The Final Scare

The bear market is about to complete its second year. There's yet to be a sign of things getting better. The strong momentum we witnessed in January faded over the months, and the weak outlook dominated the market from June onwards.

This long bear market has not discouraged those with in-depth knowledge of crypto. Crypto has seasons, and we are in winter. The previous bear market lasted about two years. Moreover, this time, the macroeconomic environment is much more negative. Investing in innovative businesses with the highest interest rates of the last 40 years is problematic.

There is a reasonable explanation for our situation, and that's a good thing. Analysts predict that things will go much better in 2024. Bitcoin halving, which will take place in March, will support prices. We also estimate that the FED will start reducing interest rates in 2024.

The problem is that there are 3.5 more months until 2024. And some analysts say that altcoin prices will fall for the last time. Analyst Benjamin Cowen calls this expected move "the final scare."

While prices have fallen so much, encountering a new wave of decline may scare some investors. On the other hand, investing in high-risk/return assets is for the brave. If a final price decline wave occurs, few crypto enthusiasts will panic.

Bear season has been pretty rough. The portfolios of those who made credit/leveraged transactions have shrunk considerably. Those who invested without using credit/leverage shrank only in dollar terms. And, of course, there are daily needs. I had to sell crypto to pay for the kids' school fees, and I wouldn't say I liked it. This situation shows that keeping more cash aside for unexpected expenses is necessary.

Will The Final Scare scenario come true? Will there be no positive surprises during the bear season? Creating a sustainable increase trend in an environment where liquidity is shrinking isn't easy. We need to follow the macroeconomic situation closely.

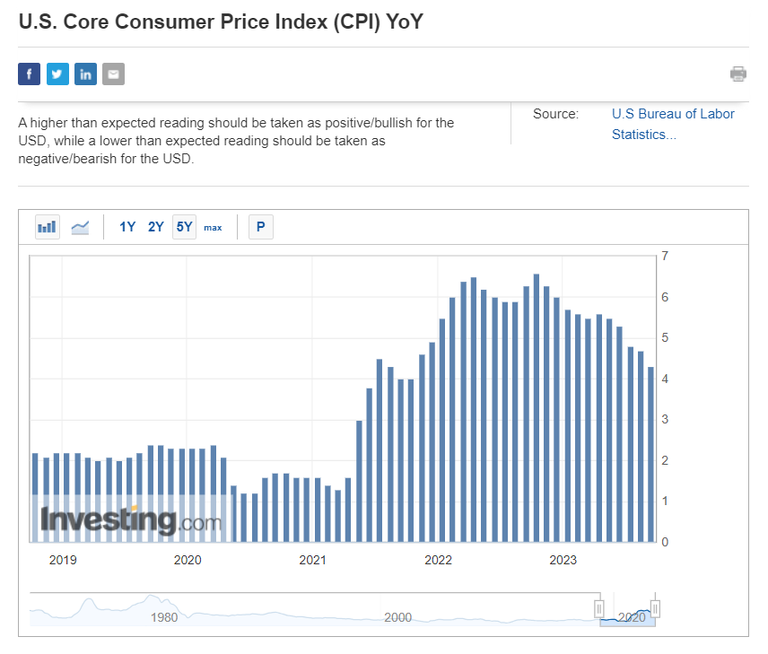

Core CPI, the data the FED attaches most importance to, was published on Wednesday. Core consumer inflation (Core CPI), which excludes food and fuel, was 4.3% in August. There is a clear downward trend in inflation, as seen in the graph below.

Inflation has decreased by 2 points in the last year. If the trend continues, the inflation problem will be alleviated towards the middle of next year. The critical question is how long market players will continue their wait-and-see strategy. And when the Fed will be satisfied and stop tightening. For example, a Core CPI falling below three could be a meaningful sign. We must wait until the second quarter of 2024 for this to happen.

Market players buy in advance the events that are likely to occur. However, it doesn't seem easy to establish a sustainable increase trend before the new year. Of course, a catalyst other than macroeconomic developments may also come into play. Approval of Bitcoin spot ETF applications could boost crypto's sails again.

Crypto can create its power like a perpetual machine, but only if it reaches a confident acceleration. The most crucial factor that can build momentum will be the end of monetary tightening.

TL;DR

It is not easy to predict whether there will be a final sales wave in altcoins by the end of the year. We face unknowns such as the FED's interest rate decisions and the SEC's attitude. It seems inevitable that the FED will not raise interest rates in September. The probability of an interest rate increase in November is calculated as 27%.

Facts impose themselves over time. As time progressed, I became more cautious about the crypto market. On the other hand, the main thing is that we can hold crypto assets until the next bull season. When the bull season comes, we will not care whether the costs are 30% less or more. Because once momentum builds in the altcoin market, prices increase exponentially.

Thank you for reading.

Cover Image Source: Midjourney App

Congratulations @muratkbesiroglu! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 94000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts:

Absolutely. I have no problem with the prices going lower as I make purchases. DCA might be one of the most effective strategies at these price levels.

Obviously, some people started to fill their BTC bags, already :)

I think the final scare will be a good investment opportunity as the waiting game continues for the bull market. However, I hope there will be a good surprise before the end of the year. Not every investor will see the final scare as a good investment opportunity.

They will point out the next dip and miss the opportunity :)

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

In that case, cash is king when you have to pay for the kid's entrance fees with crypto. It is a tough market from the last two years after the NFT big hype where many projects get killed!

I still believe we are near the bottom...

!PIZZA

!HUG

I sent 1.0 HUG on behalf of @tin.aung.soe.

(3/3)

$PIZZA slices delivered:

@tin.aung.soe(1/10) tipped @muratkbesiroglu

not sure if we are still in a bear market; most coins haven't made a lower low and BTC is up by around 80% from 2022. Perhaps something in between bear and bull

We're in a bull market since November 2022. Early phase of the bull market. Parabolic run for bitcoin will happen after the halving. Sometime after the halving...

You wrote:

This is a key point for bear market growth, and bull market success.

The investment income is for investments, but unexpected expenses happen.

I still think your plan is a good plan.

We all should copy this plan, and like all financial strategies it should be executed and it’s results recorded and analyzed, so we perform a cycle of continuous performance improvement, **think, do, assess *** & then do better , this is how we reach our goals.

Thank you for sharing.