Can Bitcoin Finally Take Off?

After days of fluctuating prices, Bitcoin has managed to climb above the $91,500 mark once again. This represents a strong signal for the market, but investor skepticism remains high. According to the Crypto Fear & Greed Index, the market is still gripped by "Extreme Fear," with a value of 25, despite Bitcoin's 5.7% recovery over the last 24 hours. This illustrates the cautious approach many investors are taking, even in the face of a recent price surge.

Source

The $91,500 Mark: A Crucial Threshold

Experts like Michaël van de Poppe consider the $91,500 level to be a crucial point for Bitcoin. He emphasized that a sustained breakthrough of this threshold could pave the way for a new all-time high. The previous record was set at $109,000, just before Donald Trump's inauguration in January. However, uncertainty remains in the air. While some traders believe that this marks the beginning of the next rally, others still see unclear signals.

The upcoming US Crypto Summit on March 7th could be a critical factor for the short-term development of Bitcoin. The summit will feature members of the President’s Working Group on Digital Assets discussing potential regulations and future outlooks. The market will be closely monitoring the signals that come from this meeting.

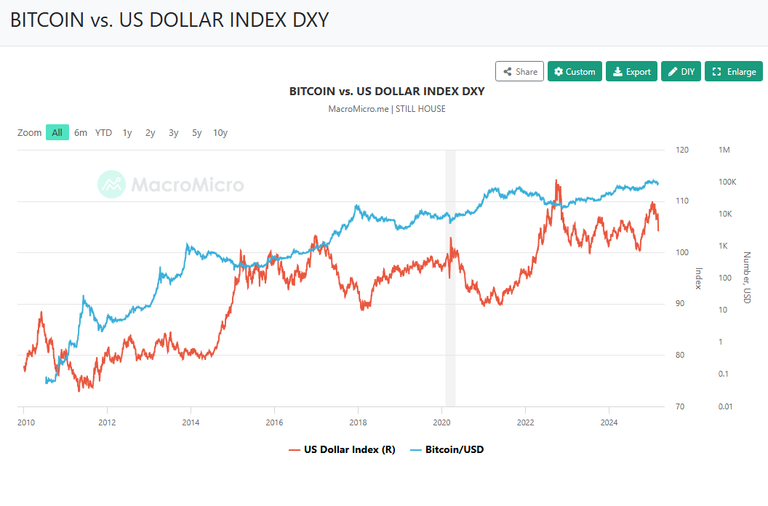

The Weakening US Dollar: A Potential Bitcoin Catalyst

Source

Another potential catalyst for Bitcoin's rise is the weakening US dollar. Raoul Pal, CEO of Real Vision, sees this as a clear advantage for cryptocurrencies. He points to a 2.79% drop in the US Dollar Index since February 5th and notes that a continued weakness in the dollar traditionally leads to strong performance for Bitcoin. During such periods, investors often look for alternative assets to safeguard their capital. We saw similar trends in 2020 when massive economic stimulus programs weakened the dollar, and Bitcoin surged from $5,000 to over $60,000. With the US Federal Reserve now shifting towards lower interest rates, these conditions could potentially repeat. Pal is therefore optimistic about a promising second quarter for both cryptocurrencies and tech stocks.

Regulatory Shifts and State-Level Developments

On the macroeconomic level, the environment for Bitcoin is improving. At the state level in the United States, new developments are also unfolding. A bill recently passed in New Hampshire could allow the state to invest up to 5% of its reserves in Bitcoin. The bill was overwhelmingly approved with a vote of 16 to 1 in a committee and will now go for a final vote in the House of Representatives. If passed, New Hampshire would become the next state to integrate Bitcoin as a strategic part of its financial reserves – a move that could have wide-reaching implications. Interestingly, the original proposal to include stablecoins and staking mechanisms was scrapped, with the focus now solely on digital assets with a market cap of over $500 billion – a category that currently only includes Bitcoin. This aligns with Donald Trump's recent strategy to create a state-run crypto reserve, where Bitcoin is likely to play a central role.

Mt. Gox: A Potential Market Shock

However, not everything driving Bitcoin’s movements is bullish. The insolvent exchange Mt. Gox has once again moved large amounts of Bitcoin – this time 12,000 BTC, valued at over $1 billion. The sudden transaction has caused nervousness in the market, as there is no clear explanation for what will happen to these funds. Part of the coins were transferred to a known cold wallet, while the rest went to an unknown address. Historically, such movements are often associated with upcoming creditor payouts, which could create selling pressure. While the final payout deadlines have been extended until October 2025, any large movement from Mt. Gox still triggers memories of past market turbulence.

A Market at Crossroads

Bitcoin finds itself in a tension between macroeconomic influences, regulatory progress, and the lingering issues from its past. The market has stabilized, but uncertainty and a cautious investor sentiment continue to dominate. The coming days, especially the US Crypto Summit, could be decisive in determining whether Bitcoin will move towards new highs or enter another phase of consolidation.

Posted Using INLEO

Congratulations @no-advice! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 25000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: