paying for trading fees, I EARN trading fees. You know, the fees places like Binance never give back to their users.

On ICP that can all be decentralized and spread around to on-chain market makers, rather like it should be.

Moreover, I do not have to rely on a centralized exchange to accept my orders when the market is tanking and the Binance servers go bananas again, refusing deposits, withdrawals or even plain limit orders for the sheer volume of data coming in at once. Instead I can set my orders on ICPswap and wait for them to execute, including a near-pro-level trading interface and steadily gaining trading volume as more people become aware of the tech.

To any BTC trader this is amazing news.

It means you could trade BTC-USDC fully-on-chain and would never have to trust a centralized exchange again. There is also a pro-mode interface more reminiscent of typical trading interfaces.

ICPswap does not offer stop loss settings at the moment but they are constantly innovating and I would hope that is coming eventually. It's sort of a necessity for any serious trader.

Once people find out about this, and the daily trading volume becomes larger, there really will be no more reason to ever give your assets away in order to trade them. But it's still early and nobody cares about ICP yet, so there is that ;)

ICPswap also offers liquidity pools for those willing to provide liquidity for others to trade, with great APRs, earned from market takers' trading fees spent. But it is merely one of several places on ICP where trading has been "democratized" radically, ICPswap is not the only service. It just worked really well for me thus far.

To me, this model is clearly where we are headed in the long run - the more hacks occur in the archaic web 2 architecture and the more people are fed up with the constant platform risk looming over their assets.

Not your keys, not your BTC. It’s just that ICP takes this much, much further.

interesante!